Bitcoin: Whales accumulate despite stagnating prices – is this why?

- Regardless of Grayscale’s ETF developments, Bitcoin’s value stagnated, inflicting concern.

- Whale accumulation and aged Bitcoin actions indicated potential market shifts.

Regardless of Grayscale’s ETF transferring nearer to seeing the inexperienced gentle, the value of Bitcoin [BTC] remained stagnant. This occasion made many merchants pessimistic about whether or not Bitcoin will see development sooner or later.

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

Whales transfer in

Nonetheless, based on Santiment, whale accumulation was on the rise. Notably, sixteen extra wallets held between 100-1K BTC. As key stakeholders grew, the argument for a bullish future obtained stronger.

Supply: Santiment

In the meantime, there was a notable motion of older BTC. Greater than 16,000 Bitcoins aged between two and 5 years have just lately been moved. Transactions of this magnitude and age are comparatively uncommon within the Bitcoin community, and this prevalence has garnered appreciable consideration.

🚨 JUST NOW: Notable Transactions on the Bitcoin Blockchain

Greater than 16,000 bitcoin aged between 2 to five years have simply been moved on the blockchain. Transactions of this magnitude and age are comparatively uncommon 👀https://t.co/zoUGtz05V8 pic.twitter.com/757nEk3Qxn

— Maartunn (@JA_Maartun) October 14, 2023

Transaction quantity on the Bitcoin community additionally noticed a big improve. Just lately, Glassnode’s knowledge reported that the median transaction quantity over a 7-day transferring common reached a five-month excessive at $324.79.

This uptick in exercise mirrored an rising variety of transactions on the Bitcoin blockchain, which may have numerous results in the marketplace.

Greater transaction quantity may point out rising adoption and utilization of Bitcoin, however may additionally lead to elevated community congestion.

📈 #Bitcoin $BTC Median Transaction Quantity (7d MA) simply reached a 5-month excessive of $324.79

Earlier 5-month excessive of $322.80 was noticed on 05 October 2023

View metric:https://t.co/Oqu9AN81mM pic.twitter.com/nS7KFyOwsJ

— glassnode alerts (@glassnodealerts) October 6, 2023

Wanting on the numbers

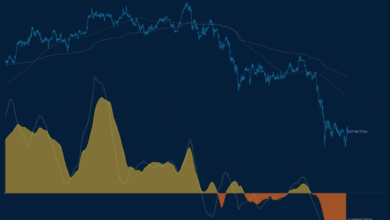

On the time of writing, Bitcoin’s value was $26,700. But, the MVRV Ratio had undergone a decline over the previous month. The MVRV Ratio compares the market worth of Bitcoin to its realized worth.

A decrease MVRV Ratio suggests that the majority addresses are usually not as worthwhile, doubtlessly decreasing the possibility of a mass sell-off. This pattern is important to discover because it indicators shifts in sentiment and holder habits.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Concurrently, the king coin’s velocity spiked over the previous few days. The rate of a cryptocurrency displays its financial exercise. A speedy improve in velocity might point out larger liquidity, elevated buying and selling, and even speculative buying and selling.

Quite the opposite, the Whole Quantity of Holders fell throughout this era as properly. A reducing variety of holders might be interpreted as a consolidation of possession or a discount in new members.

Supply: Santiment