Bitcoin traders borrow more money to trade amid price drops – A big risk?

- The month to this point has seen an uptick in BTC’s leverage ratio.

- The dearth of corresponding worth development places the coin susceptible to additional decline.

Bitcoin’s [BTC] estimated leverage ratio has risen previously few days, at the same time as its worth has declined. This implies that merchants have gotten extra leveraged or borrowing more cash to commerce the main crypto asset, pseudonymous CryptoQuant analyst BQYoutube finds in a brand new report.

How a lot are 1,10,100 BTCs value right now?

BTC’s estimated leverage ratio tracks the typical quantity of borrowed funds (leverage) that merchants use to commerce the asset.

Sometimes, when BTC’s leverage ratio climbs, it may very well be taken as an indication of bullish sentiment, because it means that merchants are assured that BTC’s worth will proceed to rise in worth.

Nonetheless, it may be an indication of risk-taking, as merchants with excessive leverage are extra weak to liquidations if the market strikes in opposition to them.

This spells “doom” for BTC

Based on the CryptoQuant analyst, the uptick in BTC’s estimated leverage ratio has “been continuously build up with funding charges and trade reserve alongside.”

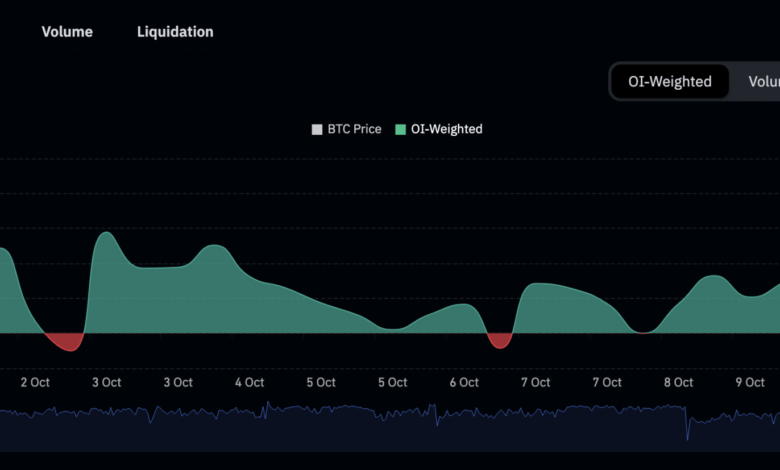

At press time, the coin’s funding charge was 0.0124%. Based on information tracked by Coinglass, it has elevated by over 115% since 7 October.

Supply: Coinglass

Nonetheless, with a decline in BTC’s worth previously few days, the surge within the quantity of buying and selling with borrowed cash signifies a excessive degree of greed amongst traders, particularly these taking important leveraged lengthy positions.

This implies that folks could be betting on a worth rebound, and they’re doing so at any price.

BQYoutube discovered additional that the interval beneath overview has additionally been marked by low buying and selling quantity within the main coin’s spot market.

This implies there may not be a robust natural demand for the asset at its present worth, as market contributors focused on buying and selling with out leverage seldom achieve this.

Supply: CryptoQuant

Based on the analyst, one of the best plan of action could be to carry off on making sturdy shopping for choices till using leverage and the reserves on exchanges settle down.

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

Open curiosity rally poses the same threat

Along with the rising estimated leverage ratio, funding charges, and trade reserve, BTC’s futures & choices open curiosity has additionally elevated this month. Knowledge sourced from Santiment put the coin’s open curiosity at $6.14 billion at press time, having risen by 9% since 1 October.

Supply: Glassnode

Whereas commenting on the impression of the rallying open curiosity, one other pseudonymous analyst SignalQuant, famous:

“The present open curiosity has been growing since Sept ’23 however shouldn’t be at a degree that will set off a large-scale liquidation. Nonetheless, it could actually attain the liquidation zone shortly at any time, so concentrate on the volatility in that case.”