Bitcoin ‘volatility to emerge soon:’ Should you believe this key indicator?

- BTC’s key on-chain metric hinted at worth volatility.

- Nevertheless, technical indicators on a worth chart refuted that declare.

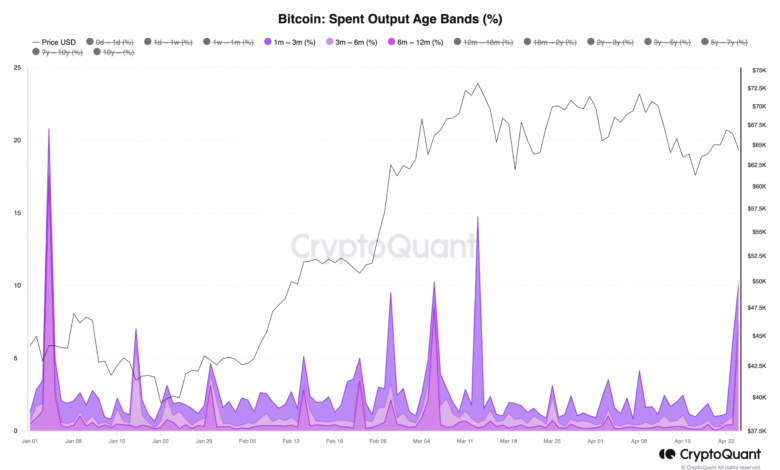

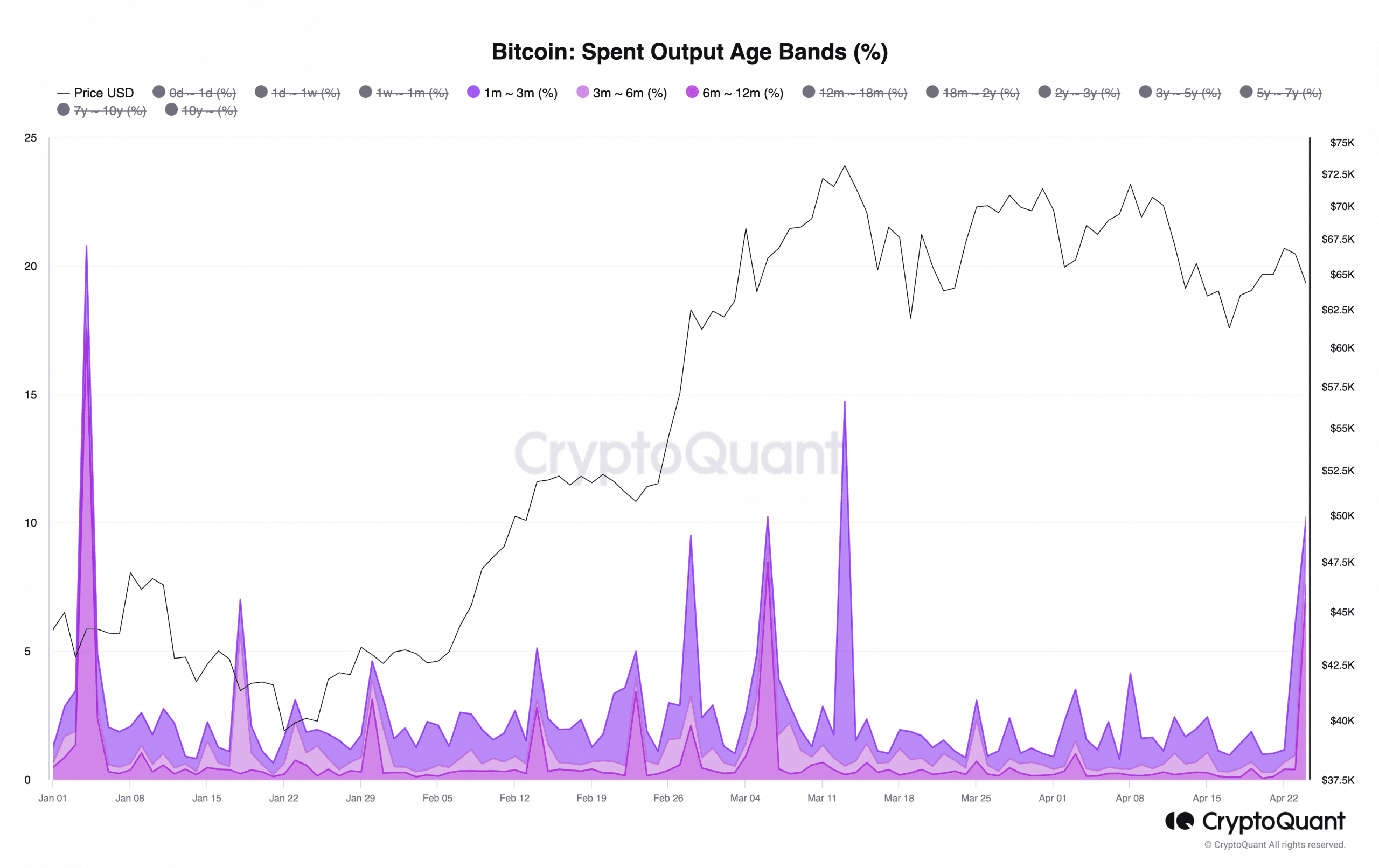

Bitcoin’s [BTC] spent outputs for buyers which have held their cash for one to 12 months have witnessed a spike, hinting at the potential of a worth swing, in keeping with CryptoQuant’s knowledge.

Supply: CryptoQuant

BTC’s spent outputs for various age bands of buyers supply insights into coin holders’ spending habits.

For instance, it may possibly observe whether or not cash held by short-term holders are being moved, indicating an uptick in profit-taking exercise.

Volatility within the BTC market?

When the quantity of spent output for short-term BTC holders will increase, it typically suggests a rally in market volatility.

In a latest report, pseudonymous CryptoQuant analyst Mignolet mentioned,

“Motion of this entity may be seen as knowledge for volatility affirmation moderately than for worth will increase or decreases. It seems that volatility is more likely to emerge quickly.”

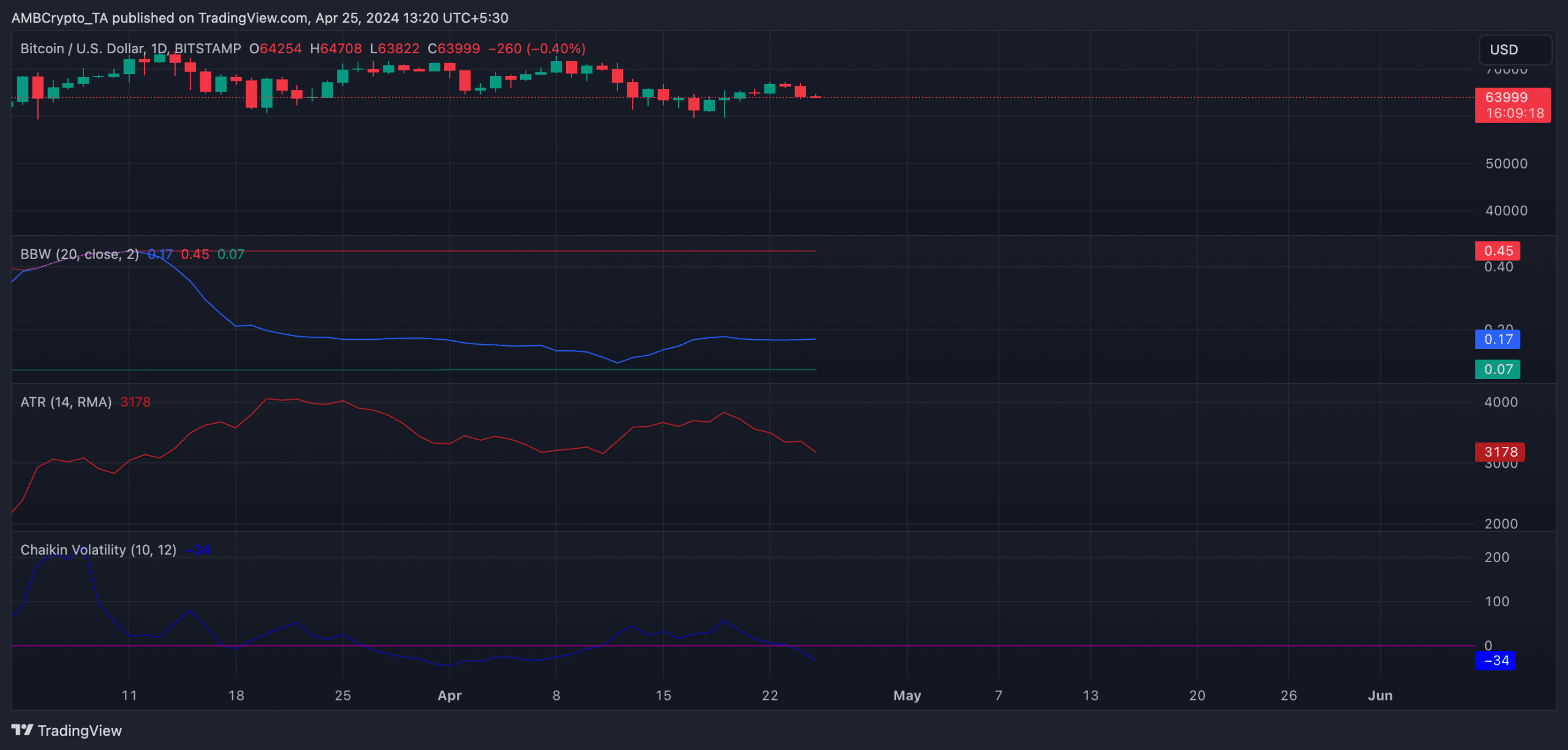

Nevertheless, an evaluation of the coin’s key volatility markers on a each day chart instructed minimal danger of any important short-term worth swings.

Readings from the BTC’s Common True Vary (ATR) confirmed that it has steadily declined because the nineteenth of April.

This indicator measures the common vary of worth actions over a specified interval. When it falls, it signifies a discount in market volatility.

Confirming the decline in market volatility, BTC’s Chaikin Volatility was noticed in a downtrend at press time. For the reason that nineteenth of April, the worth of the indicator has dropped by 162%.

This indicator measures an asset’s worth volatility by evaluating the present vary between the excessive and low costs to a earlier vary over a particular time frame.

When it declines this fashion, it means that an asset’s market is turning into much less risky as a result of the vary between its excessive and low costs is contracting.

Additional, BTC’s flat Bollinger Bandwidth (BBW) lent credence to the low volatility within the coin’s market.

Learn Bitcoin [BTC] worth prediction 2024 -2025

When an asset witnesses a flat BBW, it means that its worth is experiencing low volatility and its actions are comparatively secure and confined to a slender vary.

Supply: BTC/USDT on TradingView

At press time, the main crypto asset exchanged palms at $64,241. In line with CoinMarketCap’s knowledge, its worth has climbed by 5% prior to now seven days.