Bitcoin whale returns after 8 years with $250 mln in tow: Will BTC heat up?

- Bitcoin whales are making large strikes, together with a $200M BTC buy and an 8-year dormancy return

- Whale place sentiment indicators potential bearish outlook, suggesting a attainable Bitcoin worth correction forward

Bitcoin [BTC] whales are stirring the market as soon as once more, with dormant wallets reawakening and large transactions reshaping on-chain dynamics.

One whale lately amassed $200 million in BTC, whereas one other, inactive for eight years, moved over $250 million price of Bitcoin.

As BTC’s worth rebounds, whale sentiment seems divided — some doubling down on accumulation, others signaling potential quick positions.

The end result? A market stuffed with uncertainty, the place each main transfer may dictate the following development.

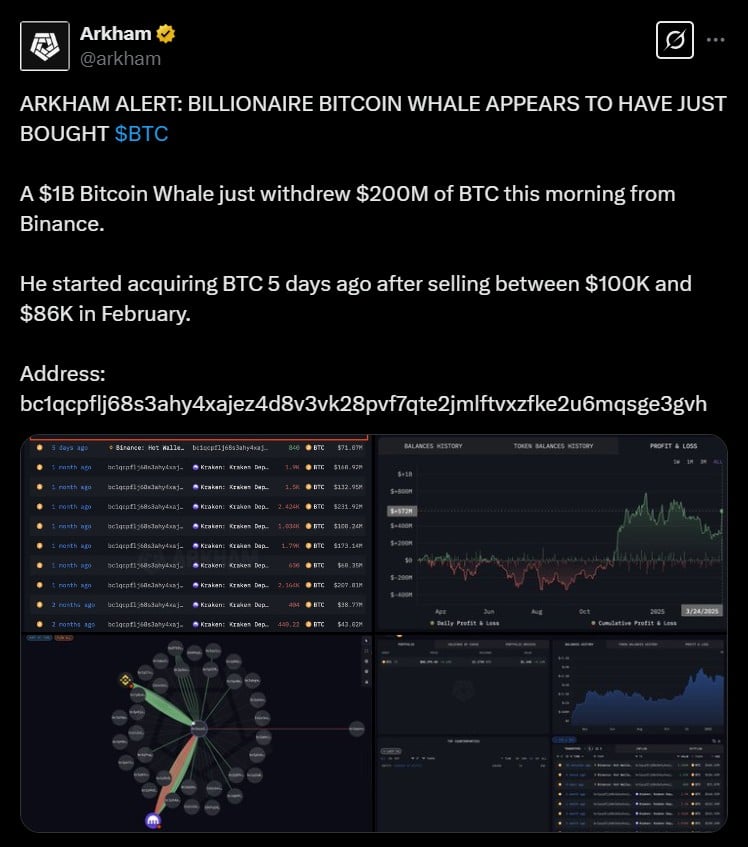

A $200 million Bitcoin accumulation spree

One of the vital vital whale strikes in latest weeks got here on March 24, when a Bitcoin whale withdrew 2,400 BTC — price over $200 million — from Binance, in accordance with blockchain analytics agency Arkham Intelligence.

This buy follows months of strategic promoting, throughout which the whale offloaded 11,400 BTC earlier than re-entering the market.

Supply: X

Regardless of trimming its holdings in February, when Bitcoin fluctuated between $100,000 and $86,000, the whale has now elevated its place to over 15,000 BTC, valued at roughly $1.3 billion.

The timing of this accumulation aligns with Bitcoin’s worth rebound, which has seen BTC buying and selling between $81,000 and $88,000 over the previous week.

An eight-year dormant whale resurfaces

Whereas some whales are actively accumulating, others are resurfacing after years of dormancy.

On the twenty second of March, an deal with that had remained untouched for over eight years abruptly moved 3,000 BTC — price roughly $250 million — in a single transaction.

Supply: X

Arkham Intelligence noted that the whale initially acquired its BTC stack when it was price simply $3 million in early 2017, making this an astronomical acquire.

Is that this an early signal of long-term holders cashing out, or does it sign a shift in whale technique? Both method, the return of dormant wallets provides one other layer of intrigue to an already unstable Bitcoin market.

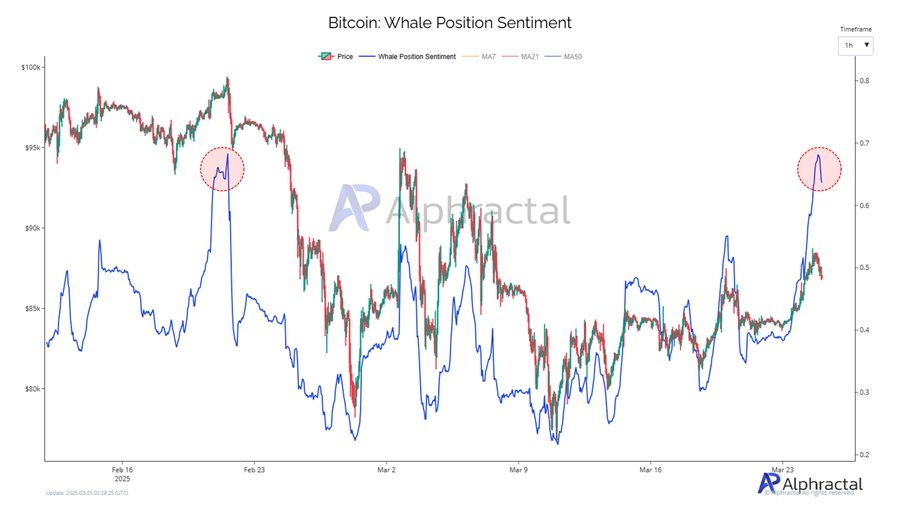

Whales betting in opposition to Bitcoin at $88K?

The newest whale position sentiment data reveals that giant holders could also be shifting bearish regardless of Bitcoin’s latest rebound.

The metric reveals a pointy decline after peaking — traditionally an indication that whales are getting into quick positions.

Supply: Alphractal

An analogous sample emerged in February when sentiment dropped regardless of BTC pushing towards $95K, resulting in a steep correction.

With Bitcoin round $88K, a drop in sentiment suggests whales could also be getting ready for a downturn. If historical past repeats, volatility may observe.

Whereas BTC stays resilient, additional declines in whale sentiment could sign an impending correction.