Bitcoin whales buy up 250K BTC in 2024 alone – Sign of market confidence?

- Bitcoin alternate reserve famous a drop prior to now three weeks.

- The regular accumulation amongst whales signaled expectations of additional worth appreciation.

Bitcoin [BTC] has witnessed an enormous worth appreciation prior to now three weeks. It was buying and selling at $38.5k on twenty third January and rose to an area excessive of $52.8k on fifteenth February, representing a 37% acquire in 23 days.

An enormous a part of this bullish sentiment could be attributed to the BTC ETFs. However as a latest Santiment post confirmed, whale accumulation additionally performed a component within the worth appreciation.

Latest findings gasoline additional bullish expectations

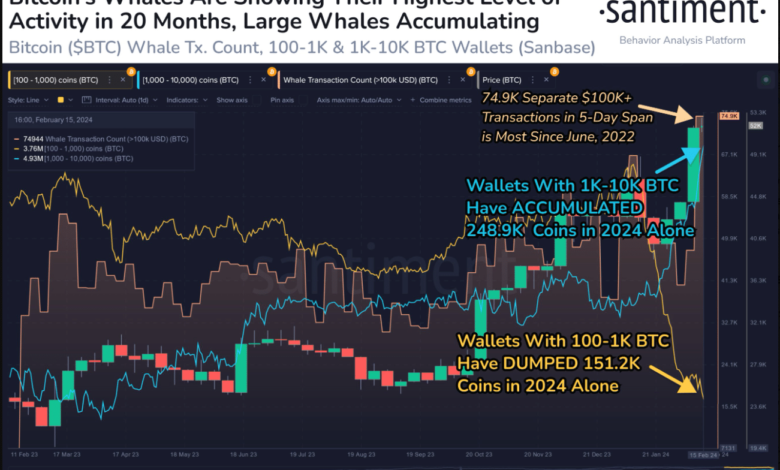

Santiment posted a chart on X (previously Twitter) highlighting that wallets holding 1k to 10k BTC elevated their holdings by 248.9k Bitcoin in 2024. This amounted to a whopping determine of $12.95 billion. The scale of their wallets demarcated them as whales.

In the meantime, wallets with 100 to 1k BTC dumped 151.2k cash in 2024, or $7.89 billion price of Bitcoin. Moreover, the previous 5 days additionally witnessed the very best stage of whale transactions (transactions exceeding $100k) since June 2022.

Taken collectively, this was an indication that the Bitcoin sharks had been taking income and promoting, presumably hoping for a deep retracement within the coming months. In the meantime, the whales continued to ply their commerce and accumulate BTC, assured that over the bigger time horizon, their conviction could be validated.

Supply: CryptoQuant

AMBCrypto analyzed the Bitcoin alternate reserve metric from CryptoQuant and located a downtrend over the previous three weeks. The alternate reserve went from 2.106 million BTC to 2.068 million BTC from the twenty fifth of January to the time of writing.

Mixed with the Santiment information, it was proof of accumulation. Therefore, it supported the expectations that demand for BTC was larger than the availability, which might see costs pattern larger nonetheless.

Supply: CryptoQuant

Nonetheless, a have a look at the stablecoin provide ratio confirmed the metric has been strongly rising prior to now 5 months. This meant that the stablecoin provide witnessed its shopping for energy cut back in latest months.

Is your portfolio inexperienced? Examine the BTC Revenue Calculator

Whereas this highlights some bearishness for Bitcoin, total, the metrics recommended that accumulation was underway.

Within the brief time period, some volatility may come up since Bitcoin was buying and selling at a key larger timeframe resistance zone at $52k.