Bitcoin vs. gold: Which is the better inflation hedge?

- Bitcoin raises blended sentiments amongst merchants as its value traits between $70k and $71k.

- Skeptics argue that Bitcoin is unfit to be thought-about even near conventional asset courses.

Regardless of a short decline, Bitcoin [BTC] has as soon as once more climbed to $71,000, surpassing expectations set earlier than the halving occasion. But, amidst this heightened demand, Bitcoin skeptics keep sturdy of their criticism, typically evaluating its value to conventional asset courses.

This prompts a vital query – How is Bitcoin being evaluated and understood within the broader monetary panorama?

Bitcoin’s resilience amidst rising skepticism

Yassine Elmandjra, Director of Digital Property at Ark Make investments, in a current dialog on the Bitcoin Buyers Day in New York, weighed in on the continued debate. He emphasised that Bitcoin’s lack of yield technology, in contrast to bonds, is what poses a problem in its analysis. He stated,

“I believe a lot of bitcoin’s skepticism stems from, you recognize, its incapability to suit neatly inside conventional asset class frameworks particularly from a elementary valuation standpoint.”

Individually, Chris Kuiper, Director of Analysis for Constancy Digital Property, highlighted, that Bitcoin’s value actions have intently aligned with adjustments in inflation expectations, notably when measured over a five-year horizon. He stated,

“In case your inflation expectation goes from 3% a 12 months to six%, that’s an enormous change and Bitcoin tracked that completely throughout COVID and post-COVID, with all the cash creation.”

On remarks that Bitcoin isn’t an inflation hedge, Kuiper exclaimed,

“I believe it’s!”

This sentiment was additional confirmed by the Woodbull Charts which highlighted the drop in Bitcoin’s personal inflation charge from 3.72% in 2020 to 1.7% in 2024.

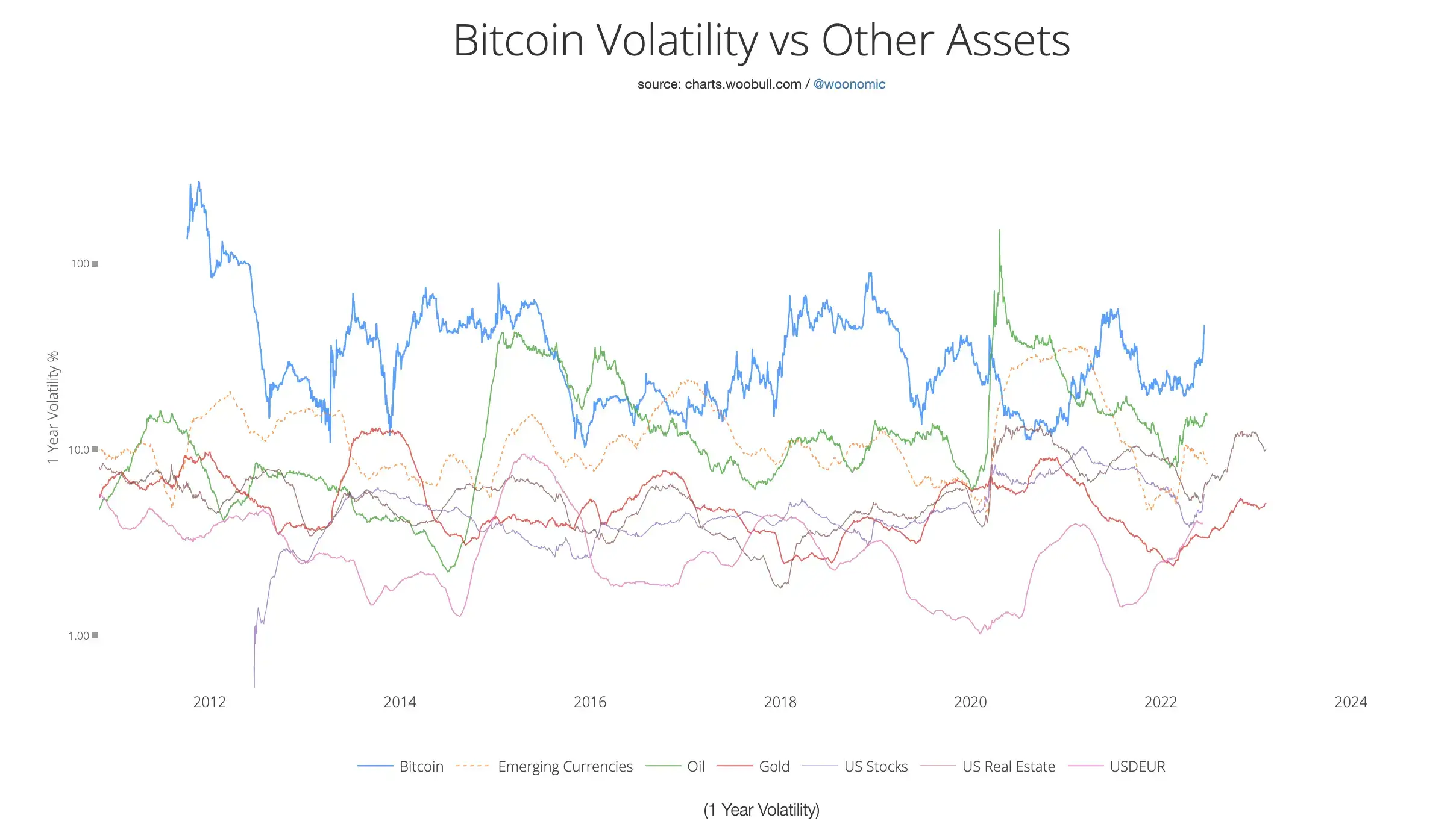

Nonetheless, when inspecting the 1-year volatility chart of Bitcoin alongside different asset courses, a stark distinction emerges. Bitcoin’s volatility stands out at 46.95%, whereas gold, reveals considerably decrease volatility, of simply 5.6%.

This comparability underscores the notable distinction in value fluctuations between Bitcoin and gold over the previous 12 months.

In response, Matthew Siegel from VanEck famous that Bitcoin’s effectiveness as an inflation hedge might need been affected by current coverage choices, inflicting a brief setback. He famous,

“We at all times need to remind ourselves that is an rising market asset, frontier market asset. People are into it as a result of we will speculate simply with our ETFs”

What lies forward?

With the uncertainty relating to whether or not the upcoming Bitcoin halving occasion can have the same impact on value as earlier ones. Kuiper acknowledged that the halving occasion coincides with election cycles and liquidity cycles. This means that a number of components can affect value traits.

Thus, regardless of missing a transparent comparability from the previous, the specialists consider that the halving occasion will doubtless dampen sure features of value volatility.