Bitcoin: Waiting for BTC’s price to recover from its crash? Wait for…

- Information confirmed that Bitcoin may fall beneath $66,000 regardless of rising bullish sentiment.

- A report defined how Bitcoin may hit new peaks quicker than earlier halvings.

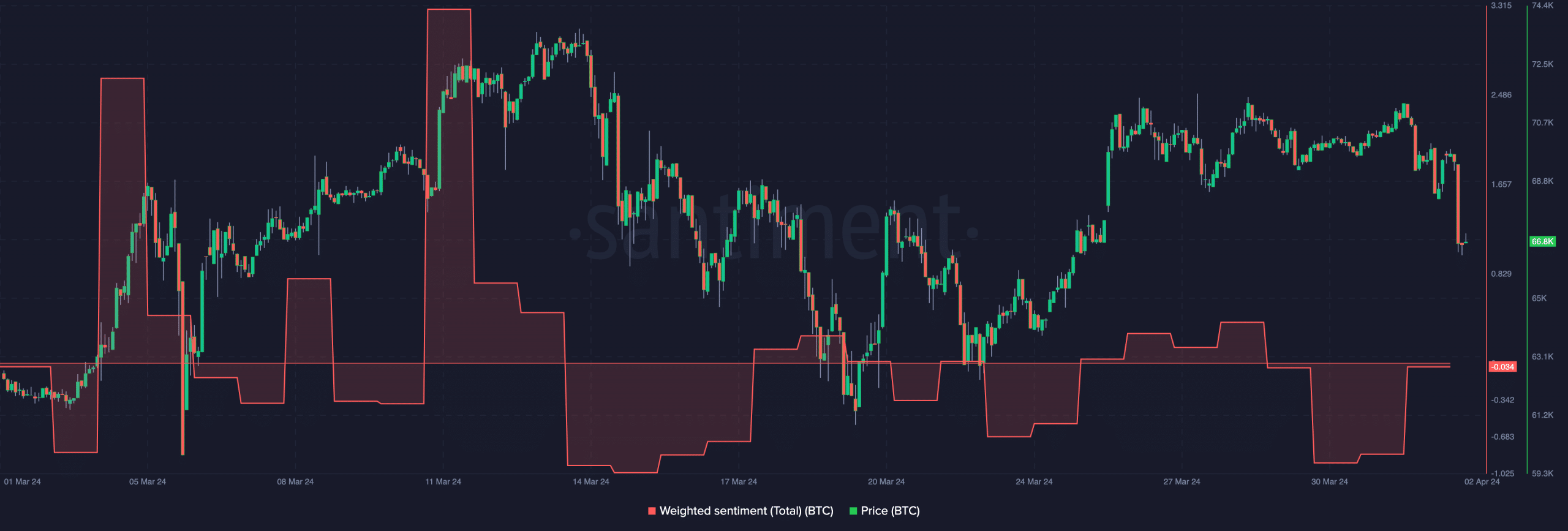

As an alternative of panicking after Bitcoin’s [BTC] value collapsed, market members are assured that the coin may recuperate. AMBCrypto received this data after reviewing the social quantity utilizing Santiment.

In line with our evaluation, there was a surge in the usage of phrases like “bullish” and “shopping for.” Likewise, statements that embrace “promoting” and “bearish” additionally elevated.

Scared cash to make extra?

Nonetheless, we observed that the bullish aspect was nearly double the dimensions of these in concern. Sometimes, you’ll anticipate this sentiment to gasoline a fast bounce for Bitcoin. However historical past says in any other case.

Sure, shopping for alternatives seem when costs crash, as they did within the final 24 hours. Nonetheless, an extra crash may nonetheless occur if conviction is as excessive because it was at press time.

Supply: Santiment

Traditionally, if concern outweighs bullish conviction, and the retail cohort is panic promoting, that might be one of the best time to purchase the dip. As of this writing, that has not occurred.

Therefore, it’s more likely to see BTC drop beneath $66,400 within the close to time period. Hours earlier than the piece, AMBCrypto reported how Bitcoin might expertise excessive volatility because the halving approaches.

“This cycle could also be quicker”

Apparently, crypto asset administration agency Grayscale additionally launched its thesis concerning the occasion and the doable affect on value.

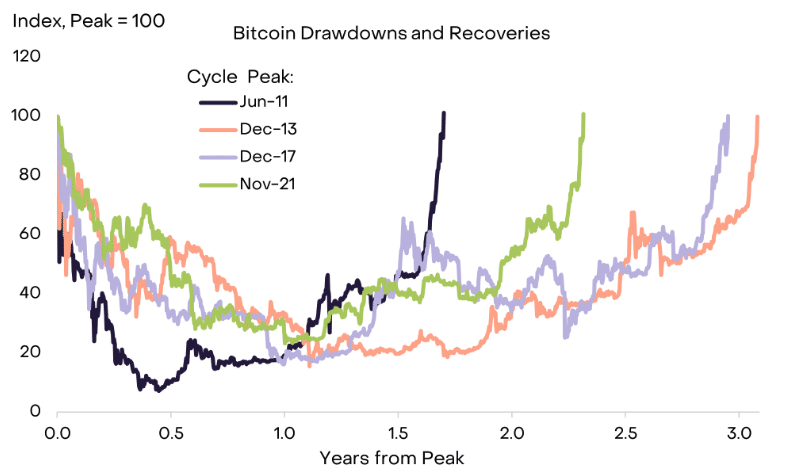

The report, dated the first of April, targeted on Bitcoin’s efficiency in March and its doable restoration after the halving. Grayscale additionally talked about sure components that might affect BTC later this 12 months.

In line with the report, Bitcoin outperformed many different belongings final month as a result of many central banks worldwide displayed indicators of lowering rates of interest.

Subsequently, demand for different shops of worth like Bitcoin jumped. Regarding the upcoming halving, the agency famous that it anticipated costs to drop.

Supply: Grayscale Funding

Nonetheless, restoration might be quicker than it was through the earlier halvings. The thesis learn,

“By comparability, the restoration from the prior two drawdowns took roughly three years, whereas the restoration from the primary main drawdown took about one and a half years. In Grayscale Analysis’s view, we at the moment are within the “center innings” of one other Bitcoin bull market.”

Bitcoin has others to look as much as

In the meantime, AMBCrypto checked the general notion of the coin out there. On the first of April, the Weighted Sentiment dropped to -0.937, suggesting that almost all members had been bearish.

However at press time, the metric appeared to be heading back to constructive territory. If the studying turns into constructive, it might reinforce members’ confidence initially talked about.

Supply: Santiment

Shifting on, Grayscale talked about that Bitcoin ETFs are more likely to stay a driver of the worth. Subsequently, if inflows improve, BTC may climb.

Nonetheless, a rise in outflows, as we mentioned in latest instances, might trigger Bitcoin to stall or decline additional.

Past that, the agency famous that the Federal Reserve’s resolution to cut back rates of interest may assist BTC admire.

For the long-term horizon, it additionally famous that the November 2024 U.S. elections might affect the coin’s path.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

Over the past elections in 2020, Bitcoin went from lower than $13,000 and received near hitting $20,000 inside a month.

Will the state of affairs be related this time? Time will inform. However for now, the coin’s decline may prolong a bit longer.