Bitcoin walks on tightrope as SEC hints at appeal for Ripple ruling

- The SEC is as soon as once more preventing to get its foot again within the crypto market.

- BTC’s uncertainty noticed a shift to the facet of warning.

What’s Bitcoin’s [BTC] subsequent transfer? This can be a query on many BTC merchants’ minds, particularly contemplating the slowdown we’ve noticed in its worth motion just lately. The stakes are notably excessive contemplating the most recent developments involving the SEC.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

There may be now a major likelihood that we might even see one other main worth transfer in BTC. On the bullish facet, we’ve potential Spot ETF approvals which might ship costs hovering as soon as once more.

The SEC, alternatively, may contribute to a different main selloff. It’s because the U.S. regulator is reportedly interesting the current Ripple ruling.

#XRPCommunity #XRP Within the SEC v. Terraform Labs/Do Kwon case, the SEC has filed a pleading discussing Decide Torres’s determination in SEC v. Ripple wherein it states that “SEC employees is contemplating the varied accessible avenues for additional evaluate and intends to suggest that the SEC…

— James Okay. Filan 🇺🇸🇮🇪 (@FilanLaw) July 21, 2023

In response to current stories, the SEC is looking for a evaluate based mostly on rulings made within the Terra lawsuit. In different phrases, there’s a appreciable likelihood that the SEC’s request is likely to be authorized.

Such an consequence, in addition to an unfavorable judicial consequence for the crypto market, might ship costs tumbling as soon as once more.

Are regulatory issues priced in?

The prevailing uncertainty might clarify Bitcoin’s current consolidation. The SEC state of affairs has already brought about some worth weak spot and we just lately noticed vital outflows from whales. This may increasingly counsel that the potential worth affect in case of damaging information is likely to be considerably cushioned.

Promote stress might already be slowing down. A current Glassnode alert revealed that Bitcoin alternate deposits have now dipped to a 3-year low. Though this may occasionally verify a drop in promote stress, it might simply be a pause. Extra promote stress might happen in case of an unfavorable consequence.

📉 #Bitcoin $BTC Variety of Change Deposits (7d MA) simply reached a 3-year low of 1,859.440

Earlier 3-year low of 1,860.750 was noticed on 18 Could 2023

View metric:https://t.co/v3uKq4dCjX pic.twitter.com/AUhYqb0ez0

— glassnode alerts (@glassnodealerts) July 21, 2023

We beforehand regarded into how extra promote stress might probably result in sub $28,000 costs. Bitcoin must crash by simply 6.2% from its $28,894 press-time worth degree.

The identical worth represented a 6% dip from its present month-to-month excessive, thus confirming that hypothesis has been leaning on the bearish facet.

Bitcoin merchants are undoubtedly in a section of heightened uncertainty. The aforementioned decrease alternate deposits warrant a have a look at the opposite facet of the coin.

How a lot are 1,10,100 BTCs value right now?

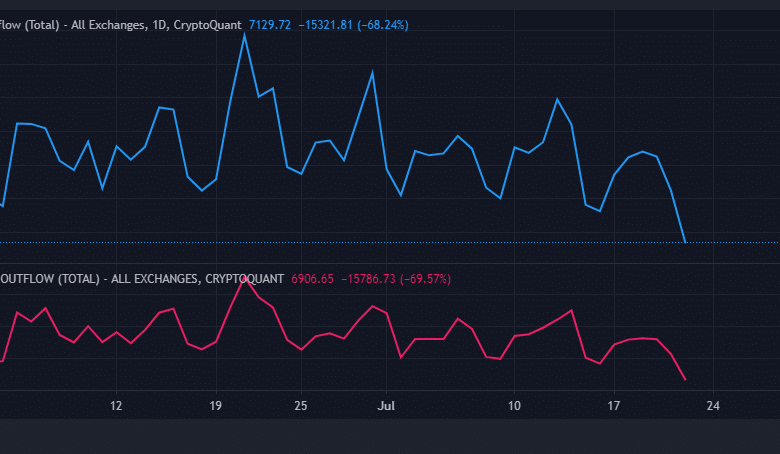

It seems that BTC flows out of exchanges have additionally been affected. BTC alternate outflows are right down to a 2-month low.

Supply: CryptoQuant

The above findings verify that it’s nonetheless tough to find out which method the market will sway based mostly on on-chain knowledge. That’s to say, the following main Bitcoin worth transfer will seemingly be decided by weighty information resembling regulatory-related or Spot ETF-related information.