Bitcoin vs. Ethereum: Higher fees spark debate as demand booms

- Bitcoin transaction charges hit an all-time of $80 million.

- Stacks exec believes charges will go even increased as BTC L2 expands.

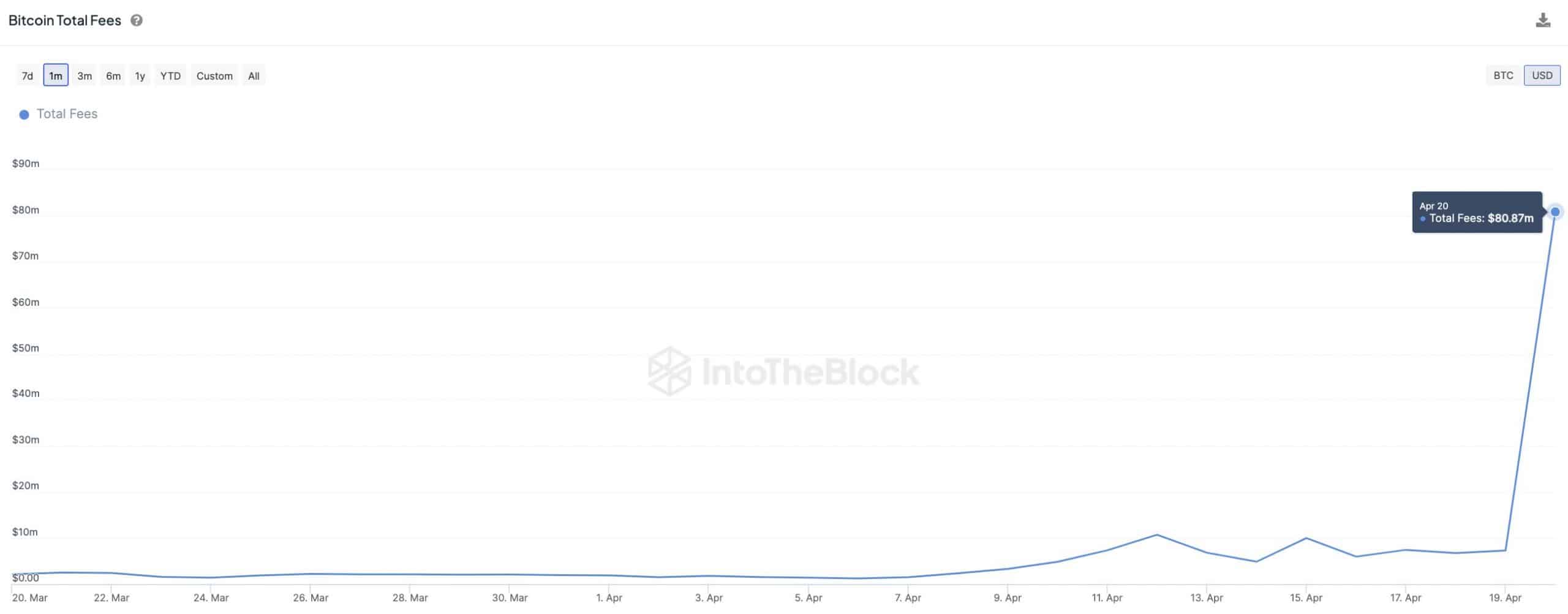

Bitcoin [BTC] miners have been extra worthwhile after the fourth halving. On twentieth April, BTC hit file charges of over $80 million, outpacing its earlier all-time excessive in 2017, based on IntoTheBlock’s Head of Analysis, Lucas Outumuro;

“The $80M in every day charges is roughly 4x bigger than the earlier ATH set in December 2017. The common $BTC transaction price was a whopping $128, dwarfing the $30 peak reached through the first Ordinals frenzy.”

Supply: X/Lucas Outumuro

The upper-than-average transaction charges have attracted debate on demand for block house between Ethereum [ETH] and Bitcoin networks.

BTC vs. ETH: Runes impact?

Referencing BTC’s higher-than-normal $128 common charges, a pseudonymous crypto analyst claimed that the Bitcoin community now has extra demand for block house than Ethereum. He stated;

“The common price to ship worth on Ethereum community is about $0.50 proper now (single digits gwei). On Bitcoin community it’s $20. That’s a 40x distinction in demand for BTC blockspace. Enormous alpha there.”

It’s price noting that the spike in BTC charges additionally coincided with the launch of Runes Protocol, a brand new Bitcoin fungible token commonplace.

Nevertheless, one other consumer, Adriano Feria, downplayed Bitcoin’s increased charges and acknowledged,

“BTC’s charges are nonetheless $20 as a result of LN (Lighting Community) is rubbish, and there are not any different options.”

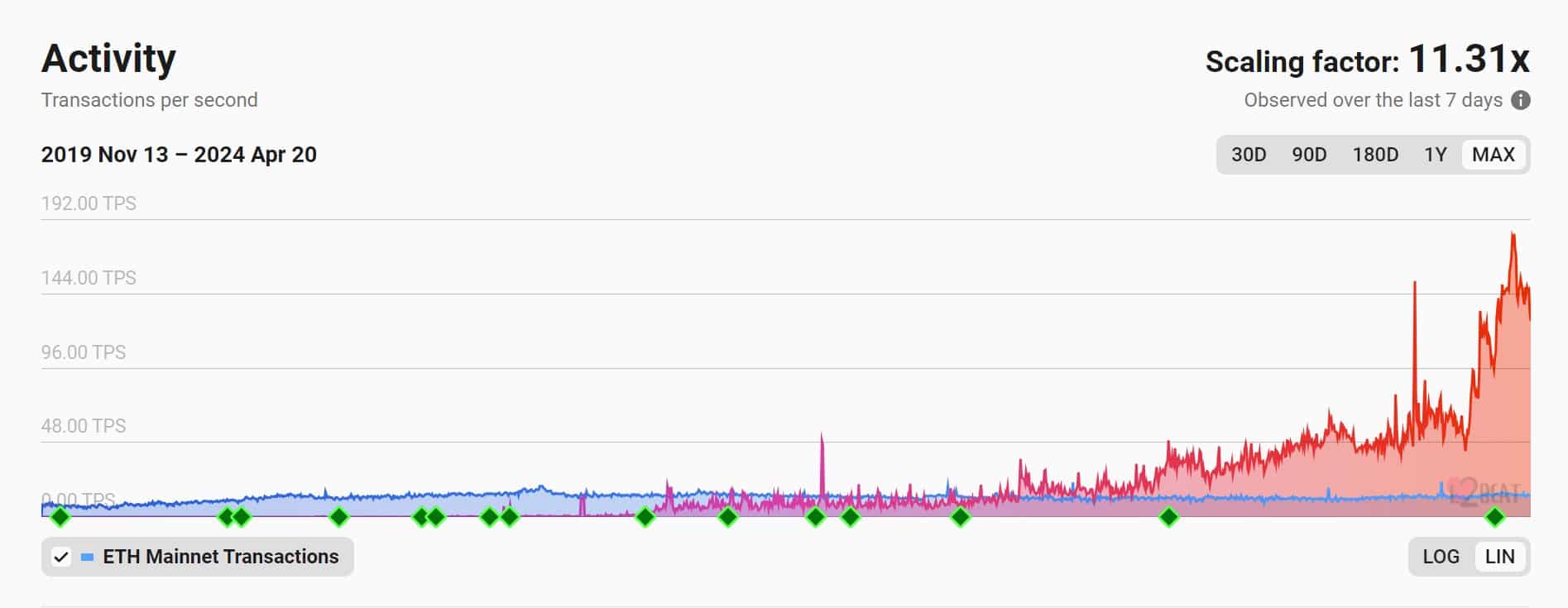

Feria added that blobs have positively impacted Ethereum and shifted demand to L2s;

“Demand for transactions secured by ETH are at an ATH, however they’re simply shifting to L2s.”

Supply: X/Adriano Feria

Nonetheless, different analysts and execs anticipate Bitcoin to file extra charges as Runes Protocol positive factors extra traction and BTC L2s warmth up.

On Runes’ impression on BTC charges, Outumuro added;

“24 hours after the halving, inflationary rewards have dropped by 50%, however transaction charges spiked 1,200% attributable to Runes. Miners made a file $100M+ in income on 4/20.”

Proper now, Runes Protocol is dominated by memecoins. Nevertheless, the upcoming Nakamoto improve of the Bitcoin layer-2 scaling answer, Stacks [STX], might additional gasoline exercise and charges.

Stacks co-founder, Ali Muneeb not too long ago highlighted that;

“Bear in mind after we instructed you that Bitcoin charges will do a 500x? Yeah, we’ve been engaged on Bitcoin L2s for a cause. Completely satisfied halving, everybody! Subsequent cease, Nakamoto.”

Merlin Chain, one other BTC L2, went stay on nineteenth April and now leads by way of TVL (Complete Worth Locked) per DefiLlama data.

If the BTC L2 ecosystem re-ignites curiosity within the community, BTC transaction charges might stay increased.