Bitcoin: Why miners continue to get rid of their BTC

- Miners proceed to deplete their reserves as promoting strain will increase.

- The BTC quantity has continued to pattern with no vital impression.

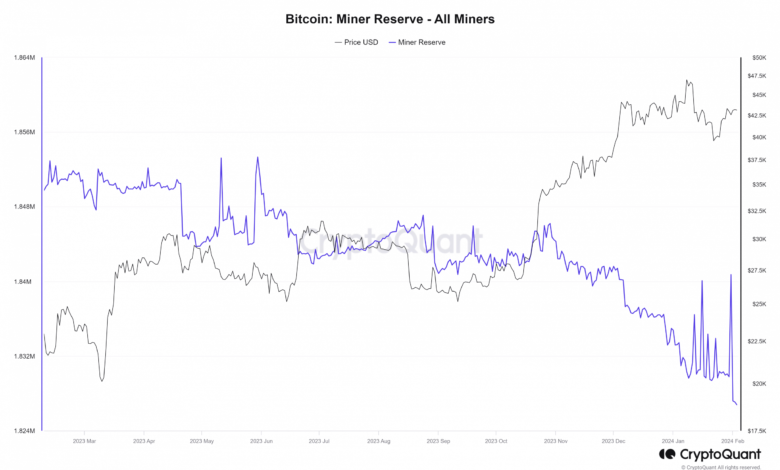

Bitcoin [BTC] miners are quickly liquidating their holdings, resulting in a big lower in reserves, reaching the bottom ranges in years.

Bitcoin miner reserve hits a low

Current information from CryptoQuant confirmed a notable improve in promoting strain from Bitcoin miners over the previous few weeks. Based on evaluation, this heightened promoting exercise has had a damaging impression on the Miner Reserve.

Over 14,000 BTC, equal to about $600 million, left the reserve in the previous couple of days. This discount marks the bottom degree the reserve has skilled since July 2021.

Additionally, the most recent evaluation of the reserve confirmed it at present holds about 1.83 million BTCs. Notably, the reserve continued to say no additional on the time of this writing.

Supply: CryptoQuant

Outflow dominates Bitcoin’s miner netflow

Analyzing the Bitcoin Miner netflow, it has proven constant outflow dominance for the reason that starting of February. The final notable influx was on thirty first January, recording virtually 11,000 BTCs.

Nonetheless, the pattern has predominantly been outflow since then, reaching its peak with a quantity of over 13,500 on 1st February. This outflow on 1st February marked the best single every day quantity noticed over a 12 months.

Supply: CryptoQuant

Understanding netflow values is essential; a constructive netflow signifies a rise within the reserve, whereas a damaging netflow signifies a decline.

The netflow information supplies a clearer perspective on how miners have been promoting their holdings and the makes an attempt of influx to counterbalance this exercise.

Bitcoin quantity pattern stays the identical

Analyzing the Bitcoin quantity information confirmed a scarcity of serious developments in the previous couple of days. Over the previous three days, the best recorded quantity reached round $26 billion.

On the time of this writing, the quantity was round $22 billion. This means that regardless of the substantial decline within the quantity of miner reserves not too long ago, it has not influenced the general quantity pattern.

Supply: Santiment

How a lot are 1,10,100 BTCs value immediately

Moreover, as of this writing, Bitcoin was buying and selling above $43,000. The every day timeframe chart confirmed a slight decline in its present buying and selling place.

Nonetheless, it has proven upward developments over the past two days.