Bitcoin wallets shift to ‘buy mode’ – Is a bullish reversal imminent?

- Bitcoin confronted resistance at $106K, with RSI close to overbought and OBV displaying stalled shopping for stress.

- Dense lengthy positions between $101K-$106K may set off liquidations if BTC drops beneath key help.

Bitcoin [BTC] is displaying indicators of a possible shift, as latest knowledge highlights a notable enhance in lengthy positions clustered between the $101K-$106K vary.

Though a value retracement may set off liquidations, on-chain indicators reveal recent accumulation from retail traders and enormous holders.

This rising confidence suggests the market could also be getting into the early levels of a bullish reversal.

Bitcoin wallets enter purchase mode

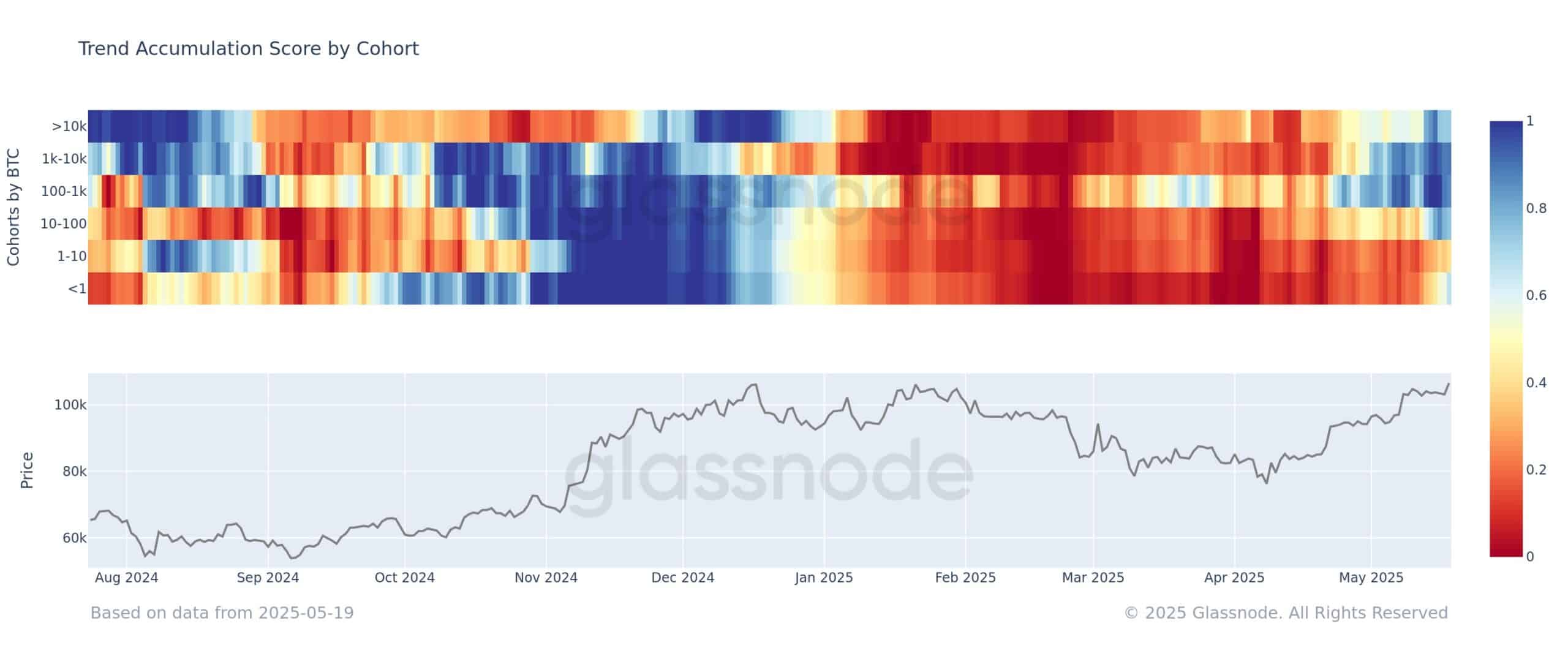

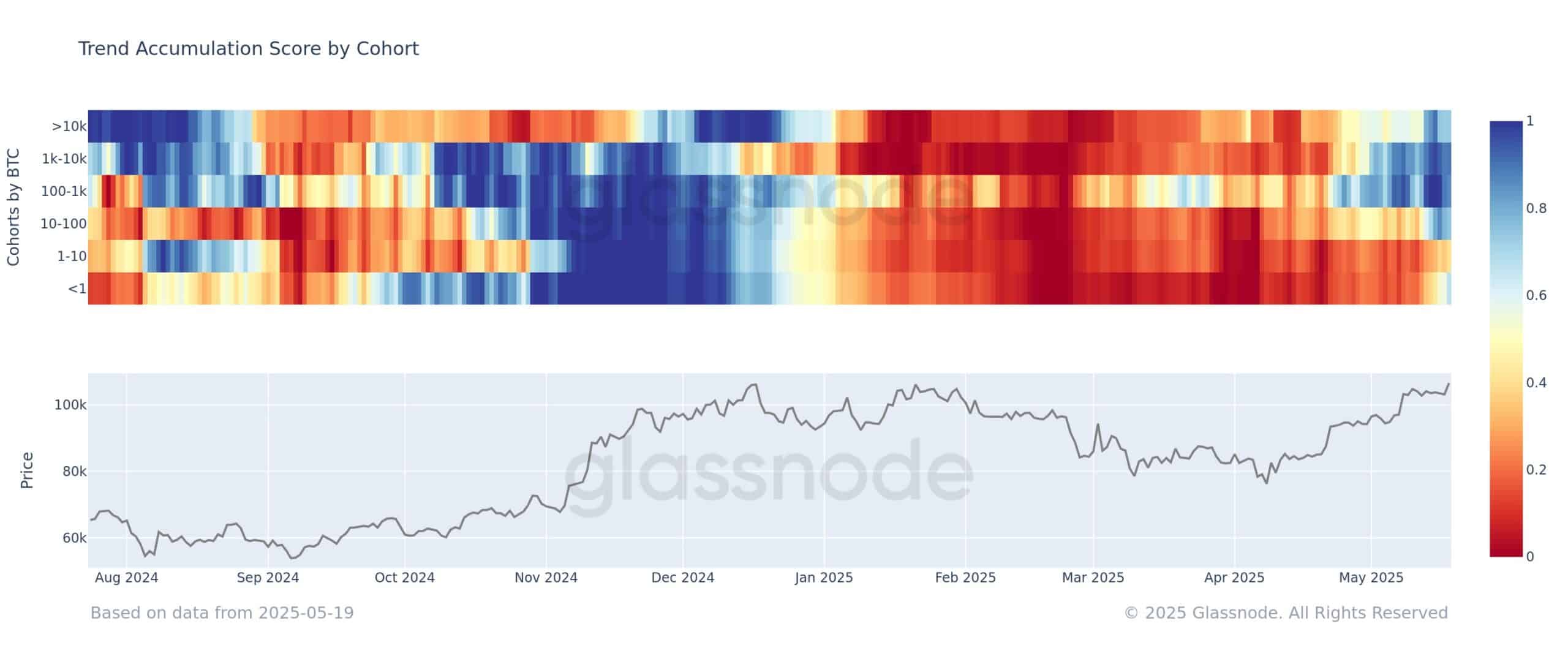

Current knowledge from Glassnode revealed a transparent change in market habits, with accumulation traits now spanning practically all pockets sizes.

Smaller holders with lower than 1 BTC have reversed their earlier distribution development and at the moment are flippantly accumulating, mirrored in an accumulation rating of roughly 0.55.

Supply: Glassnode

In the meantime, bigger pockets cohorts—holding between 100–1,000 BTC and 1,000–10,000 BTC—are exhibiting even stronger accumulation traits.

The one section nonetheless in internet distribution mode is the 1–10 BTC vary, reinforcing a broader resurgence in confidence towards Bitcoin’s value motion.

Clustered lengthy positions may amplify draw back volatility

A big focus of lengthy positions between $101K and $106K has fashioned a high-risk liquidity zone.

In line with Alphractal data, this setup will increase the market’s vulnerability to sharp liquidation cascades, particularly if Bitcoin’s value falls beneath the $100K threshold.

Supply: Alphractal

In distinction, the potential for brief liquidations on upward strikes seems comparatively restricted. With lengthy publicity closely stacked on this zone, any indicators of weak point in BTC may shortly unravel into compelled promoting and elevated volatility.

Value stalls close to resistance

As seen on the day by day chart, BTC confirmed indicators of exhaustion slightly below the $106K degree. Regardless of briefly touching $106,813, BTC failed to shut above this key resistance, slipping barely to $105,504 at press time.

Supply: TradingView

On the time of writing, the RSI stood at 69.42 – hovering simply beneath the overbought threshold – an indication of waning bullish momentum.

In the meantime, the OBV has flattened round -86.6K, hinting at a pause in buy-side stress.

If Bitcoin can preserve help above $105K, a breakout towards $110K stays believable. Nevertheless, a dip beneath $101K may set off lengthy liquidations and escalate draw back volatility.