Bitcoin: Whales count counters the norm, but what does BTC get in return

- The variety of whales has elevated because the final halving cycle.

- BTC’s worth would possibly quickly drift away from the purple.

In response to Glassnode, there was a significant change in Bitcoin’s [BTC] whale pattern over each cycle. On 15 Might, the on-chain analytic platform talked about that the variety of whales on this cycle had elevated, as an alternative of lowering because it has been over every Epoch.

The expansion within the Variety of Whale on the #Bitcoin community has been diminishing cycle upon cycle.

Nonetheless, when assessing for our present cycle, we observe a slight deviation in pattern, with our current Epoch recording a 7% bigger growth in Whale development than the prior.

🟡 Epoch… pic.twitter.com/dHGll8Wj9U

— glassnode (@glassnode) May 15, 2023

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

The Epoch within the Bitcoin context is used to explain the distinction between one halving and one other. For context, the halving is a four-year occasion the place Bitcoin miners get rewards for sustaining the block creation on the community.

Bitcoin: Away from the standard

Primarily based on the tweet above, the primary cycle and second led to a lower in whale development. This was the identical case because the second and third cycles, and the season when Bitcoin got here into the sunshine and the preliminary halving.

Nonetheless, a 7% development lower than 400 days to the following halving implies that many deep-pockets would possibly take into account the worth drawdown from the ATH until now a greater alternative than the earlier ones.

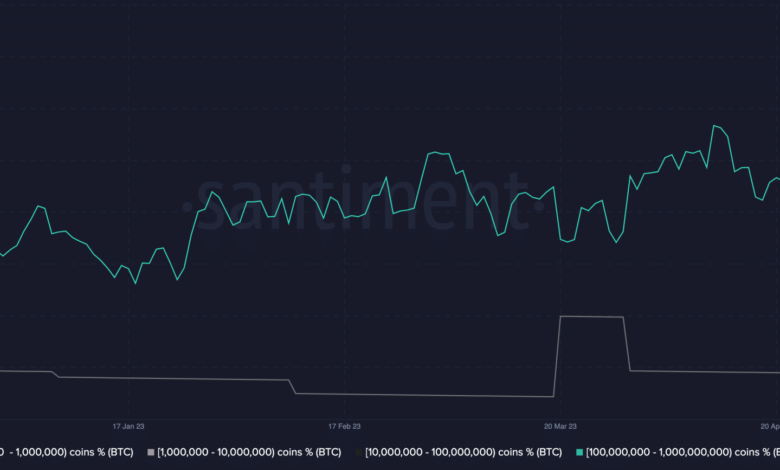

However, there was nonetheless an opportunity that the pattern may change. Nonetheless, Santiments’ information confirmed that whales who’ve been a significant driver of the BTC value, had taken the again seat.

At press time, the balance of addresses that maintain 10,000 to 1 billion cash has considerably decreased. This implied that there was fairly quite a few profit-taking, particularly because the coin value surged within the first quarter.

Supply: Santiment

Subsequently, whale transactions within the $100,000 and $1 million vary heightened over the previous couple of days. At 275 and 81 respectively, the hike in giant transactions may function a parity to indicate the whale curiosity in buying and selling Bitcoin.

Supply: Santiment

Gentle on the finish of the tunnel?

In the meantime, Bitcoin has consistently hovered across the $27,000 area. However will the change within the cycle pattern have an effect on the BTC value?

As per the day by day chart, the Transferring Common Convergence Divergence (MACD) confirmed indicators that BTC may stay bearish. This was as a result of the orange and blue dynamic strains had fallen beneath the zero-histogram line.

How a lot are 1,10,100 BTCs price in the present day?

Therefore, this depicts that sellers had been in management. As well as, the Exponential Transferring Common (EMA) confirmed that BTC’s long-term potential may finish in inexperienced. This was as a result of there was an upward crossover of the 50 EMA (yellow) towards the 200-day EMA (cyan).

Subsequently, a state of affairs like this might individuals the beginning of a brand new uptrend. For the brief time period, the 20 EMA (blue) is positioned above the 50 EMA. In a state of affairs the place this pattern continues, BTC may get better from the draw back.

![Bitcoin [BTC] price action](https://statics.ambcrypto.com/wp-content/uploads/2023/05/BTCUSD_2023-05-16_08-20-42.png)

Supply: TradingView