Bitcoin vs Ethereum: How they have fared since January’s ETF approval

- Ethereum has recorded low capital inflows since January in comparison with Bitcoin.

- ETH’s long-term holders proceed to attend for a brand new all-time excessive.

Main altcoin Ethereum [ETH] has underperformed in comparison with Bitcoin [BTC] since January, Glassnode present in a brand new report.

In keeping with the on-chain knowledge supplier, whereas BTC, aided partly by the US spot exchange-traded funds (ETF), has seen important capital inflows because the starting of the 12 months, ETH has recorded a decline in buying and selling exercise.

ETH stays in BTC’s shadows

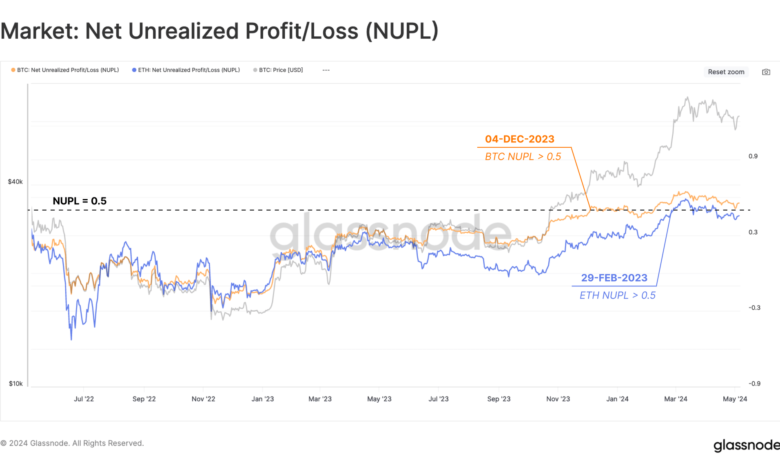

Following the approval of spot Bitcoin ETFs on the tenth of January, Glassnode knowledge reveals a big divergence in Web Unrealized Revenue/Loss (NUPL) between BTC and ETH.

In its report, the on-chain analytics agency famous that this implies that BTC’s traders have captured a bigger share of earnings in comparison with their ETH counterparts since then.

The NUPL metric determines whether or not an asset’s holders are experiencing unrealized positive aspects or losses. It compares the common buy value of all tokens held by traders to the present market value.

If the market value is increased, there’s a net-unrealized revenue, whereas whether it is decrease, there’s a net-unrealized loss.

In keeping with Glassnode, a big threshold for the NUPL is when the worth exceeds 0.5. It’s because it indicators that an asset’s unrealized revenue is larger than 50% of its whole market capitalization.

Glassnode mentioned,

“Amidst the hype and market rally surrounding (the) approval of the spot Bitcoin ETFs, the unrealized revenue of Bitcoin holders expanded significantly sooner than that of Ethereum traders. In consequence, the Bitcoin NUPL metric crossed 0.5 and entered the euphoria section three months earlier than than equal metric for Ethereum.”

Supply: Glassnode

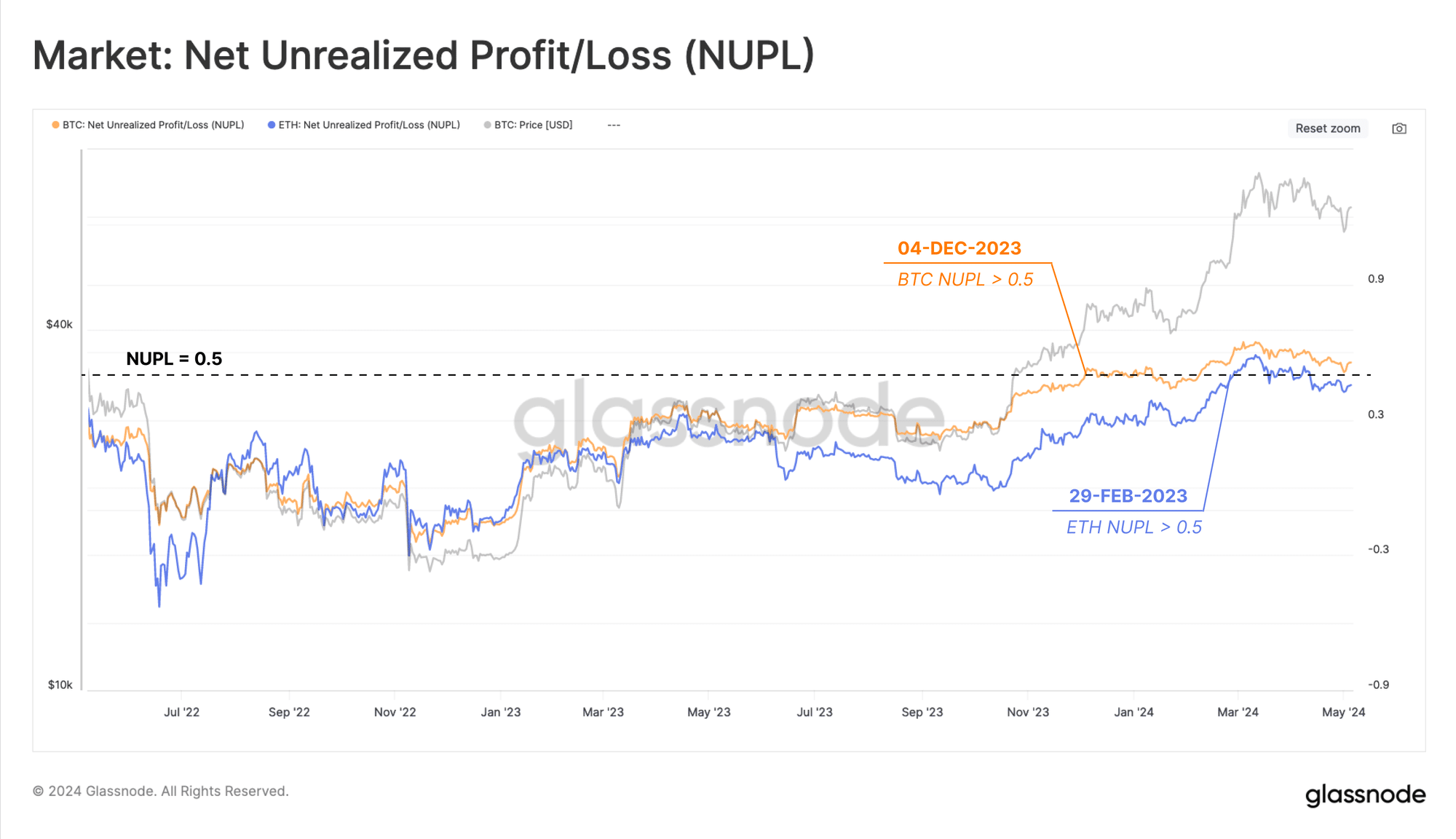

Additional, ETH has but to see a powerful influx of recent capital as BTC has since spot ETFs grew to become tradeable within the US.

Glassnode assessed the Quick-Time period Holders’ Realized Cap for each cash and located that ETH’s stays low.

This means decreased exercise from the coin’s short-term traders, whose actions are recognized to considerably affect an asset’s value efficiency.

The report additional acknowledged,

“In some ways, this lack of recent capital inflows is a mirrored image of the under-performance of ETH relative to BTC. That is doubtless partly as a result of consideration and entry caused by the spot Bitcoin ETFs.”

On why this may be occurring, Glassnode added:

“The market remains to be awaiting the SEC’s determination for approval of a set of ETH ETFs anticipated in direction of the tip of Might.”

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

Because of the distinction within the efficiency of the cash, BTC and ETH’s long-term holders (LTHs) have adopted completely different methods.

Whereas BTC’s LTHs have let go of a few of their holdings to ebook earnings following the coin’s rally to a brand new all-time excessive, ETH’s LTHs –

“Seem to nonetheless be ready for higher profit-taking alternatives.”