Bitcoin traders alert! – Do key indicators mirror the 2018 crypto crash?

- Bitcoin’s current 22% decline is drawing comparisons to previous bull cycle corrections.

- This evaluation examines historic traits, market circumstances, and BTC’s potential subsequent transfer.

Lower than three months into Trump’s second time period, market volatility has surged to unprecedented ranges. Bitcoin [BTC] has dropped 22% from its $109k all-time excessive, just like corrections seen within the 2016-17 bull run.

Throughout that cycle, BTC delivered a 122.8% full-year return, but ended Q1 down 4% from its opening worth of $434.46. Nevertheless, this yr’s deeper decline raises questions.

Is BTC mirroring the 2018 Q1 crash (- 48%) to $6,929, as a substitute? AMBCrypto explored this risk.

2018 macro parallels: Commerce conflict and Bitcoin’s 72% crash

In 2018, Bitcoin closed the cycle with a 72% yearly decline, bottoming at $3,740.50.

Notably, macro circumstances on the time carefully resemble at present’s panorama – Trump’s commerce conflict with China and escalating tariffs. By mid-Q2 2018, inflation spiked to a two-year excessive of two.9%.

In response, Bitcoin, which had surged to $9,826 in April, suffered a 40% quarterly decline.

Supply: BitBo

Now, as Q2 unfolds, the crypto market faces renewed macro pressures.

With $7 trillion in debt refinancing forward, traders are shifting capital into safe-haven belongings like bonds – a pattern confirmed by the 10-year treasury yield (curiosity on bonds), which has dropped to a two-month low.

Merely put, the bond market is absorbing liquidity, pulling capital away from danger belongings because the U.S. authorities secures cheaper borrowing charges.

If this pattern continues, Bitcoin and broader crypto markets may face heightened draw back danger, rising the chance of a 2018-style crash.

On-chain indicators sign BTC capitulation danger

In line with Glassnode’s newest report, Bitcoin’s market construction has shifted from accumulation to distribution. In the meantime, the Accumulation Pattern Rating remained near 0.1, reflecting constant promote strain since January.

Moreover, the Price Foundation Distribution (CBD) heatmap reveals a decline in “buy-the-dip” exercise beneath $92K, indicating lowered demand for accumulation.

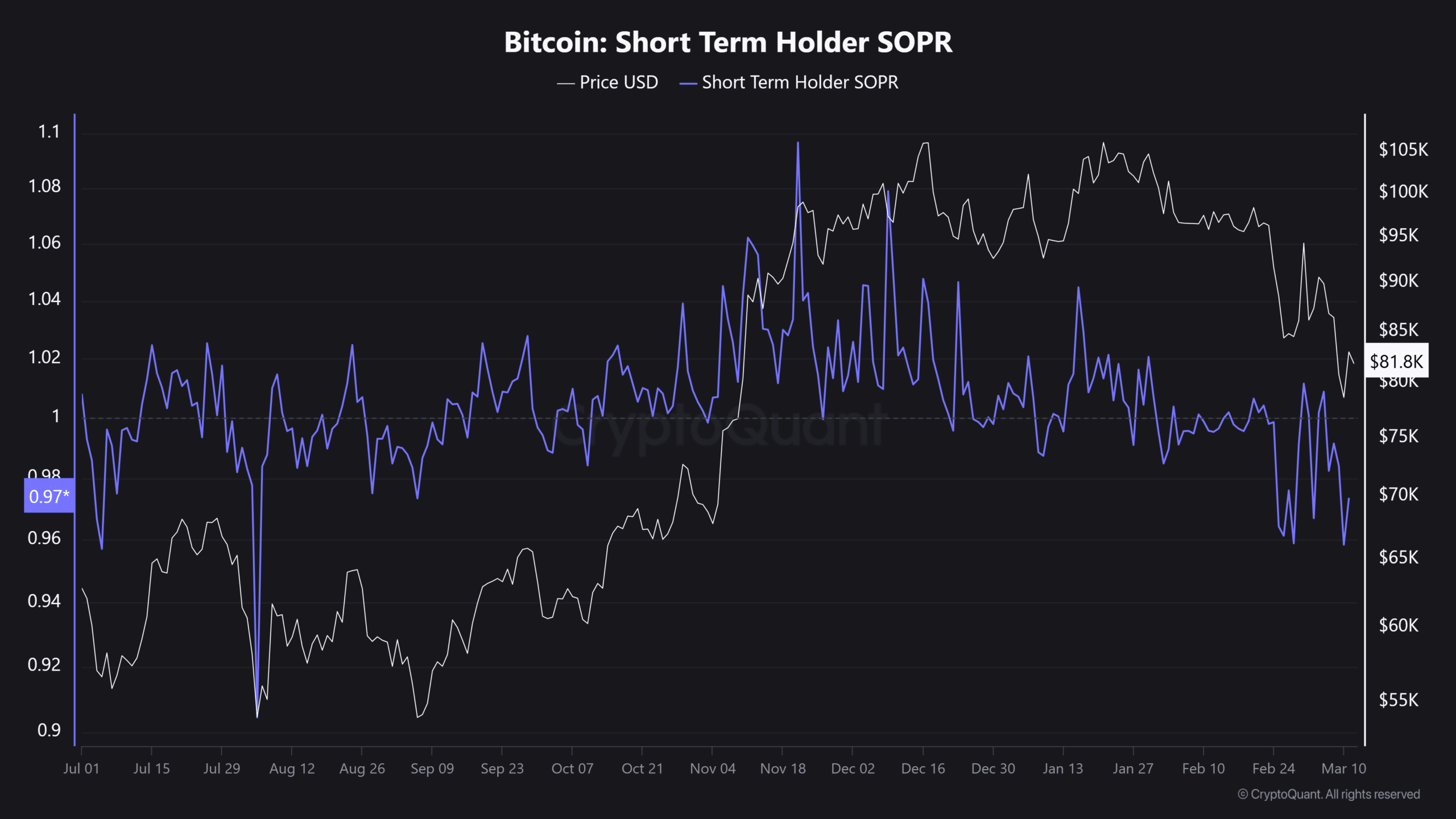

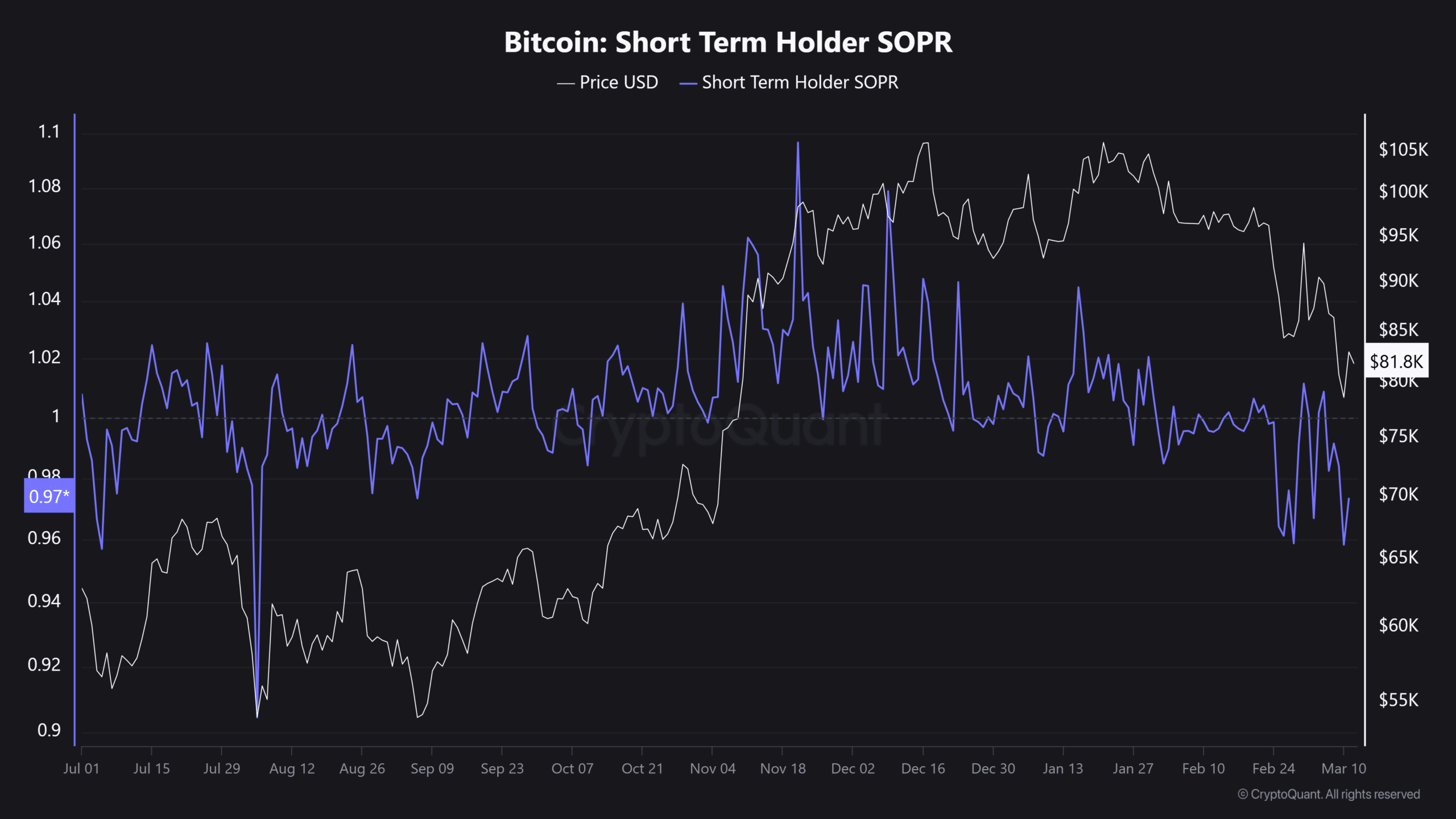

Quick-Time period Holders (STHs) are exhibiting indicators of capitulation. The STH Spent Output Revenue Ratio (STH-SOPR) has stayed beneath 1, suggesting that many traders are promoting at a loss.

It reached 0.97 when Bitcoin fell to $78K, highlighting vital capitulation.

Supply: CryptoQuant

This sample carefully resembles August 2024, when Bitcoin plummeted to $49K beneath intense promoting strain.

At current, accumulation stays weak at vital demand zones, regardless of Bitcoin buying and selling 22% beneath its all-time excessive of $109K. This displays a transparent risk-off sentiment, with patrons exhibiting reluctance to enter the market.

Coupled with prevailing macroeconomic challenges, the present situation more and more mirrors the 2018 crash, the place prolonged distribution led to extended downward actions.

Because of this, Bitcoin faces an elevated danger of additional corrections earlier than establishing a powerful assist stage.