Bitcoin transaction volume plummets to 2023 lows – Bearish trend ahead?

- Bitcoin’s transaction quantity has declined sharply, reaching ranges final seen in 2023, indicating decreased community exercise.

- Open curiosity traits urged merchants are cautious, whereas BTC worth struggles to take care of key assist ranges close to $86K.

Bitcoin’s [BTC] transaction quantity has dropped to ranges not seen since early 2023, elevating issues in regards to the market’s power.

The decline in transaction exercise comes at a crucial juncture as BTC faces growing resistance close to the $86,000 mark. May this sign the beginning of a bearish pattern, or is the market merely consolidating earlier than one other transfer?

A pointy decline in Bitcoin transactions sparks concern

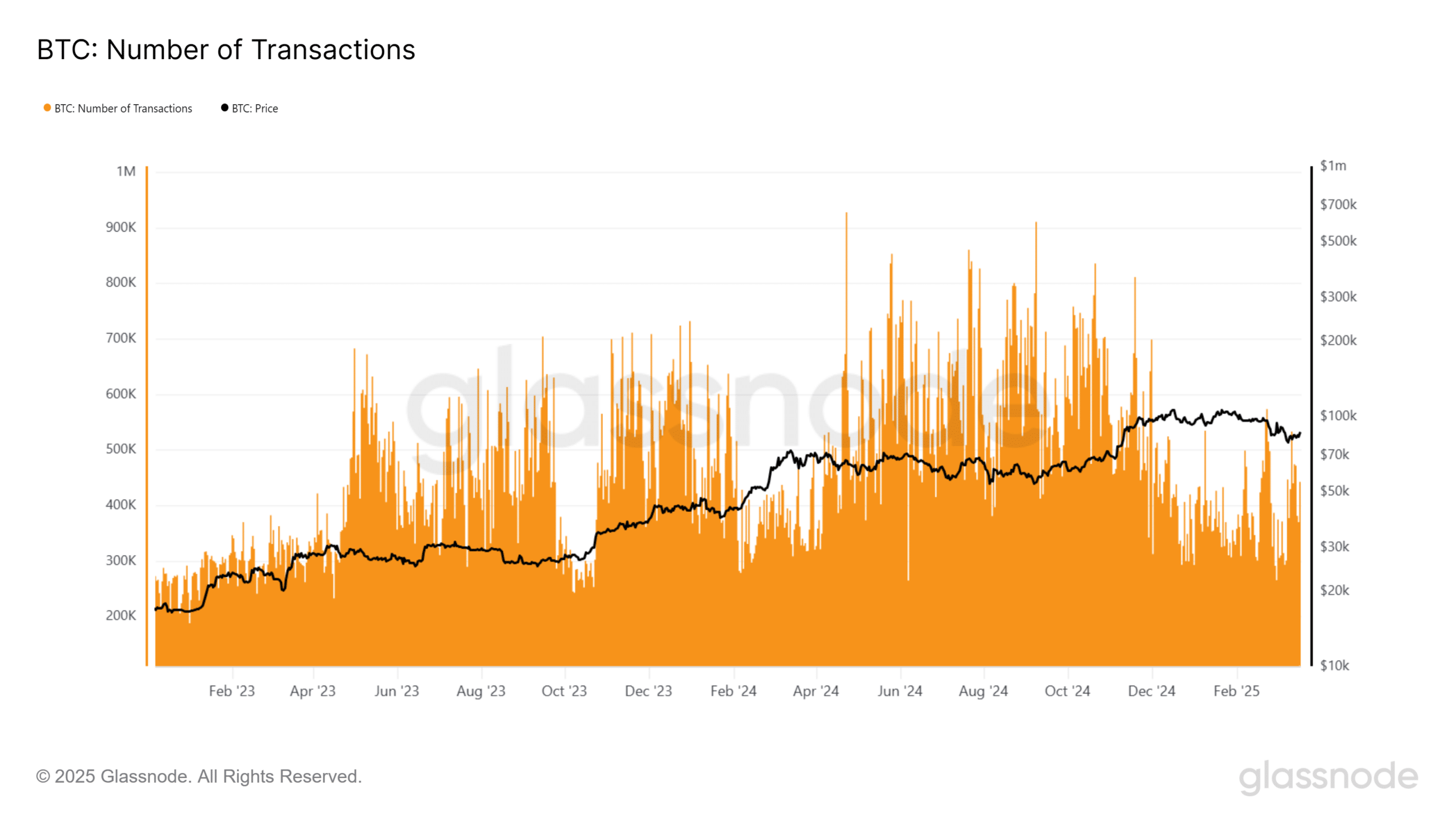

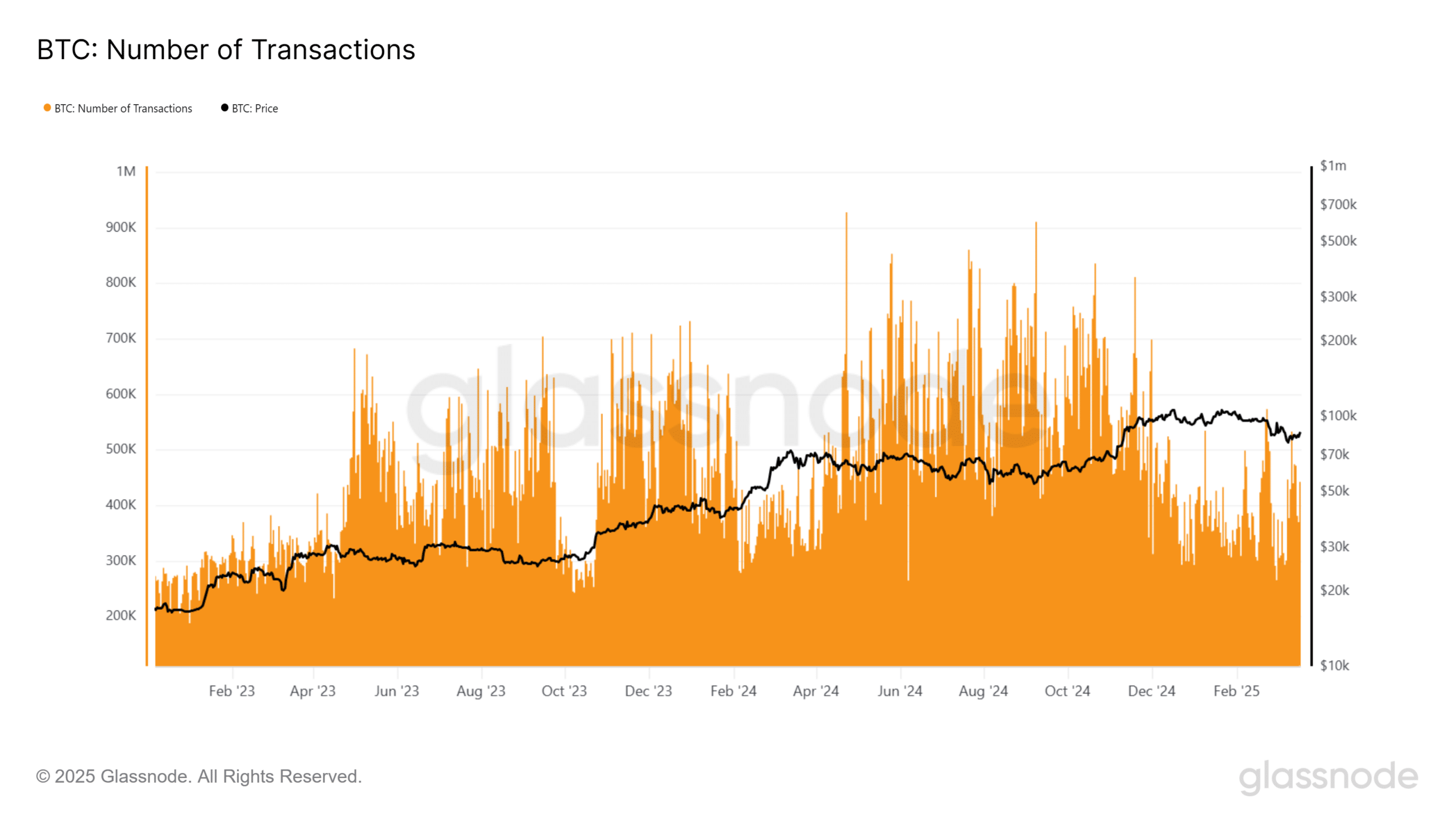

Latest information from Glassnode highlights a major drop in BTC’s transaction quantity.

At its peak in mid-2024, Bitcoin noticed over 700K every day transactions, a pointy distinction to the present ranges, which have fallen under 400K. Traditionally, a drop in transaction quantity has typically preceded intervals of worth stagnation or corrections.

Supply: Glassnode

This discount in transaction rely means that community exercise is slowing, which might point out decreased market participation.

If the pattern continues, Bitcoin might wrestle to take care of its present worth ranges, as an absence of demand might weaken assist zones.

Open Curiosity and quantity affirm weakening momentum

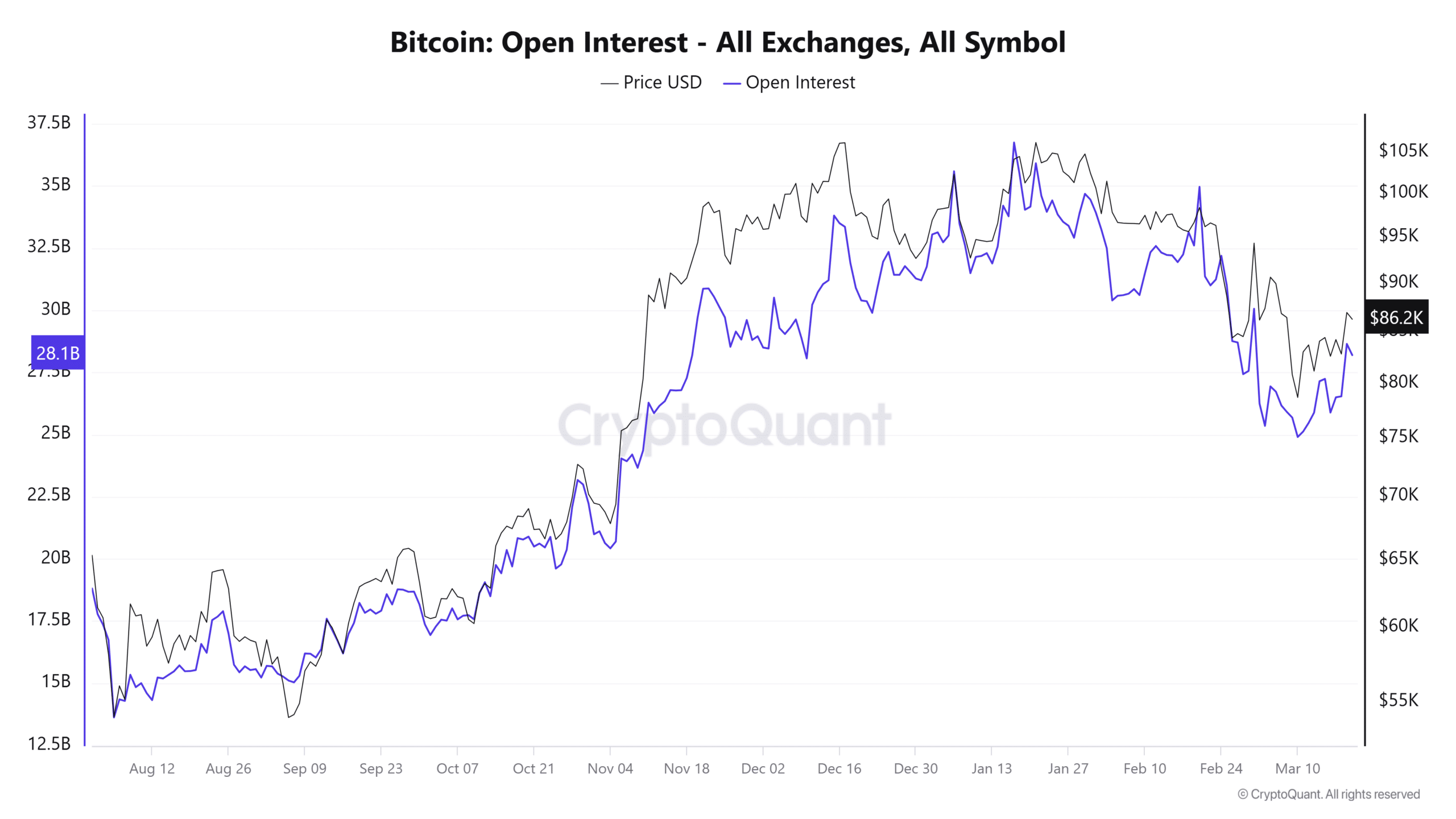

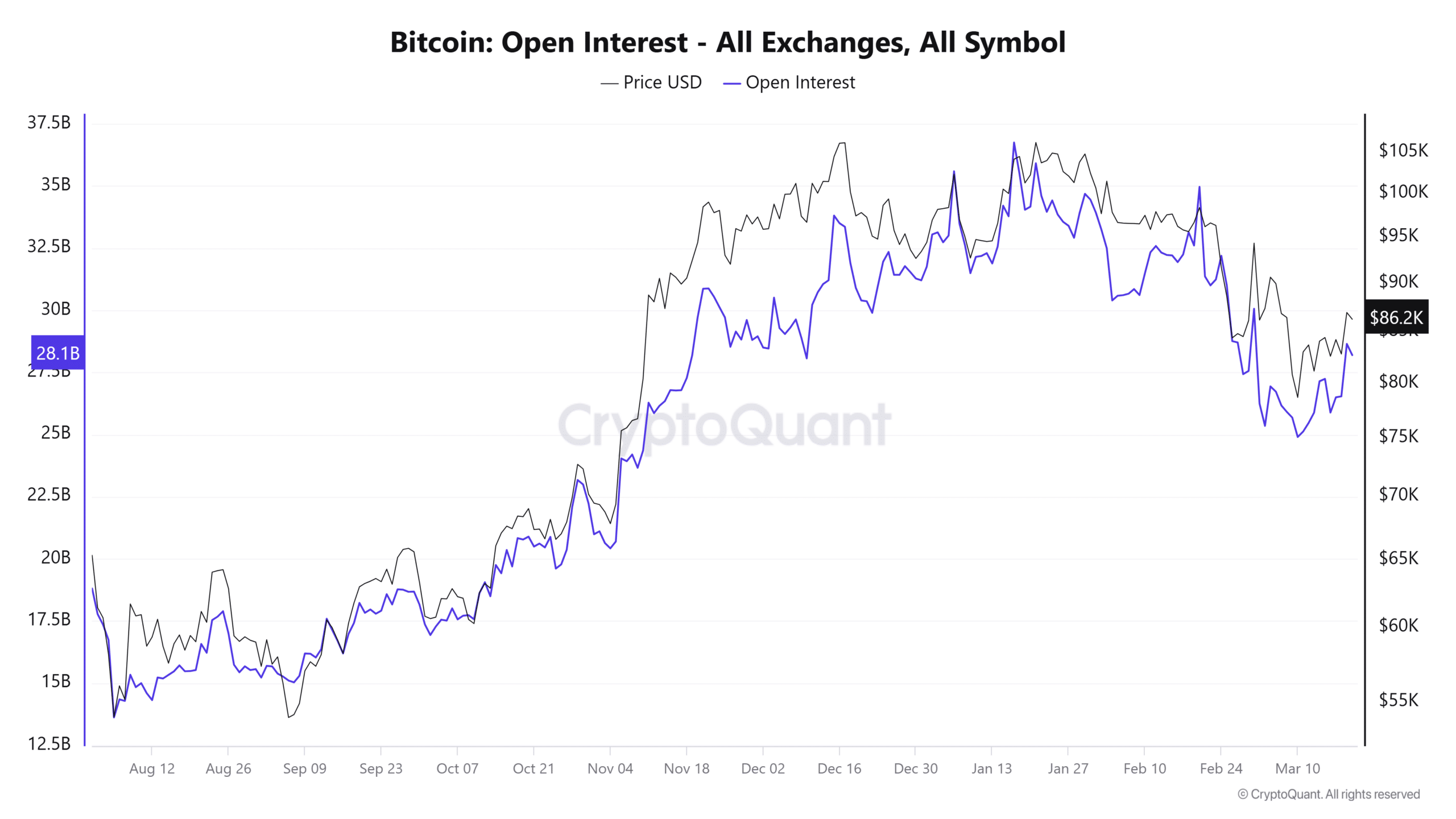

A broader evaluation of market indicators reveals additional bearish alerts. Based on CryptoQuant, Bitcoin’s Open Curiosity (OI) has additionally declined considerably.

Supply: CryptoQuant

OI throughout exchanges was at $86.2 billion, at press time, down from highs above $100 billion earlier within the yr.

Though the OI has considerably elevated in the previous couple of days, the comparability means that merchants are lowering their leveraged positions. This pattern might result in decrease volatility and a diminished speculative shopping for urge for food.

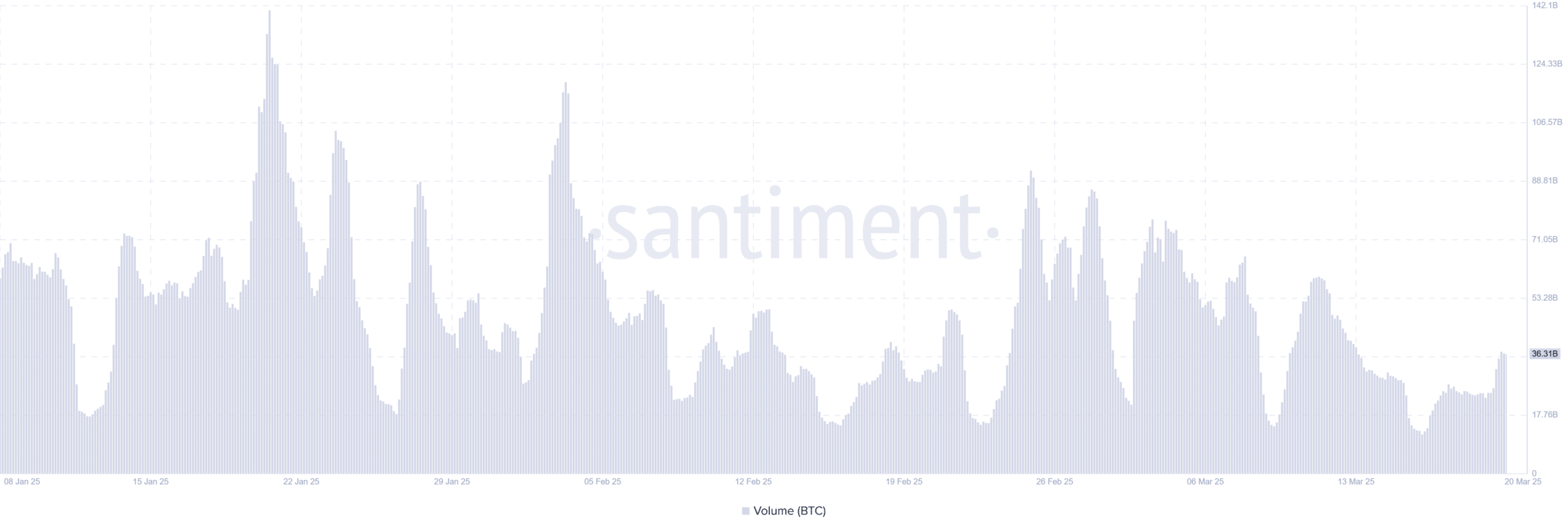

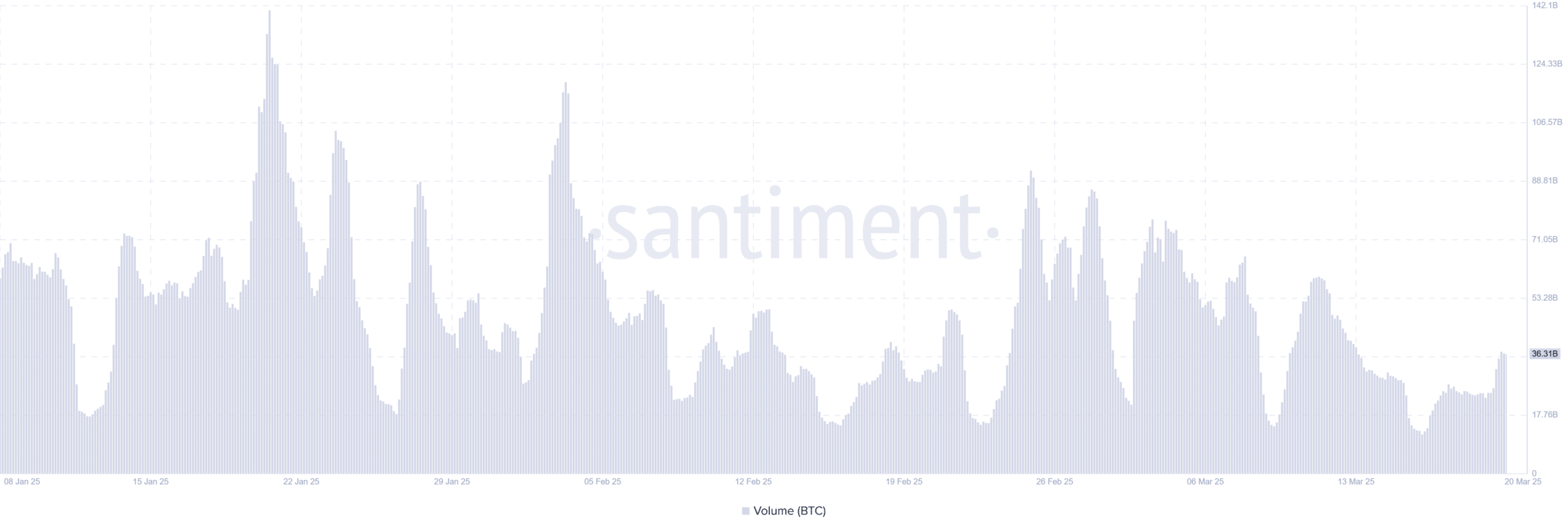

In the meantime, as tracked by Santiment, Bitcoin’s buying and selling quantity has additionally seen a notable drop. BTC quantity not too long ago touched 36.31 billion, a pointy decline from its February highs.

The decrease quantity confirms that fewer merchants are actively partaking with BTC at its present worth, growing the probability of a draw back transfer if consumers fail to step in.

Supply: Santiment

Key ranges to look at

On the time of writing, Bitcoin was buying and selling at round $85,856, dealing with resistance at $86,877. The 50-day Shifting Common was at $85,873, performing as a vital pivot level. Failing to carry above this stage might ship BTC again towards assist at $80,000.

Conversely, if BTC breaks previous $87,500, it might problem the $90,000 stage, which stays a psychological barrier.

Whereas a worth breakdown isn’t but confirmed, merchants ought to maintain a detailed eye on transaction quantity and OI for indicators of additional deterioration.

Bitcoin might enter a protracted consolidation section or perhaps a bearish correction within the coming weeks if community exercise fails to get well.