Bitcoin: Traders bet on sideways momentum for BTC as…

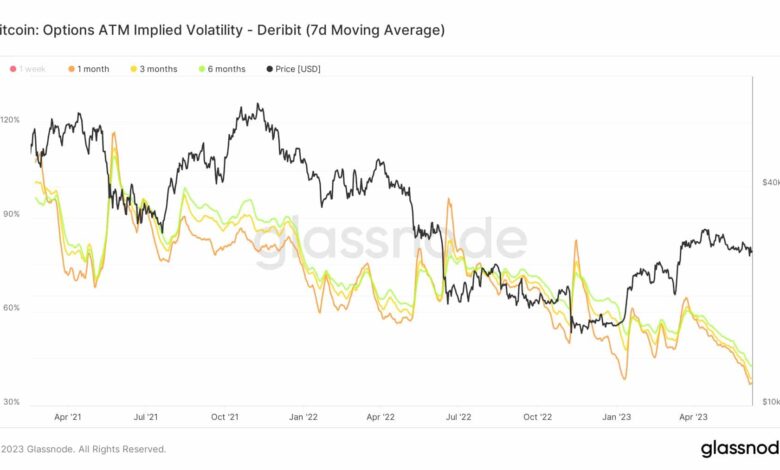

- Bitcoin’s Implied Volatility begins to say no. Choices market expects sideways momentum for BTC sooner or later.

- Value and velocity declined, indicating low transaction exercise round BTC.

Bitcoin’s value has seen some harsh volatility over the previous few months, nevertheless over the previous few days it has appeared that BTC is predicted to maneuver sideways within the close to future.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Some stability for BTC sooner or later?

This was indicated by the declining Implied Volatility for Bitcoin. In response to glassnode’s knowledge, it has began to succeed in new lows. This showcases the choices markets expectation of Bitcoin to keep up stability when it comes to value.

Supply: glassnode

Coming to the behaviour of merchants, at press time, roughly 27,000 Bitcoin choices have been nearing their expiration date, possessing a Put to Name Ratio of 0.64. A Put to Name Ratio of 0.64 signifies the next proportion of open name choices, which means that market sentiment leans in the direction of value enhance expectations.

Moreover, these choices carry a most ache level worth of $26,500. The utmost ache level at $26,500 signifies the worth stage at which choice holders might expertise probably the most vital monetary losses. The expiring choices collectively possess a notional worth of $720 million, signifying a considerable stake available in the market.

Will FUD “unfold”?

Nevertheless, the spreads on Binance, that are at present about 20 instances wider than these on Coinbase and Kraken might affect BTC in the long term.

Spreads on https://t.co/pup2WYms9R are at present about 20 instances wider than these on Coinbase and Kraken

pic.twitter.com/qVt06FGnx7

— Kaiko (@KaikoData) June 9, 2023

Large spreads point out a bigger distinction between the shopping for and promoting costs of BTC on Binance in comparison with Coinbase and Kraken. This implies decrease liquidity on Binance, making it more difficult for merchants to enter and exit positions effectively. Diminished liquidity can result in elevated value volatility and probably affect BTC’s stability.

Moreover, wider spreads sometimes end in larger buying and selling prices for market contributors. Merchants who want to purchase or promote BTC might incur larger bills as a result of bigger value distinction between the bid and ask costs.

Learn Bitcoin’s Value Prediction 2023-2024

On the time of writing, BTC was buying and selling at $25,754.89 in response to CoinMarketCap. Over the past week, BTC’s value declined materially. Coupled with that, BTC’s velocity fell, indicating a drop in exercise. Moreover, the curiosity in Bitcoin’s NFTs additionally fell as indicated by the falling NFT trades on the community.

Supply: Santiment