Bitcoin Whales Accumulate $3,000,000,000 in BTC in Less Than a Month, According to IntoTheBlock

New knowledge from crypto intelligence agency IntoTheBlock finds that Bitcoin (BTC) whales have collected billions of {dollars} value of the crypto king in lower than 30 days.

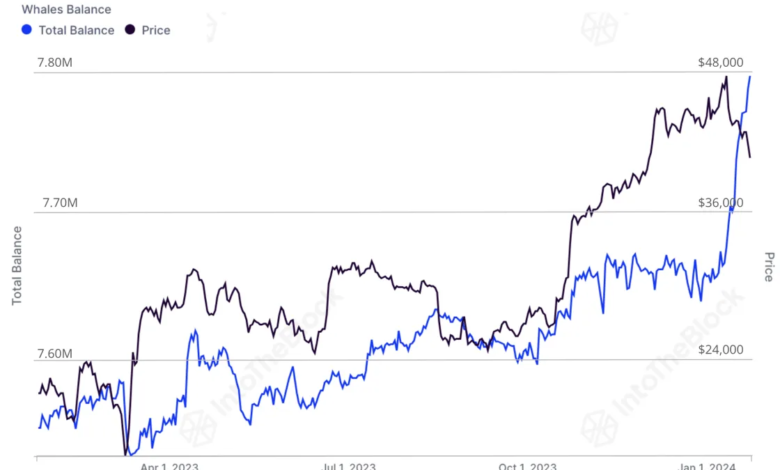

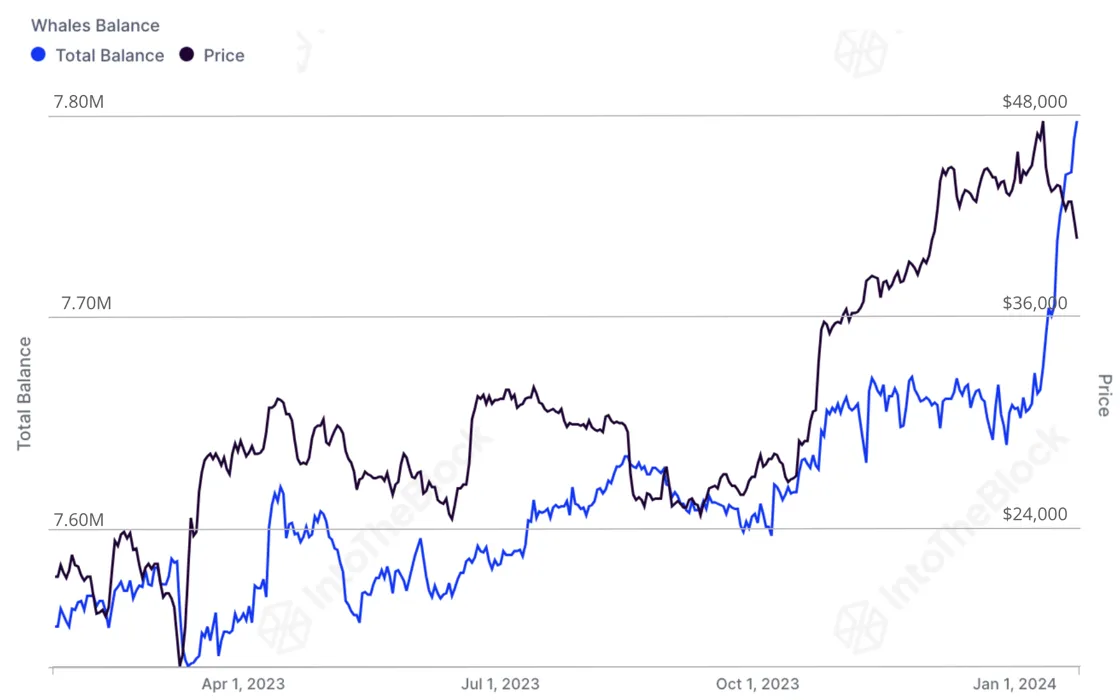

In a brand new article, the crypto analytics platform says the quantity of BTC held in wallets with over 1,000 Bitcoin has sharply risen throughout the first month of 2024.

IntoTheBlock notes that the determine consists of entities comparable to BTC exchange-traded funds (ETFs), which had been accepted earlier this yr by the U.S. Securities and Alternate Fee (SEC).

“‘Whales’ embody any entity, particular person or fund (together with the ETFs) holding over 1,000 BTC. Whereas Bitcoin ETFs have seen internet inflows of $820 million, Bitcoin whales have seen a rise of ~$3 billion (76,000 BTC) up to now in 2024. Together with GBTC, Bitcoin ETFs now maintain 3.23% of Bitcoin’s circulating provide.

This can be a larger share of provide than in gold’s case, the place $110 billion out of a market cap of ~$10 trillion is held in US-traded ETFs (roughly 1% of provide). Regardless of Bitcoin’s correction, the excessive possession of Bitcoin ETFs suggests these have really been getting respectable traction amongst conventional finance traders.”

The analytics agency goes on to investigate the concern, uncertainty and doubt (FUD) surrounding the Grayscale’s spot market BTC ETF (GBTC), saying that its $4.3 billion in outflows have been casting doubt on the success of BTC ETFs.

IntoTheBlock finds that not less than $1 billion value of the outflows had been from bankrupt crypto alternate FTX.

“FTX’s chapter property had been holding GBTC at a reduction and opted to not notice a loss by promoting previous to the probably ETF conversion. Many different entities, together with DCG (the father or mother firm of Genesis) that had been holding at a loss probably determined to exit GBTC as soon as it transformed to an ETF and its low cost went to near-zero.”

GBTC traded at a -47.35 % low cost to its internet asset worth on February thirteenth, 2023. The low cost progressively narrowed over time and went to zero on January twenty sixth.

Bitcoin is buying and selling for $42,274 at time of writing, a fractional lower over the past 24 hours.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Featured Picture: Shutterstock/Stavtceva Iana