Bitcoin vs Altcoins: Why the next few days could be crucial for your portfolio

- The altcoin market is making a comeback as Bitcoin recovers from a market-wide crash.

- Now, vigilance is essential for increasing your portfolio and capitalizing on potential alternatives.

Bitcoin’s latest pullback has opened the door for altcoins to surge. As BTC takes a breather, altcoins are racking up spectacular double-digit positive factors. Buyers are clearly leaping on the chance to diversify and get well from the losses.

Usually, retail consumers strategize round Bitcoin’s peak, seeing it as the right time to redirect capital into the altcoin market. But when the market’s present shift suggests BTC is likely to be nearing a neighborhood prime, might this be the candy spot to scoop up altcoins on the ‘dip’?

Bitcoin is reclaiming its dominance however there’s a catch

Proper now, all eyes are on Bitcoin. After bouncing again from the chaos post-FOMC, BTC is creeping nearer to the $100K mark, at the moment buying and selling at $97K (as of writing).

However don’t anticipate a easy journey – challenges nonetheless loom forward. Whereas Bitcoin dominance has climbed to 59%, that doesn’t assure a bullish run. On the psychological entrance, BTC nonetheless faces hurdles.

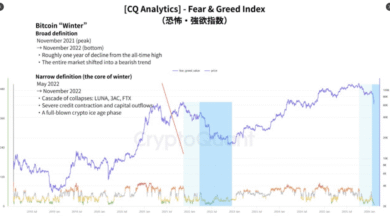

For one, the greed index has dipped again to early November ranges. A small pullback might push it into the “worry” zone, signaling warning amongst merchants – a logical transfer after the latest dump.

Secondly, short-sellers are reaping rewards by betting towards BTC, a method as rewarding as shopping for on the backside and promoting on the prime of the cycle.

These elements mixed counsel that whereas BTC’s present worth might look attractive, the cautious temper amongst traders factors to a probable consolidation part forward.

In the meantime, the altcoin market has been thriving in Bitcoin’s restoration, main the cost within the top gainers’ chart. If this pattern continues, most altcoins could possibly be poised for an enormous leg-up.

So, time to dig into the altcoin dip?

The subsequent few days might be essential in figuring out whether or not the altcoin market is really experiencing an inflow of recent capital.

Current activity reveals huge gamers scooping up main names – a traditional indicator of a backside forming – however a robust rebound should be untimely.

Why? For one, Bitcoin continues to be within the early phases of restoration. As outlined earlier, the excellence between “consolidation” and “correction” stays razor-thin, leaving the market on edge.

Much more telling is the ETH/BTC correlation chart beneath, which hints at additional draw back except the RSI reaches historic lows. This uncertainty would possibly preserve altcoin traders cautious, not less than for now.

Supply : TradingView

For a better play, specializing in low to mid-cap altcoins might provide faster returns, given the present market dynamics.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Prime-tier altcoins, nevertheless, are nonetheless intently tied to Bitcoin’s worth motion and stay riskier bets – particularly till Bitcoin reveals clearer indicators of consolidation or an overheated market.

Furthermore, with whales accumulating prime altcoins, these cash might change into extra weak to manipulation. Till then, staying agile could possibly be key to seizing alternatives, which, for now, might lie in low-cap gems.