Bitcoin Threatens To Retreat To $60,000

After a spectacular ascent to file highs, Bitcoin (BTC) is going through a actuality examine. The previous week has seen a dramatic value correction, leaving traders questioning if it is a momentary setback or an indication of a extra bearish future.

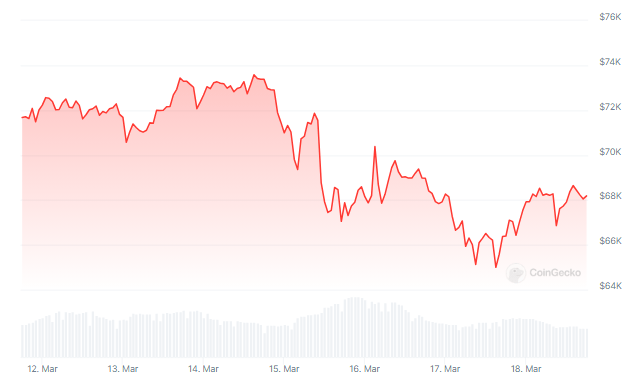

The world’s hottest cryptocurrency reached an intraday low of $64,620 on March seventeenth, a big drop from its current peak above $73,000. This pullback has triggered a wave of pessimism, with analysts pointing to declining profitability and a drop in every day energetic addresses on the community.

Bitcoin down within the final week. Supply: Coingecko

A Bearish Shadow Looms

In accordance with analysts, investor sentiment has been damage by a collection of descending peaks and failed upturns, whereas promoting strain stays rampant as we strategy the “weekly candle shut.” This sentiment is echoed by knowledge from IntoTheBlock, which exhibits a pointy decline within the variety of addresses “Within the Cash,” signifying a lower in total profitability throughout the Bitcoin community.

Supply: IntoTheBlock

Discovering Help: A Beacon of Hope?

Nonetheless, not everyone seems to be hitting the panic button. Technical evaluation suggests a possible help zone for consumers between $60,000 and $67,000. Common dealer Skew highlights this space as a doable turning level, whereas additionally acknowledging vital spot promoting from main exchanges like Coinbase and Binance.

$BTC Spot Market Information Thread, in partnership @_WOO_X $BTC Binance Spot

Weekend spot purchaser right hereSpot Provide ($72K – $74K)

Spot Demand ($60K)Curiously final bounce which was offered into additionally resulted in a stack of restrict bids being quoted decrease.

~ Regulate these bids… pic.twitter.com/3PKHyddNlv— Skew Δ (@52kskew) March 17, 2024

Bulls On The Horizon: Are The Giants Awakening?

Whereas the rapid future seems unsure, some analysts stay bullish on Bitcoin’s long-term prospects. They view the present correction as a pure and wholesome a part of any bull run, pointing to historic knowledge the place comparable pullbacks paved the way in which for additional development.

Associated Studying: Bitcoin Crashes: Dip To $65,000 Triggers Over $400 Million Liquidation Avalanche

Including gasoline to the fireplace of optimism is the potential return of institutional capital. The current resumption of shopping for from US Bitcoin ETFs and the prospect of a big inflow of funds from hedge funds and funding advisors within the coming months are seen as potential catalysts for a rebound.

BTCUSD buying and selling at $68,087 on the weekly chart: TradingView.com

Thomas Fahrer, CEO of Apollo, a decentralized on-line cryptocurrency platform famend for its complete crypto opinions and evaluation of ETF inflows, echoes sentiments concerning X.

Fahrer characterizes the present state as a “Bear Entice” and pinpoints the resumption of shopping for from US Bitcoin ETFs on March 18 as a possible catalyst for an upward surge in X’s worth.

Associated Studying: Neglect Dogecoin, Shiba Inu Set To Turn into The High Canine: Skilled Predicts $100 Billion Market Cap

Emphasizing the importance of elevated institutional acceptance, Fahrer anticipates a surge in liquidity inside Bitcoin ETFs, suggesting that substantial capital inflows from institutional traders have but to materialize.

The Verdict: Brace For A Risky Week

This week can be essential for Bitcoin. The approaching days can be a check of the cryptocurrency’s resilience and its potential to beat the present promoting strain. If bulls can regain management and optimistic sentiment prevails, a return to file highs stays a chance. Nonetheless, if the downtrend continues, Bitcoin may face a extra prolonged interval of correction.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use info supplied on this web site totally at your individual threat.