Bitcoin To Continue Price Discovery Rally If It Holds These Levels

Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

As Bitcoin (BTC) makes an attempt to show the $110,000 resistance into help, some analysts consider its value discovery rally has simply began, forecasting new highs for the flagship crypto.

Associated Studying

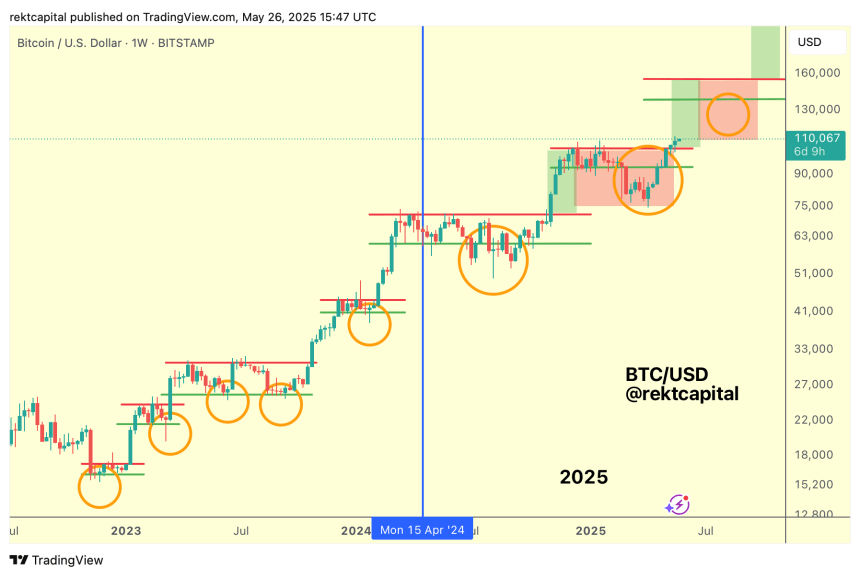

Bitcoin Begins Second Worth Discovery Uptrend

Final week, Bitcoin’s momentum propelled its value to its new all-time excessive (ATH) of $111,814 earlier than retracing to its present vary. Over the weekend, Bitcoin confirmed its breakout into its second Worth Discovery Uptrend, following its profitable retest of the $104,500 mark as help.

The cryptocurrency has been in a major market restoration for over a month, rallying practically 50% from April lows. Analyst Rekt Capital noted that BTC ended its draw back deviation interval and positioned itself for a retest of its key re-accumulation vary throughout early Could’s surge, which was efficiently reclaimed and surpassed.

The analyst considers that its new Worth Discovery Uptrend has “solely simply begun,” as Bitcoin begins Week 2 of this section. Rekt Capital highlighted that this cycle has been “a narrative of Re-Accumulation Ranges,” which alerts {that a} new vary will possible type after this Worth Discovery.

In the meantime, historical past suggests a second Worth Discovery Correction is forward as Bitcoin transitions into its new Worth Discovery Uptrend.

Throughout its future correction, BTC will possible retrace between 25%-35% “to provide yet one more Draw back Deviation under the Re-Accumulation Vary Low (future orange circle) earlier than resuming upside into a probable Worth Discovery Uptrend 3.”

Within the meantime, “All Bitcoin must do is maintain above the Re-accumulation Vary Excessive of $104,500” to proceed its value discovery rally.

$110,000 Breakout Subsequent?

Notably, the flagship crypto has been retesting the vary excessive as help over the previous two weeks, confirming the breakout. As such, dipping into the earlier $92,000-$104,500 vary’s higher zone may occur as “a part of regular volatility.”

Furthermore, it turned one other key resistance, the $102,500 mark, into help throughout this era, which it had beforehand been rejected from in January 2025. With these ranges as help, Rekt Capital considers that solely the December 2024 and January 2025 upwicks, at $108,353 and $109,588, stand in the best way of further Worth Discovery.

Dealer Daan Crypto Trades noted that Bitcoin is “nonetheless sturdy however preventing round its earlier all-time excessive from earlier this yr.” He identified that value motion appears to be like “very uneven” within the decrease timeframes, however it shouldn’t be regarding for traders if the worth stays inside its present vary.

Associated Studying

Analyst MacroCRG affirmed that Bitcoin should formally reclaim the $110,000 stage to proceed its rally, because it marks the earlier ATH and the Worth Space Excessive (VAH) from final week. “Acceptance above and we possible squeeze straight into value discovery once more,” CRG said.

At the moment, Bitcoin is retesting its Weekly opening of $109,004 as help, which may set the stage for a breakout above the $110,000 mark if held. In the meantime, rejection from this space may ship BTC value to the $106,000-$108,000 space.

As of this writing, Bitcoin trades at $109,181, a 1.4% enhance within the each day timeframe.

Featured Picture from Unsplash.com, Chart from TradingView.com