Bitcoin: Why institutions will have a say in BTC’s future

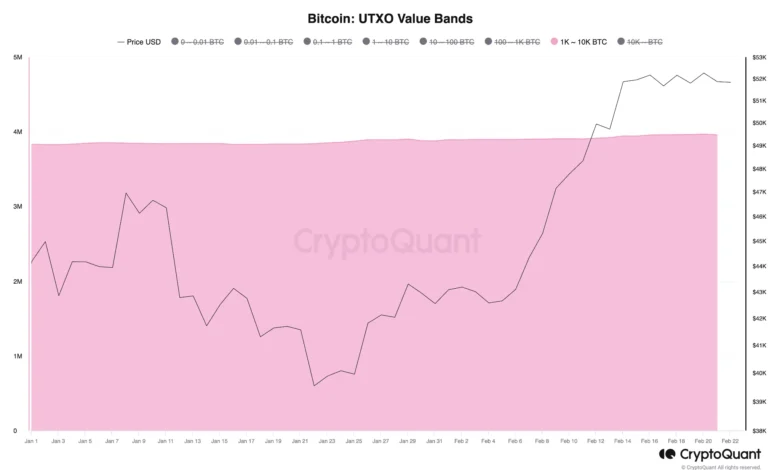

- The UTXO, which ranges from 1,000 to 10,000 Bitcoins, has grown because the starting of February.

- Bitcoin’s Coinbase and Korean Premium Indexes have each elevated throughout that interval.

In line with knowledge from CryptoQuant, there was a spike within the variety of Unspent Transaction Outputs (UTXOs) starting from 1,000 to 10,000 Bitcoins [BTC] because the starting of February.

BTC UTXO is a metric that tracks the quantity of the cryptocurrency in a pockets deal with left untouched after a transaction is accomplished.

In line with the on-chain knowledge supplier, because the 1st of February, the UTXO of coin holders that maintain between 1,000 to 10,000 BTC has climbed by 2%.

Supply: CryptoQuant

Typically, when this UTXO spike happens alongside a rally in worth, it typically suggests a surge in accumulation by institutional traders. It additionally implies that BTC whales could also be buying giant quantities of the main coin and dividing them into smaller UTXOs for storage or additional funding.

Commenting on the importance of the latest hike in UTXO starting from 1,000 to 10,000 BTC, pseudonymous CryptoQuant analyst Crypto Dan said:

“These quantities usually tend to be associated by whales or institutional traders relatively than people, and significantly because the latest approval of Bitcoin spot ETFs, they’ve been growing sharply.”

Institutional traders improve their presence

In line with Dan, whereas the latest hike in UTXO for the BTC worth band into account is “not but as important because the latter a part of the bull market in 2021,” it nonetheless depicts an inflow of institutional liquidity into the market.

AMBCrypto confirmed this by assessing the coin’s Coinbase Premium Index (CPI). This metric tracks the distinction between BTC costs on Coinbase and Binance. When the asset’s CPI worth is optimistic and in an uptrend, it signifies sturdy shopping for stress amongst US-based institutional traders on Coinbase.

In line with knowledge from CryptoQuant, BTC’s CPI has rested above the zero line because the starting of February. It even climbed to a year-to-date excessive of 0.122 on the 14th of February, signaling the hike within the presence of institutional traders available in the market on that day.

Though approaching the middle line at press time, BTC’s CPI maintained a optimistic worth of 0.004.

Supply: Cryptoquant

Compared, whereas BTC’s CPI has trended downward since its 14th of February peak, the coin’s Korean Premium Index (KPI), which tracks the worth hole between South Korean exchanges and different exchanges, has rallied considerably up to now few weeks.

When BTC’s KPI climbs on this method, it signifies a surge in shopping for stress amongst Korean retail traders.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

Nevertheless, whereas this elevated market participation has resulted in a 25% soar in BTC’s worth within the final month, analyst Dan warns:

“Typically, in bull markets, after a major inflow of institutional traders, new particular person traders enter the market, marking the tip of the bull run.”