Bitcoin’s 2024 outlook should concern you: Here’s why

- Lengthy-term holders are including to their holdings.

- An analyst opined that the BTC might not react rapidly to a possible ETF approval.

Regardless of Bitcoin’s [BTC] sideways motion, AMBCrypto realized that long-term holders are nonetheless accumulating. This revelation was made recognized by CryptoQuant’s verified writer JA Maartunn on X (previously Twitter).

Let’s finish the yr with this chart 👇

Lengthy-term holders maintain accumulating provide, reaching new highs repeatedly, which is a constructive signal for the long-term outlook. pic.twitter.com/mCy6NsL3yb

— Maartunn (@JA_Maartun) December 31, 2023

“Conviction” is the secret

The rise was proof that those that have skilled the ups and downs of the market are bullish on the BTC worth motion. At press time, Bitcoin modified arms at $42,485. This worth represented a 1.72% lower within the final seven days.

One of many causes these holders are bullish may very well be as a result of 2024 is the Bitcoin halving yr.

The Bitcoin halving yr is taken into account an necessary occasion on the crypto calendar. That is finished by slicing the Bitcoin mining reward into two to cut back the variety of cash getting into the community.

When this occurs, the demand for BTC will increase afterward.

Additionally, in previous cycles, the Bitcoin worth reaches a brand new All-Time Excessive (ATH) months after the halving. So, the sentiment across the coin may be legitimate, particularly as this yr’s occasion is billed for April.

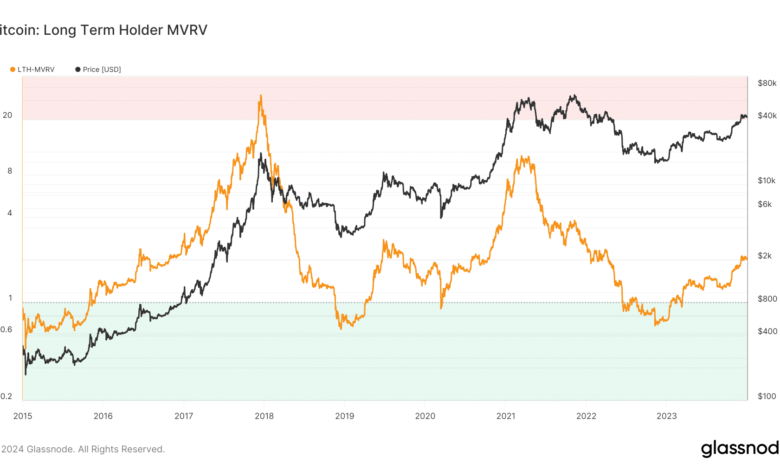

Because of the latest incidence, AMBCrypto checked the Lengthy Time period Holder-Market Worth to Realized Worth (LTH-MVRV) ratio.

At press time, Glassnode information confirmed that LTH-MVRV jumped from 0.74 to 2.0 between the first of January 2023 to the thirty first of December.

Supply: Glassnode

The LTH-MVRV serves as a macrocycle indicator to evaluate the sentiment of long-term holders inside a 155-day window. Traditionally, anytime the metric hits a double-digit studying of 10, long-term holders turn into bearish.

This was evident from the taking place of December 2017 and April 2021.

Throughout each intervals, long-term holders liquidated their holdings. This additionally prompted a correction within the BTC worth. Due to this fact, the LTH-MVRV signifies that HODLers are assured of a Bitcoin bullish worth motion for a lot of the new yr.

BTC’s future stays a vibrant one

One other metric value contemplating is the Stablecoin Provide Ratio (SSR). Excessive values of the SSR counsel low stablecoin provide, indicating potential promote strain and a worth lower.

Nevertheless, Low values indicate potential shopping for strain and a doable worth rise.

Trying on the information from CryptoQuant, the SSR within the final 30 days had fallen to 12.31. This studying implies that the market is armed sufficient to get BTC to a brand new ATH.

Nevertheless, it is usually noteworthy to say that it won’t occur within the brief time period.

Supply: Glassnode

In the meantime, Gabor Gurbacs commented on Bitcoin’s brief and long-term outlook. Gurbacs, an advisor at U.S. asset administration agency VanEck, famous that the preliminary impression of the spot ETF approval may be minimal.

He, nevertheless, suggested gamers to test the historical past of gold, as that might give an thought of Bitcoin’s long-term potential.

In my opinion, individuals are likely to overestimate the preliminary impression of U.S. Bitcoin ETFs. I believe possibly just a few $100mm flows (principally recycled) cash.

Long run, individuals are likely to underestimate the impression of spot Bitcoin ETFs. If historical past is any information, gold is value finding out as a parallel. https://t.co/6vvkA9aC09

— Gabor Gurbacs (@gaborgurbacs) December 31, 2023

Reasonable or not, right here’s BTC’s market cap in ETH phrases

In his concluding put up on X, the technique advisor wrote:

“Folks are likely to hype the present factor however stay myopic in regards to the huge image. Bitcoin is forcing its personal capital markets methods and merchandise properly past the ETF and that’s not priced in. The query isn’t what BlackRock adopts, however what Bitcoin firm is the following BlackRock.”