Bitcoin whales or Washington? U.S govt’s BTC holdings and Trump’s Summit stir debate

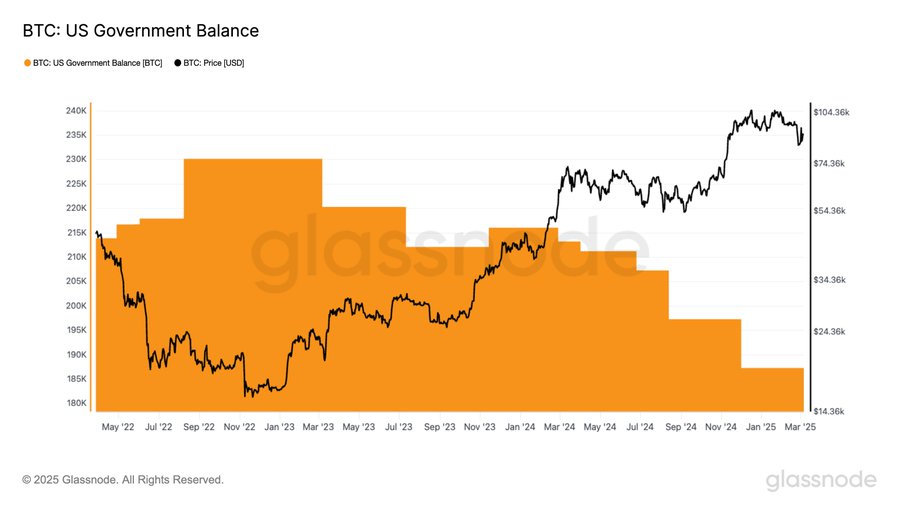

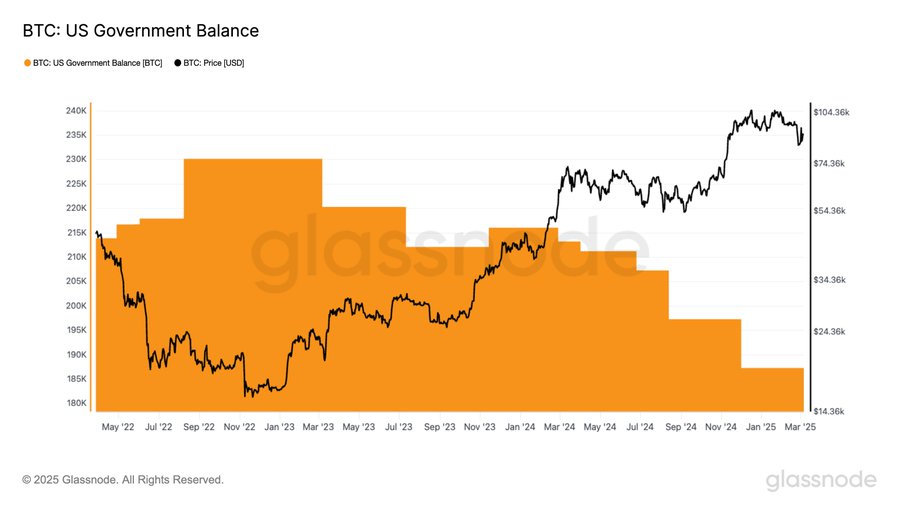

- U.S authorities maintain 187,236 BTC, elevating considerations about authorities affect on Bitcoin’s future

- Trump’s crypto summit did not ship, leaving Bitcoin’s market sentiment unsure and risky

U.S authorities now maintain 187,236 BTC, reigniting considerations over authorities affect within the crypto area. These holdings, largely acquired by asset seizures, have traditionally contributed to market volatility each time liquidated. On the similar time, Bitcoin’s worth dipped following President Trump’s much-hyped crypto summit, which critics say was heavy on reward however gentle on substance.

The truth is, some imagine the occasion signaled a shift away from crypto’s anti-establishment ethos, as trade figures seemed to Trump for regulatory aid.

Collectively, these developments pose elementary questions on Bitcoin’s future: How will government-controlled BTC have an effect on the market? And is the crypto trade abandoning its core ideas in pursuit of political favor?

U.S authorities’ Bitcoin holdings – A market-moving drive?

Supply: Glassnode

Regardless of liquidations, nonetheless, the federal government stays a significant BTC holder, elevating considerations about its rising affect over an asset designed for decentralization. If liquidation methods shift or reserves are utilized in coverage selections, the market might face important disruption.

Trump’s much-anticipated crypto summit was anticipated to deal with these considerations. As an alternative, it left the trade questioning its priorities.

Trump’s crypto summit – What went mistaken?

The White Home Crypto Summit was hyped as a defining second for the trade, however it left many dissatisfied. As an alternative of substantive coverage bulletins, the occasion was crammed with imprecise guarantees and effusive reward for Trump.

“That was essentially the most embarrassing factor I’ve ever witnessed,” said NFT dealer Clemente. “Is everybody simply worshipping Trump now?”

Trump briefly talked about plans for a Crypto Reserve, floated the thought of a FIFA token, and delayed the timeline for crypto-friendly regulation. Whereas some trade leaders backed his place in opposition to federal regulators, others noticed the occasion as a troubling shift. Clemente added,

“He has no thought what he’s studying off of, he’s simply riffing on what David Sacks wrote him. We was once cypherpunks, we was once anti-government, now we [just] need the value to go up.”

The backlash was swift. Economist Peter Schiff called the summit “a shame” and “a blight on no matter legacy Trump leaves.”

In the meantime, Coinbase CEO Brian Armstrong took a different stance, saying plans to rent 1,000 U.S workers this yr, crediting Trump’s management for the choice.

The occasion has deepened divisions within the crypto area. Some see Trump because the trade’s greatest probability at regulatory aid, whereas others fear in regards to the political seize of a motion constructed on decentralization.

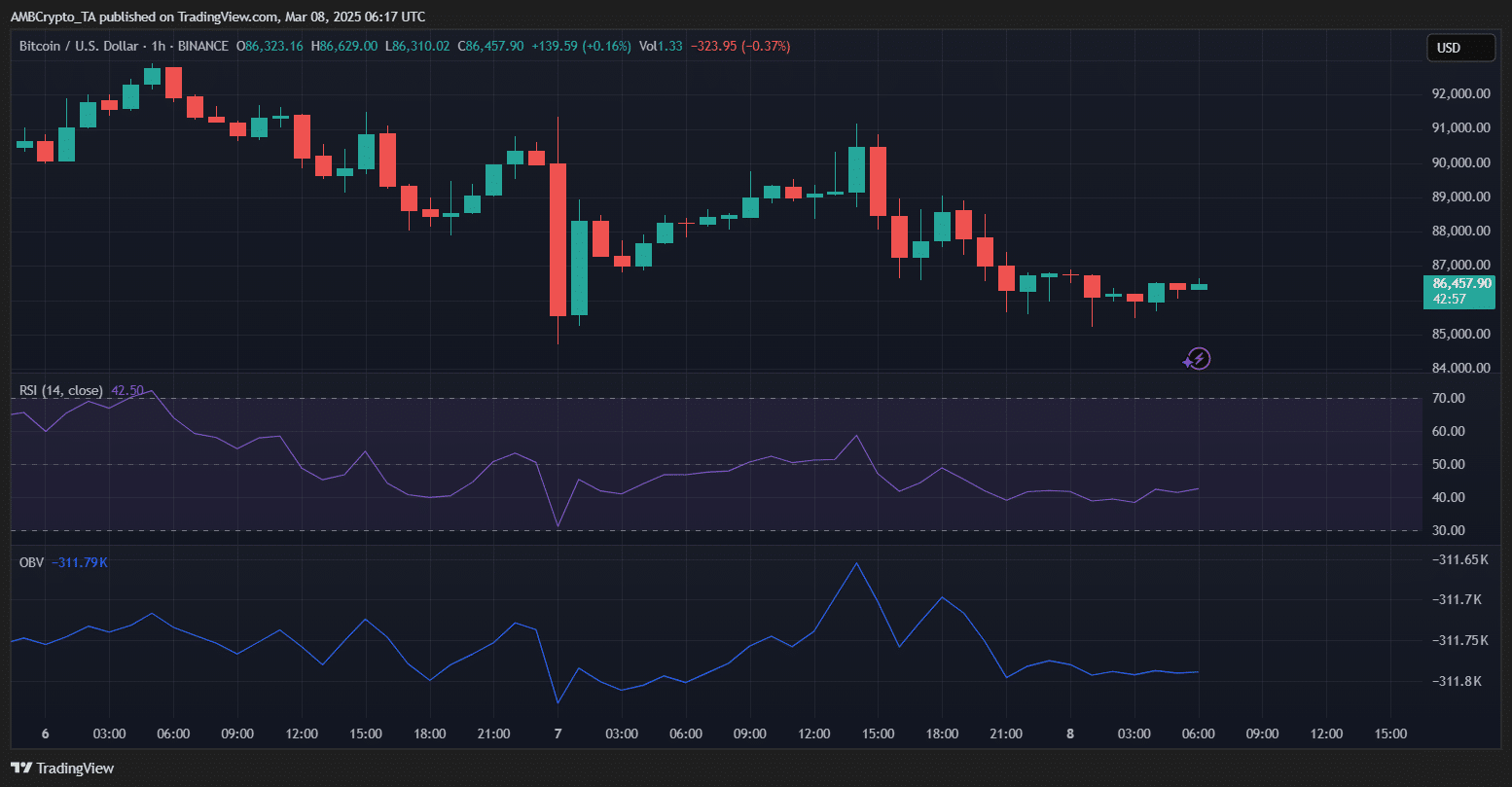

Bitcoin Value Evaluation – Publish-Summit dip alerts uncertainty

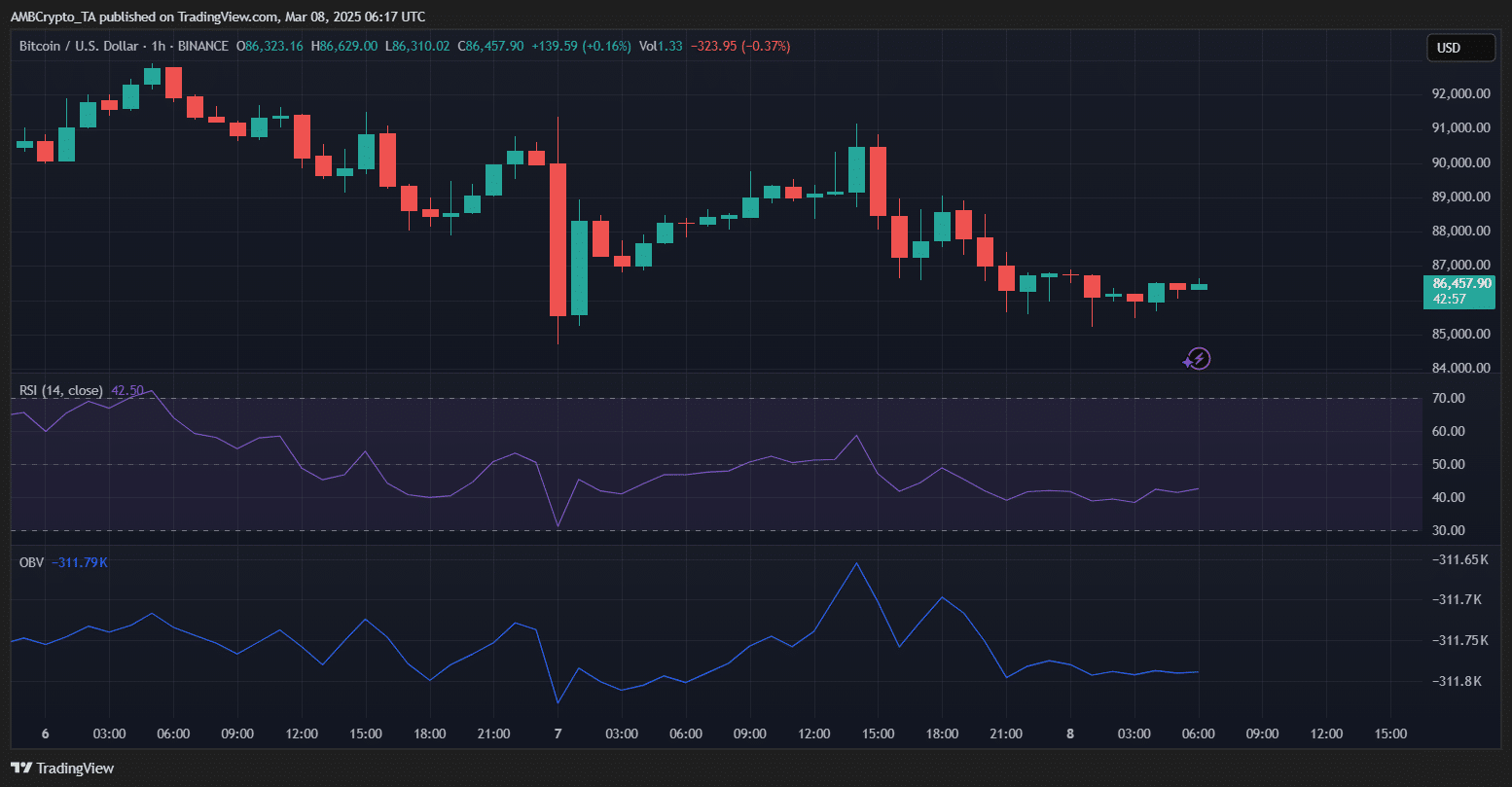

Bitcoin’s response to the summit has been lackluster, with BTC slipping to $86,457 on the time of writing. The RSI sat at 42.50, reflecting weak momentum and a scarcity of sturdy shopping for strain.

The OBV remained detrimental, indicating declining demand throughout the board.

Supply: TradingView

Regardless of preliminary hopes that Trump’s pro-crypto rhetoric would spark a rally, the market response hinted at disappointment. Merchants have been positioned for bullish information, however with no concrete coverage adjustments, sentiment cooled down.

For now, Bitcoin is holding close to $86K. A resurgence in shopping for strain might push BTC again in direction of $88k. Nonetheless, if the present pattern continues, a drop to $84k will likely be on the desk. The federal government’s BTC holdings add an additional layer of uncertainty – Ought to one other spherical of liquidations happen, volatility might spike once more.