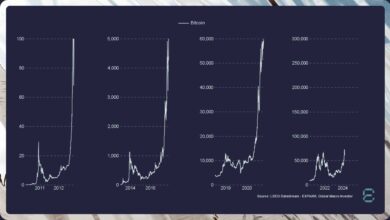

Bitcoin: Why skyrocketing realized profits impact you

- BTC’s realized revenue has climbed to a 14-month excessive.

- A continued bounce in common dealer returns could result in a worth correction.

For the primary time since Might 2022, Bitcoin’s [BTC] worth breached the psychological $30,000 worth level to trade palms at $31,200 throughout the intraday buying and selling session on 3 July.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

This worth rally pushed the main coin’s realized revenue to a 14-month excessive, in line with information from Santiment.

On-chain evaluation of BTC’s efficiency revealed that though the coin struggled with the $30,000 resistance stage prior to now few weeks, its deposits on cryptocurrency exchanges continued to say no. This indicated traders’ lack of curiosity in promoting off their BTC holdings.

As an alternative, lots of them took to additional coin accumulation.

Maintain on to your income earlier than…

The surge in BTC accumulation in the previous couple of weeks pushed the typical dealer’s returns to its highest stage since Might 2022. An unabated enhance in dealer’s income will cascade into an occasion of worth reversal.

Based on information from Santiment, BTC’s MVRV ratio (Z Rating) was a constructive 0.776 at press time, suggesting that the main coin was overvalued.

Supply: Santiment

Sometimes, when an asset’s MVRV ratio (Z-Rating worth) is overvalued, market members have bid up the value of such an asset past what’s justified by its historic common realized worth.

This can be because of speculative shopping for, investor exuberance, or different components driving the value increased within the quick time period. In such conditions, a worth correction or a interval of consolidation typically follows.

Additional, a have a look at the ratio of BTC’s on-chain transaction quantity in revenue to loss spike confirmed that BTC profit-taking transactions have been taking place twice as quick as loss-taking transactions for a number of weeks.

Thus, a worth cool-off would possibly observe if profit-taking exercise continues at this tempo.

Supply: Santiment

On the value chart, BTC’s worth rested near the higher band of its Bollinger Bands indicator. This steered that the coin’s worth was nearing the higher restrict of its current worth vary. It’s typically taken as a sign of a possible worth pullback.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Key momentum indicators such because the Relative Energy Index (RSI), Cash Circulate Index (MFI), and Chaikin Cash Circulate (CMF) have been positioned above their respective heart traces (suggesting ongoing coin accumulation). Nevertheless, BTC’s Aroon Up Line (orange) was in a downtrend at 21.43%.

When an asset’s Aroon Up line is near zero, the uptrend is taken into account weak.

Supply: BTC/USDT on TradingView