Bitcoin whales are ‘buying the dip,’ but should you follow?

- The previous few days have seen an uptick in BTC accumulation by giant buyers.

- This has occurred regardless of the decline within the coin’s value and market volatility.

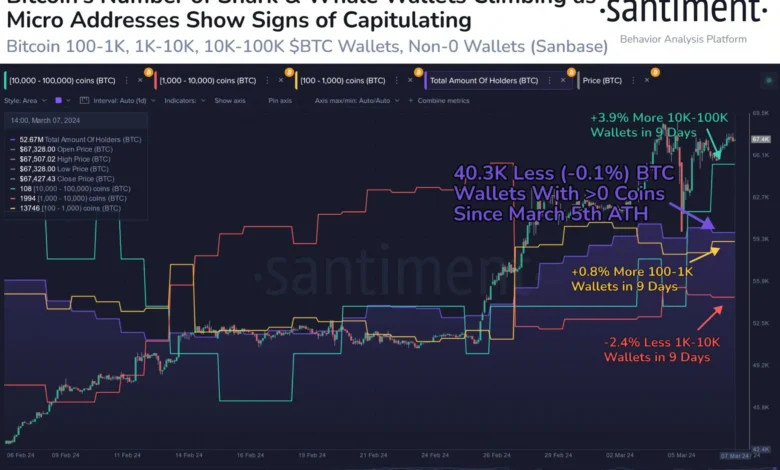

Bitcoin [BTC] giant holders have actively amassed the coin regardless of the current correction within the coin’s value after buying and selling at a brand new all-time excessive of $69,170 on fifth March, Santiment famous in a post on X (previously Twitter).

Based on the on-chain information supplier, the rely of those giant holder addresses, known as whales and sharks accounts, has rallied within the final week. For instance, the rely of addresses holding between 100 and 1000 BTC has elevated by 1% previously 9 days.

Likewise, the variety of addresses holding between 10,000 and 100,000 BTC has spiked by 4% throughout the identical interval.

Nevertheless, regardless of elevated whale and shark participation, the variety of BTC wallets with a non-zero steadiness is declining. A non-zero pockets is an handle that holds even a tiny quantity of a selected cryptocurrency.

Quick-term holders proceed to jeopardize BTC’s possibilities

Based on Santiment, the decline in BTC’s non-zero wallets is “primarily as a consequence of small merchants capitulating.” This implies that retail BTC merchants are exiting their marketplace for varied causes, similar to profit-taking, loss-cutting, or just a insecurity within the coin’s short-term prospects.

AMBCrypto beforehand reported that the current spike in BTC’s value resulted in a rally within the rely of short-term buyers holding the main coin.

As highlighted within the report, this development put BTC prone to decline as a result of a considerable amount of its provide is managed by this investor cohort comprised of merchants who’re able to promote their cash for good points at any slight change in market sentiment.

The decline in BTC’s futures open curiosity previously few days confirmed the exit of those buyers. Based on Coinglass’ information, BTC’s open curiosity has declined by 3% since fifth March.

When an asset’s open curiosity falls on this method, it means that merchants are exiting their positions with out opening new ones, and liquidity influx into the market is witnessing a normal decline.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

Nevertheless, in accordance with Santiment, regardless of the decline in non-zero Bitcoin wallets and the volatility available in the market, the presence of sharks and whales actively taking part suggests a bullish outlook.

This means that regardless of short-term fluctuations in BTC’s worth and small merchants “dumping” the coin for revenue, there’s nonetheless sturdy help from its bigger holders.