Bitcoin wallets hit a 5-month low as small traders exit – Are whales buying the dip?

- BTC’s non-empty wallets have hit a 5-month low, reflecting retail merchants’ rising issues amid market volatility.

- Giant Bitcoin holders continued to build up, signaling potential bullish sentiment regardless of smaller traders exiting.

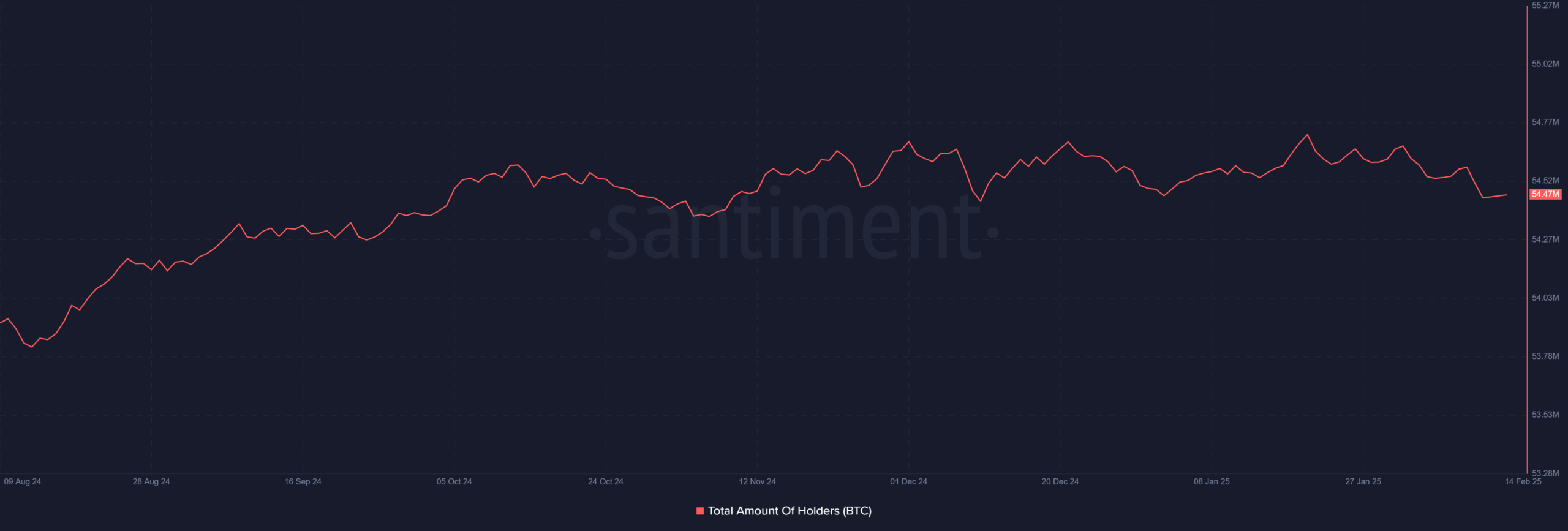

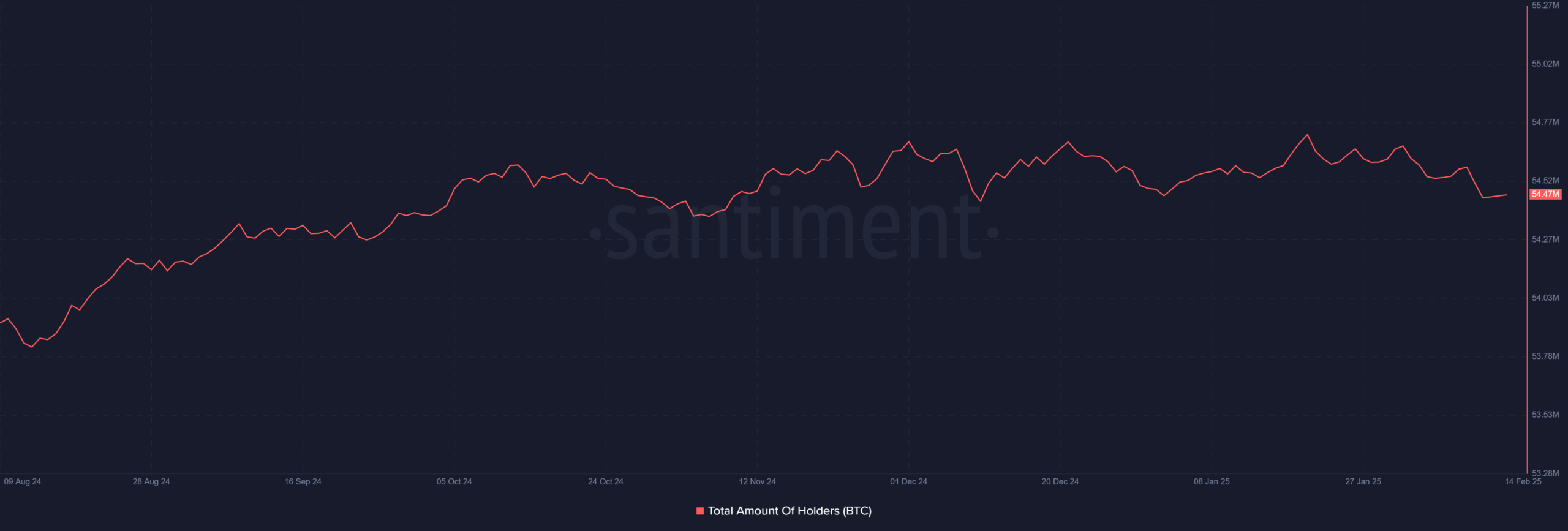

Bitcoin’s[BTC] community has witnessed a notable decline within the variety of energetic wallets, hitting a five-month low of round 54 million non-empty wallets.

This drop indicators rising retail capitulation as smaller merchants exit their positions, seemingly as a consequence of current market uncertainty. The query now could be whether or not whales are stepping in to soak up the promoting stress.

Retail exodus and its influence

Evaluation of knowledge from Santiment highlighted that the variety of Bitcoin wallets holding a steadiness has steadily declined.

The decline marked the bottom degree because the tenth of December. As of this writing, it was round 54.7 million.

Supply: Santiment

Traditionally, such traits recommend that smaller traders are liquidating their holdings, presumably as a consequence of current volatility.

Concern-driven promoting typically coincides with market bottoms, elevating hypothesis about an impending value reversal.

Whale accumulation on the rise?

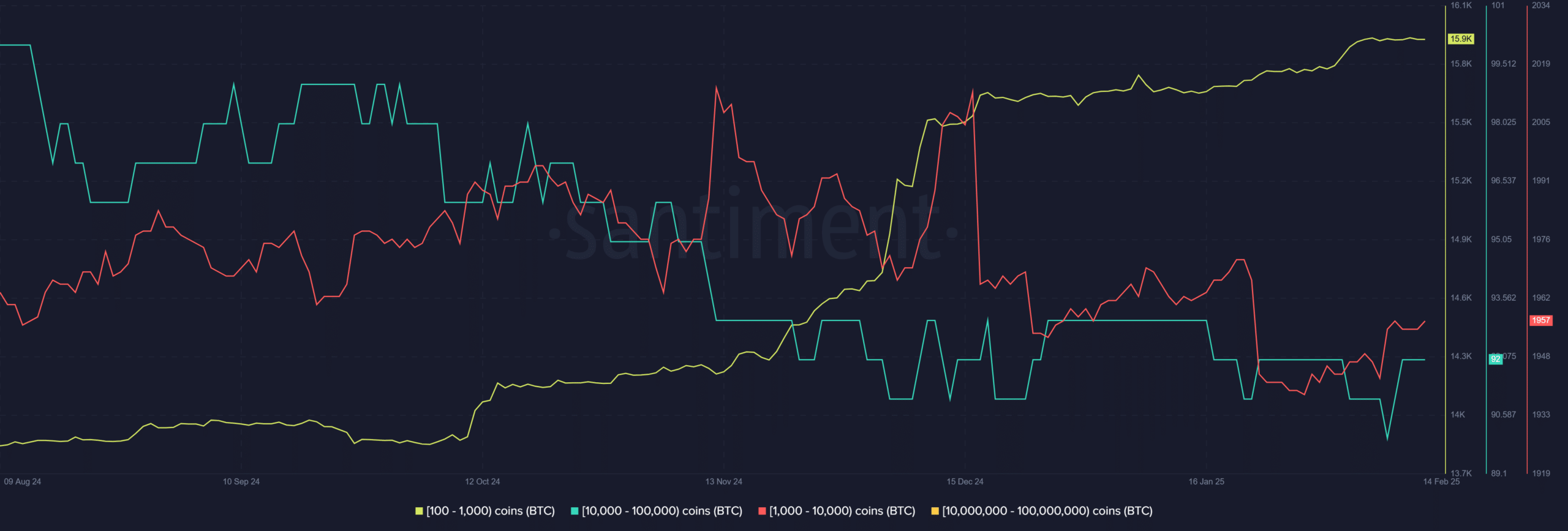

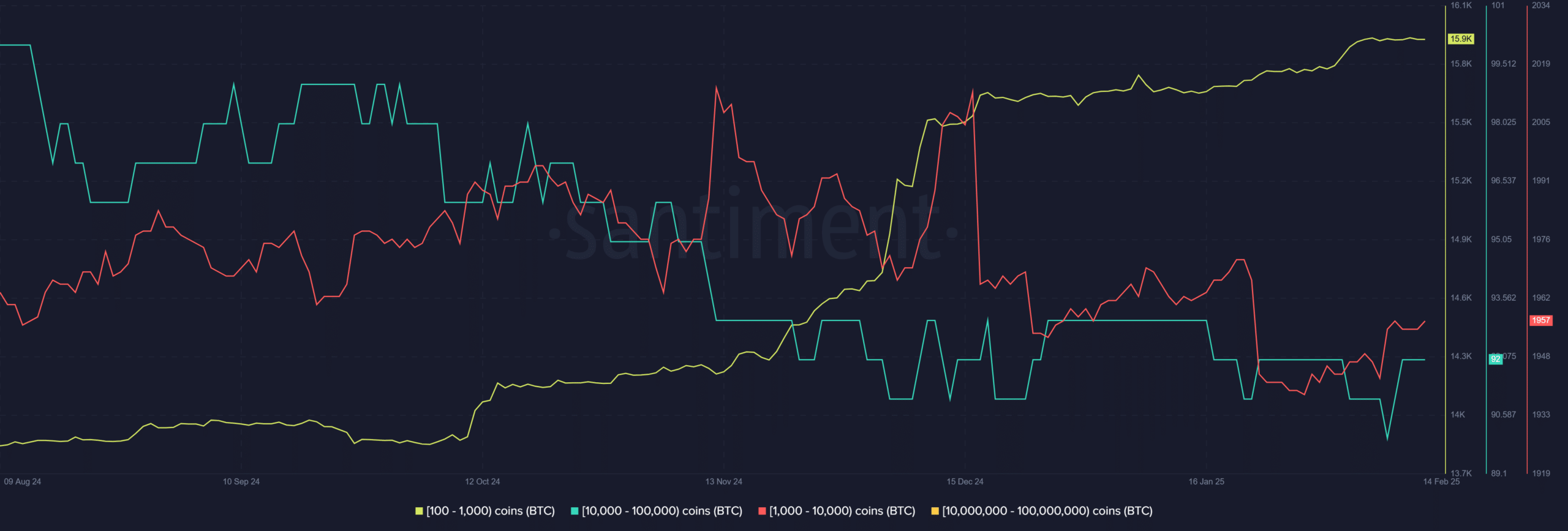

On-chain knowledge from Santiment additionally confirmed that whereas smaller pockets counts are dropping, massive Bitcoin holders—whales—are sustaining and even rising their positions.

Particularly, addresses holding between 10,000 and 100,000 BTC have remained comparatively secure, whereas these with 100-1,000 BTC have proven a slight improve.

Supply: Santiment

This divergence means that institutional traders or high-net-worth people might benefit from the dip to build up BTC at decrease costs.

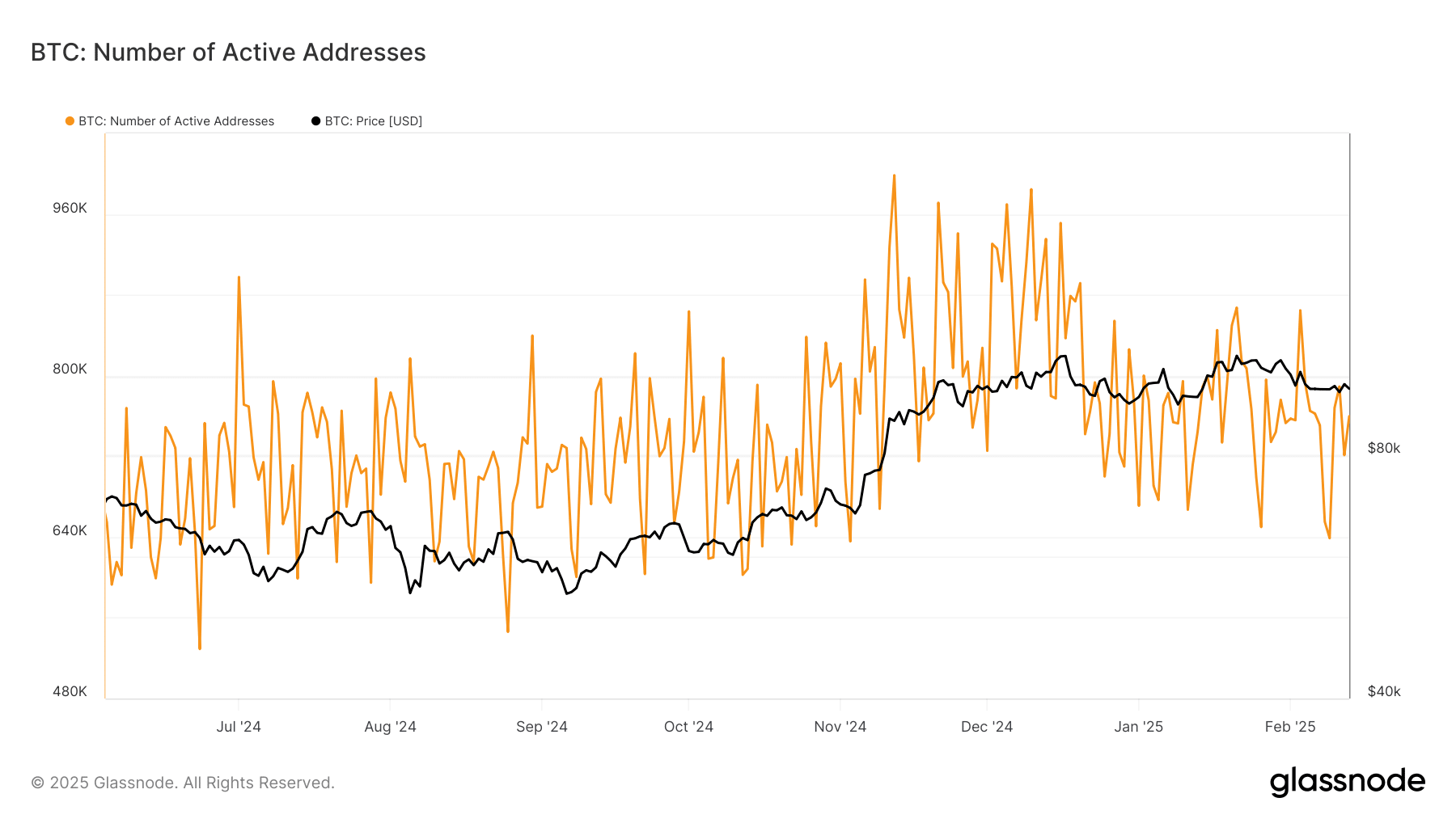

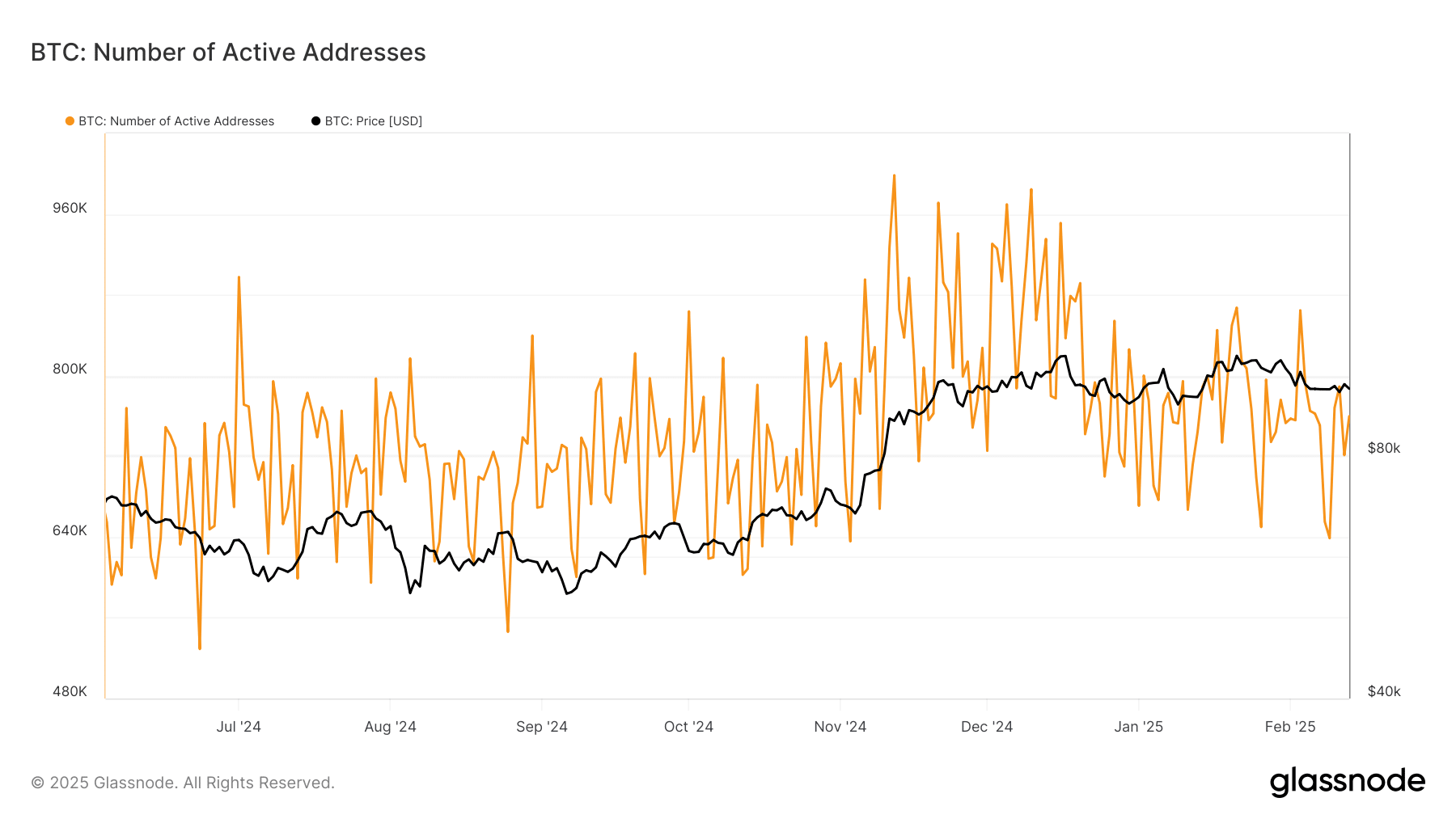

Community exercise and market sentiment

Glassnode’s knowledge evaluation revealed that Bitcoin’s variety of energetic addresses has additionally remained subdued. The subdued nature of the metric displays decrease participation from retail merchants.

Supply: Glassnode

This aligns with the development of pockets depletion and decreased market enthusiasm amongst smaller traders.

Nevertheless, comparable patterns have traditionally preceded important recoveries, particularly when institutional accumulation picks up.

What’s subsequent for Bitcoin?

If whales proceed to build up and retail-driven promoting slows down, Bitcoin may discover a robust assist base and set the stage for a rebound.

Merchants ought to monitor indicators of accelerating whale holdings, stabilization in energetic wallets, and any resurgence in on-chain exercise as key indicators of a possible development reversal.

Whereas short-term sentiment stays cautious, bigger market gamers is perhaps quietly positioning themselves for the subsequent leg up.