Bitcoin vs. altcoins: The holiday season winner might surprise you

- Bitcoin vs. altcoins — a tussle emerges in quantity and worth.

- Whereas Bitcoin exhibits dominance in these areas, the altcoin index has proven volatility.

As the vacation season progresses, the cryptocurrency market has been buzzing with exercise, showcasing a battle for dominance between Bitcoin [BTC] and altcoins.

Traditionally, this era has been marked by distinctive market dynamics, with Bitcoin typically perceived as a secure alternative whereas altcoins cater to risk-tolerant merchants in search of excessive returns.

Evaluation reveals the intricate interaction between these two segments, providing insights into which may emerge as the vacation season winner.

Bitcoin: A gentle performer amidst market flux

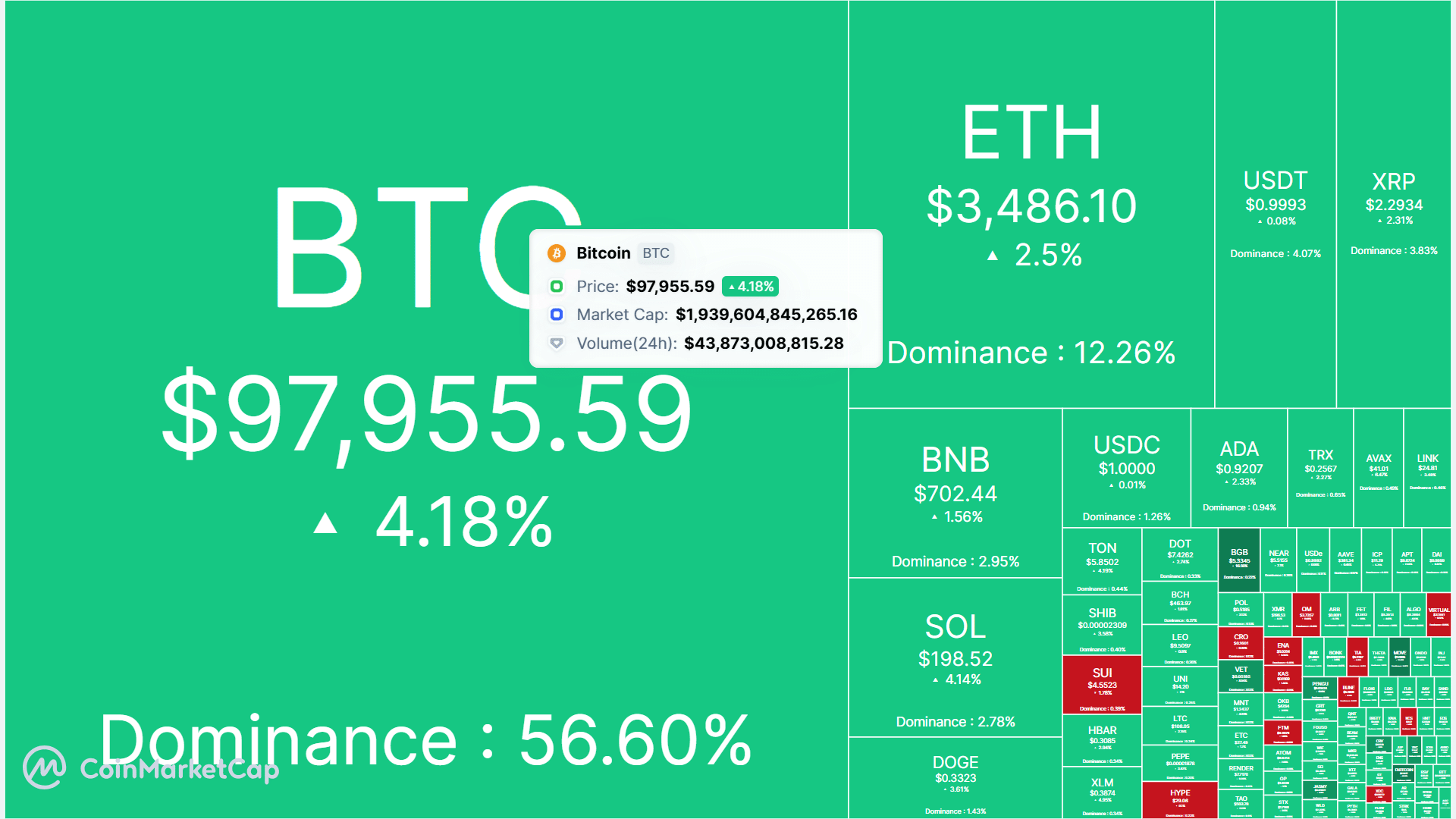

Bitcoin has demonstrated resilience throughout this vacation interval, holding its worth at $97,955 with a every day achieve of 4.18%.

The market dominance chart showcases Bitcoin’s stronghold at 56.60%, indicating a transparent desire amongst buyers for the main cryptocurrency.

This dominance underscores Bitcoin’s potential to resist market turbulence whereas delivering secure returns.

Supply: CoinMarketCap

The market heatmap additional highlighted Bitcoin’s constant efficiency, with buying and selling quantity exceeding $43.87 billion within the final 24 hours.

Such strong exercise mirrored sustained institutional curiosity and retail confidence in Bitcoin’s position as a “safe-haven” asset throughout risky occasions.

Regardless of competitors from altcoins, Bitcoin’s regular upward pattern cemented its place as a dependable asset, notably for long-term holders in search of decrease threat throughout a seasonally risky interval.

Altcoin season index: A shift in momentum

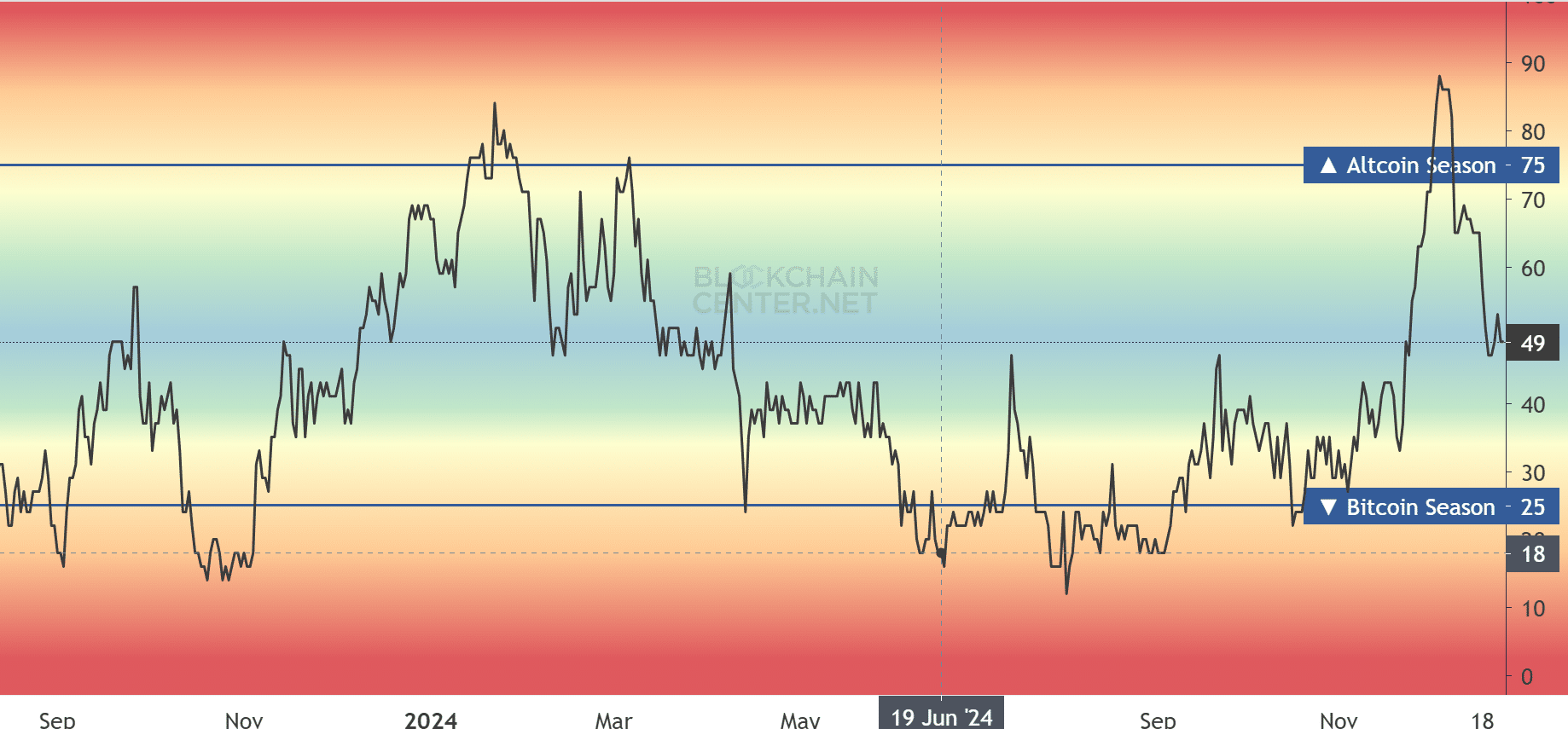

The Altcoin Season Index offered a complete overview of the broader market dynamics. The index was 49 at press time, signaling a impartial stance between Bitcoin and altcoins.

This follows a pointy decline from its earlier excessive of 75, which marked a dominant altcoin rally. This drop suggests a shift in market sentiment, with Bitcoin regaining favor.

Supply: Blockchaincenter

Blended performances inside the altcoin sector accompany the index’s decline.

Notable property corresponding to Ethereum [ETH] (up 2.5%) and Solana [SOL] (up 4.14%) have posted positive aspects, but the broader altcoin market stays fragmented.

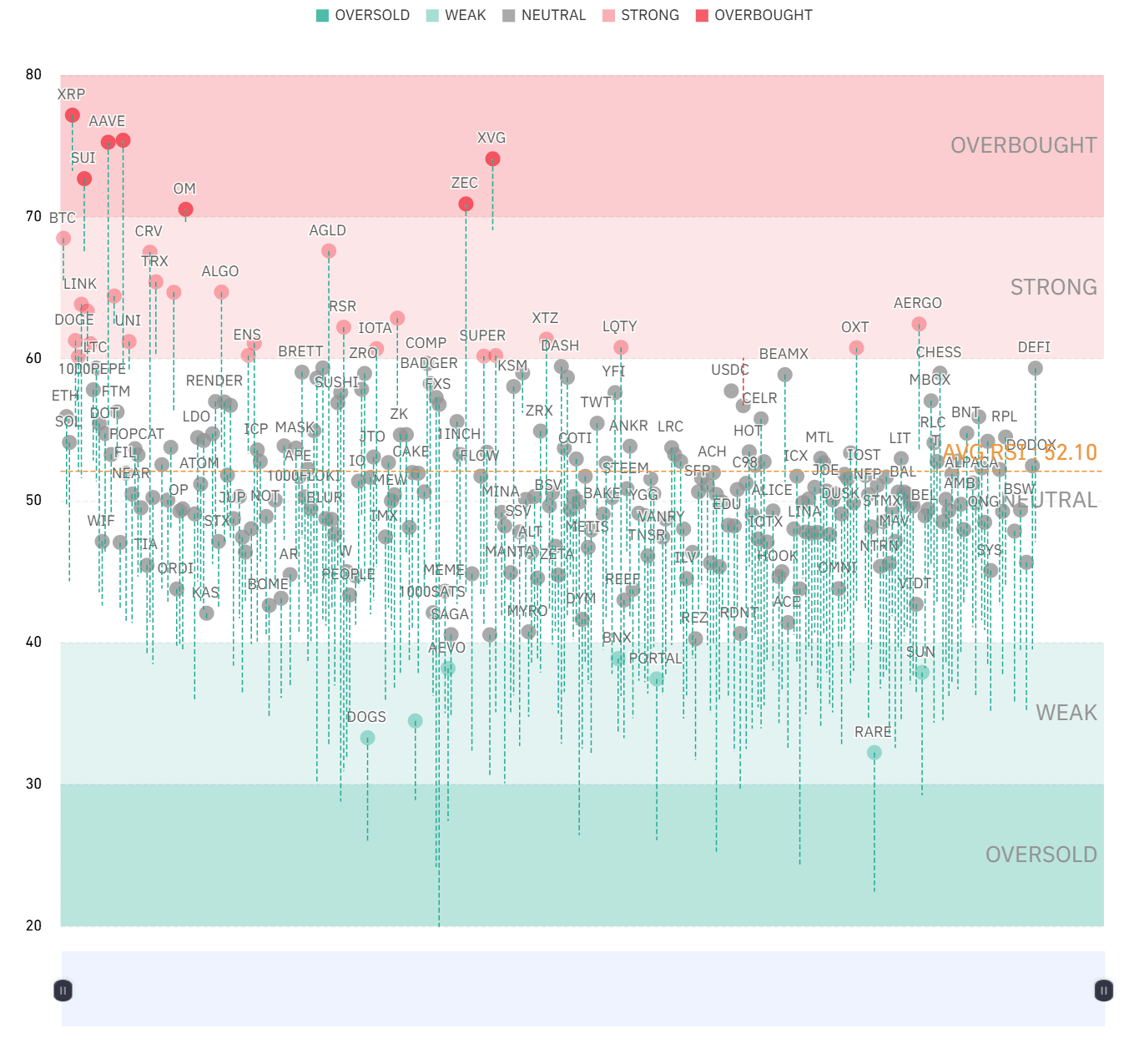

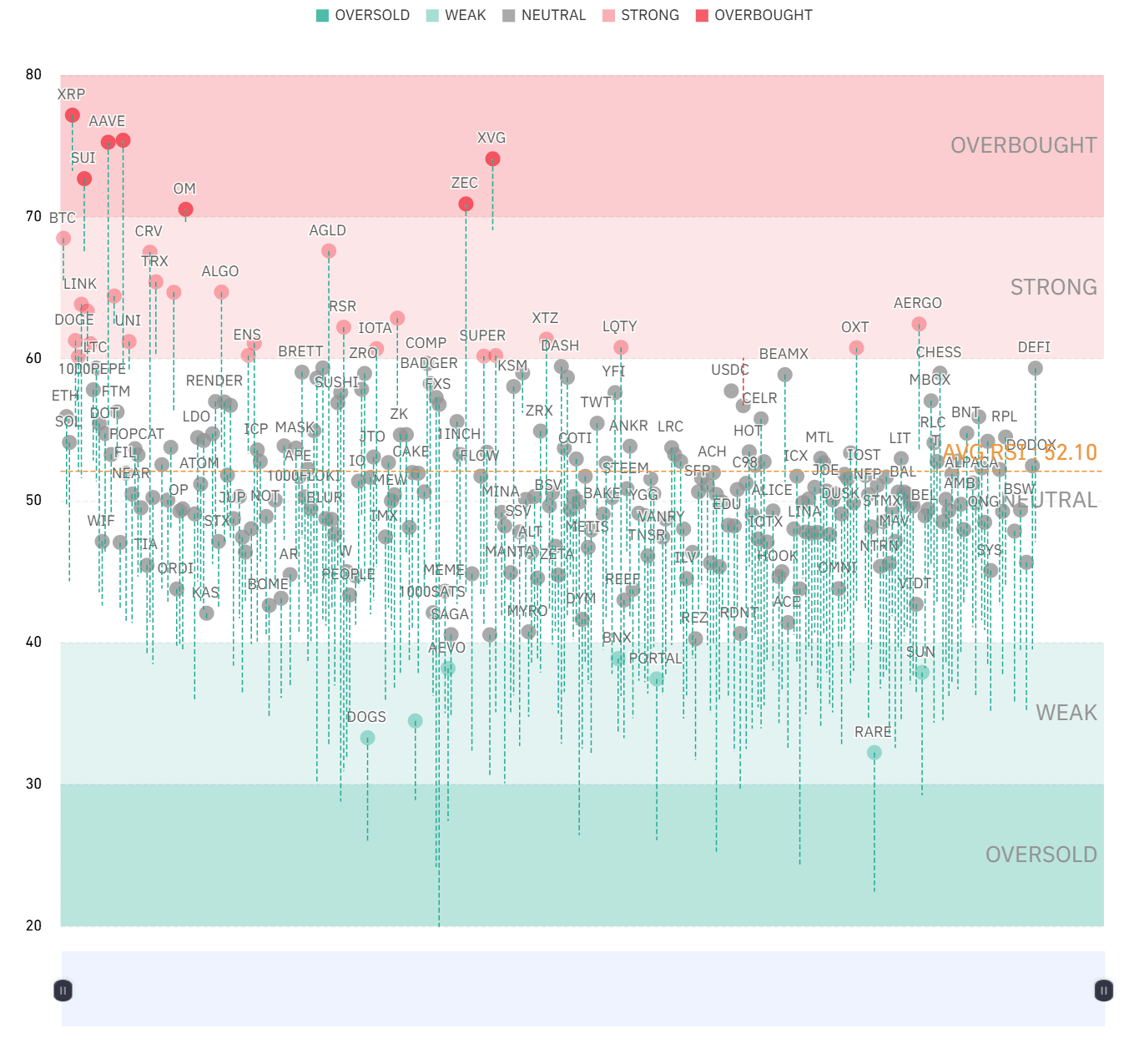

The oversold/overbought chart gives further perception, exhibiting a divergence in efficiency.

XRP and Aave [AAVE] are in overbought territory, implying potential corrections, whereas oversold property highlighted shopping for alternatives for speculative merchants.

Overbought vs. oversold: A story of divergence

AMBCrypto’s evaluation of the oversold/overbought chart revealed the stark distinction between Bitcoin and altcoins.

Whereas Bitcoin remained inside a impartial zone, indicating balanced sentiment, many altcoins had been scattered throughout overbought and oversold territories.

Belongings like Zcash [ZEC] and XRP appeared overbought, suggesting restricted upside and potential profit-taking.

Then again, oversold altcoins introduced alternatives for buyers in search of undervalued property to capitalize on in the course of the vacation interval.

Supply: Coinglass

This divergence highlighted the speculative nature of altcoins, which frequently see amplified volatility in comparison with Bitcoin.

Whereas this creates alternatives for short-term positive aspects, it additionally will increase the dangers of investing in altcoins throughout unsure market situations.

Bitcoin’s vs. Altcoin: Stability vs. volatility

The market heatmap underscored Bitcoin’s dominance in buying and selling exercise and market capitalization, reflecting its position as a stabilizing drive.

Whereas delivering greater proportion positive aspects in some circumstances, altcoins remained vulnerable to sharp worth swings on account of decrease liquidity and speculative curiosity.

Bitcoin’s constant buying and selling quantity and dominance indicated a extra secure sentiment than the fragmented and speculative nature of altcoins.

The impartial stance on the Altcoin Season Index means that whereas altcoins have seen particular person successes, the broader market stays tilted towards Bitcoin as the popular asset.

The vacation season winner

Based mostly on the evaluation, Bitcoin seems to have the sting throughout this vacation season.

Its stability, rising dominance, and powerful buying and selling volumes make it the asset of alternative for long-term buyers and risk-averse merchants.

Nevertheless, the altcoin market gives pockets of alternative for these keen to navigate its volatility, with property in oversold territory presenting potential entry factors.

The final word winner is determined by investor aims. For these prioritizing stability and sustained development, Bitcoin stays the champion.

Selective altcoins may ship surprises for these in search of greater dangers and doubtlessly greater rewards. As the vacation season progresses, conserving an in depth eye on these metrics will make clear the evolving dynamics of Bitcoin vs. altcoins.