Bitcoin: Why investors shouldn’t worry about BTC below $50K

- Shopping for strain on BTC was excessive as change reserves dropped.

- Just a few market indicators appeared bullish on BTC.

Bitcoin [BTC] buyers not too long ago had a setback because the king of cryptos’ bull rally halted. Nonetheless, they need to not lose confidence in BTC as a bullish sample shaped on the coin’s value chart, hinting at one other rally within the coming days.

Persistence is the important thing

The whole crypto house was full of pleasure because the king of crypto crossed the much-speculated $50,000 mark. However the pattern was short-lived because the token value plummeted beneath $49,000.

Nonetheless, the king of cryptos rapidly moved above $49k. In accordance with CoinMarketCap, on the time of writing, BTC was buying and selling at $49,432.19 with a market capitalization of over $970 billion.

The truth is, Ali, a preferred crypto analyst, identified an fascinating growth, which hinted at one other bull rally.

#Bitcoin seems to type an ascending triangle on the decrease time frames. This technical formation suggests $BTC is poised for a 1.60% within the short-term.

Be careful for the $50,200 resistance and the $50,000 assist!

For those who’re planning to affix me on this commerce, go to @coinexcom,… pic.twitter.com/Jtb8Eedbtq

— Ali (@ali_charts) February 13, 2024

As per the tweet, a bullish ascending triangle sample shaped on the coin’s value chart. Since BTC was transferring inside that sample, short-term value declines are widespread.

However, if the bigger image is taken into account, the potential of BTC turning $50k as its new assist stage is excessive. Buyers at massive additionally appeared fairly assured in BTC as they stored growing their accumulation.

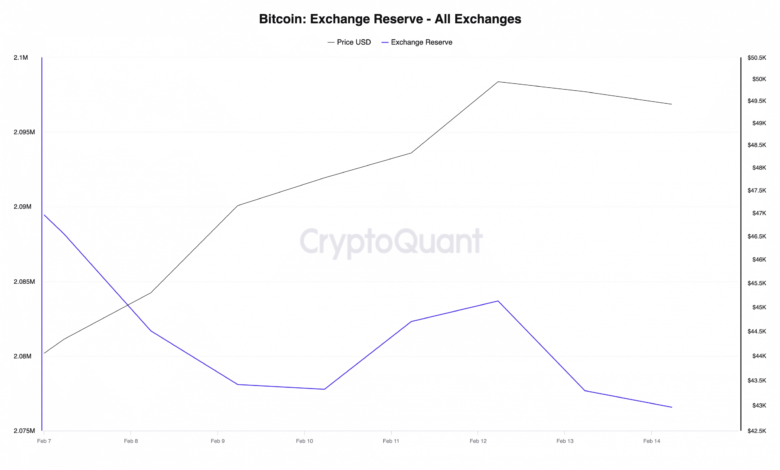

AMBCrypto’s take a look at CryptoQuant’s data clearly identified that BTC’s change reserve continued to say no over the previous couple of days. A drop within the metric signifies that buyers had been actively shopping for BTC.

Bitcoin’s Coinbase premium was inexperienced, that means that purchasing sentiment was dominant amongst US buyers.

Moreover, CryptoQuant’s information revealed that BTC’s Binary CDD was additionally inexperienced. This recommended that long-term holders’ actions within the final 7 days had been decrease than common, indicating their willingness to carry their belongings.

Is a bull rally inevitable?

To search out additional hints for a bull rally, AMBCrypto took a take a look at Glassnode’s information. We discovered that Bitcoin’s Community Worth to Transactions (NVT) Ratio registered a decline.

Usually, a drop within the metric means that an asset is undervalued, that means that the potential of a value uptrend is excessive.

To examine whether or not an uptrend is definitely across the nook, we then took a take a look at Bitcoin’s day by day chart. The MACD displayed a large bullish benefit out there.

Its Chaikin Cash Movement (CMF) additionally went up, indicating that BTC’s value may enhance quickly.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Nonetheless, nothing may be mentioned with utmost certainty because the Relative Power Index (RSI) was within the overbought zone, which may exert promoting strain on BTC.

Moreover, its concern and greed index additionally had a studying of 74 at press time. At any time when the metric reaches the “greed zone,” it will increase the probabilities of a value correction.