Bitcoin: Why a pullback could be looming after the latest $100,000 milestone

- Bitcoin kinds bearish divergence after spectacular rally that pushed above $100,000.

- Assessing whether or not BTC promote stress might be building-up, doubtlessly signaling profit-taking.

It’s an attention-grabbing day for the Bitcoin [BTC] neighborhood because the cryptocurrency achieves certainly one of its most noteworthy milestones. Worth soared above $100,000 for the primary time in historical past. However what’s subsequent for the king of the cryptocurrencies?

Bullish December is unfolding nicely for Bitcoin as its worth motion pushed as excessive as $103,620 within the final 24 hours. However what subsequent for BTC after this spectacular milestone? Properly, its worth motion might provide insights into the subsequent potential transfer.

Supply: TradingView

Whereas Bitcoin has been hitting greater highs, its RSI has been forming decrease highs. Because of this, the cryptocurrency is forming a bearish divergence. This implies {that a} wave of promote stress might start quickly.

No indicators of Bitcoin bears but

There’s a important likelihood that Bitcoin might keep above the $100,000 worth degree and probably lengthen its upside within the coming days.

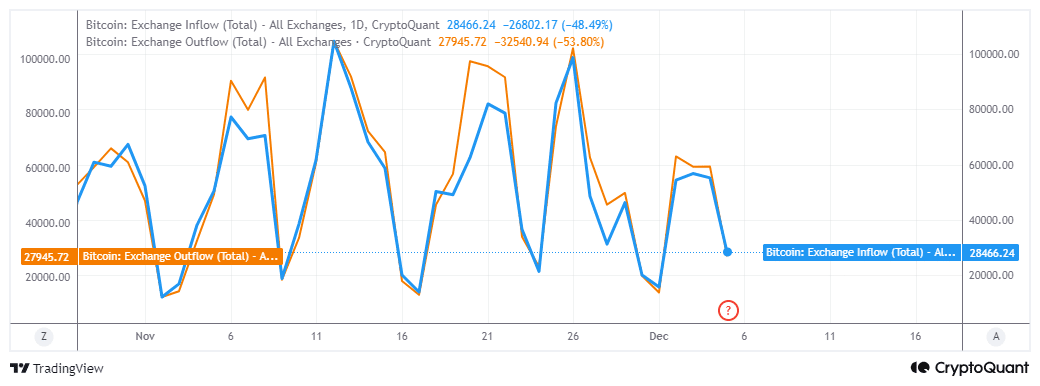

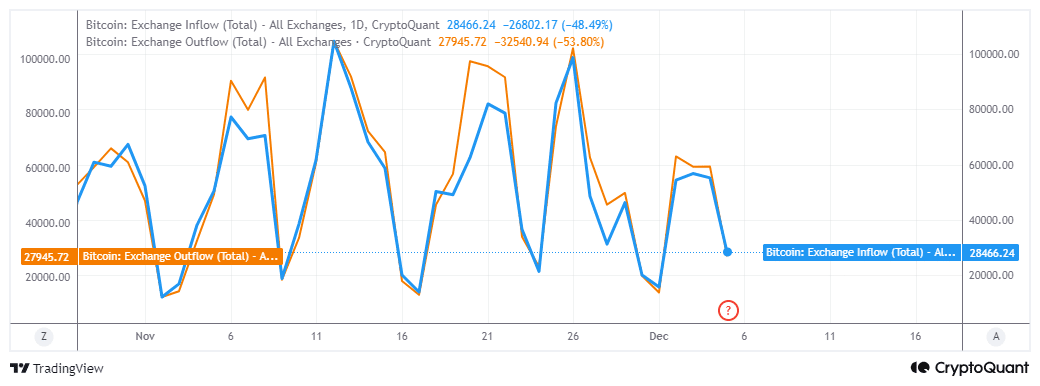

Nonetheless, a pullback is inevitable, particularly as promote stress begins build up. Which will already be occurring as evident by BTC alternate flows.

CryptoQuant revealed that alternate flows dipped considerably within the final 24 hours, indicating a momentum slowdown. Extra notably, alternate inflows peaked at 28,466 BTC on fifth December, in comparison with 27,945 BTC in alternate outflows.

Supply: CryptoQuant

Larger alternate inflows than outflows might sign a build-up in promote stress. Nonetheless, Bitcoin continued extending its upside and this may be defined by on-chain information.

Demand from the derivatives phase remained sturdy as evident by the surge in open curiosity. The latter clocked a brand new ATH at $65.23 billion on the time of writing.

Supply: Coinglass

Bitcoin funding charges remained optimistic, surging to a brand new 2-week excessive as a mirrored image of the sturdy bullish demand. This confirmed that derivatives demand contributed considerably to BTC’s push above $100,000.

The open curiosity and optimistic funding charges additionally confirmed that there was no noteworthy uptick in promote stress. Maybe a sign that the market stays bullish, with expectations of extra upside.

Whereas BTCs newest historic rally is an thrilling growth, it’s value conserving in thoughts that it’s forming a bearish divergence.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Client habits in the course of the holidays can also affect many holders to take some income off the desk.

Fairly numerous Bitcoin holders, particularly people who purchased at considerably decrease costs could be incentivized to take income. An end result that might probably set off a large retracement from BTC’s present worth degree.