Bitcoin’s $30,000 Knot Continues, MicroStrategy Buys BTC Worth $500 Million

Macroeconomics and monetary markets

Within the US NY inventory market on the twenty eighth, the Dow Jones Industrial Common fell 74 {dollars} (0.22%) from the day prior to this, and the Nasdaq Index closed at 36 factors (0.27%) greater.

Along with issues about extra rate of interest hikes by the Fed (Federal Reserve), there was disgust that the Biden administration was planning to tighten China’s export restrictions on semiconductors for synthetic intelligence (AI). Friction issues reignited. Semiconductor shares comparable to Nvidia, which has led the market within the AI (synthetic intelligence) growth, pushed down the index.

connection:US Apple continues to replace excessive costs Stricter export restrictions on US semiconductors to China have an effect on AI-related shares | twenty ninth Monetary Tankan

connection:Inventory funding beneficial for cryptocurrency buyers, consultant cryptocurrency shares of Japan and america “10 alternatives”

Digital foreign money market

Within the crypto asset (digital foreign money) market, the Bitcoin worth fell 1.04% from the day prior to this to 1 BTC = $ 30,151.

BTC/USD every day

Altcoins fell by 1.68% for Ethereum (ETH), 2.93% for XRP and 4.59% for Polygon (MATIC).

Volatility Shares 2x Leveraged Bitcoin Technique ETF (BITX) started buying and selling on the Cboe BZX alternate immediately. Buying and selling quantity was about $5.5 million on the primary day, in line with FactSet knowledge.

Though the dimensions is above common, it’s about 1/200 in comparison with the buying and selling quantity of “ProShares Bitcoin Technique ETF (BITO)”, the primary Bitcoin futures ETF authorized by the U.S. SEC in October 2021. Staying.

Curiosity in BITO has grown quickly in latest occasions, recording the biggest weekly influx for the yr.

The Bitcoin Futures ETF $BITO had its largest weekly influx in a yr as property high $1b once more. It additionally traded half a billion in shares on Friday, which it’s solely achieved about 5 occasions earlier than by way of @SirYappityyapp pic.twitter.com/Xrq0lUaaTO

— Eric Balchunas (@EricBalchunas) June 25, 2023

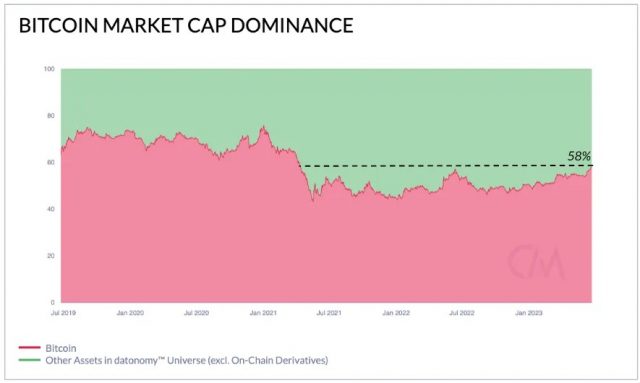

Dominance doesn’t cease rising

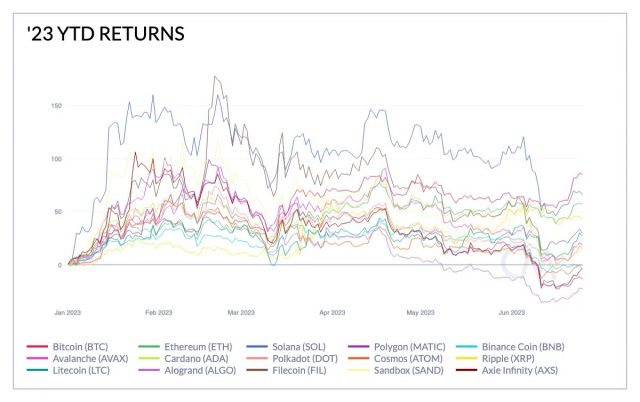

In accordance with a report by knowledge analytics agency Coin Metrics, Bitcoin (BTC) is up 85% year-to-date.

The market worth of BTC as soon as once more surpassed the $30,000 degree on account of shopping for after the applying for a Bitcoin ETF (exchange-traded fund) by BlackRock, the biggest asset administration firm.

However, the U.S. SEC (Securities and Trade Fee) sued a serious crypto asset (digital foreign money) alternate and designated many altcoins as “securities.” market dominance reached 58%, the very best degree in two years.

Coin Metrics

Bitcoin is effectively decentralized and is seen as a commodity reasonably than a safety.

Of the tokens above $1 billion in market capitalization, solely two shares, Bitcoin Money (BCH) 102% and Lido (LDO) 104%, outperformed BTC in year-to-date returns. .

Ethereum (ETH), the second largest market capitalization, +57%, and Solana (SOL), which crashed final yr as a result of chapter of FTX and Alameda Analysis, confirmed a comparatively sturdy +65% for the reason that starting of the yr, partly as a result of reactionary surge. , The impression of the lawsuit by the US SEC (Securities and Trade Fee) remains to be sturdy, and plenty of altcoins are lagging behind.

Coin Metrics

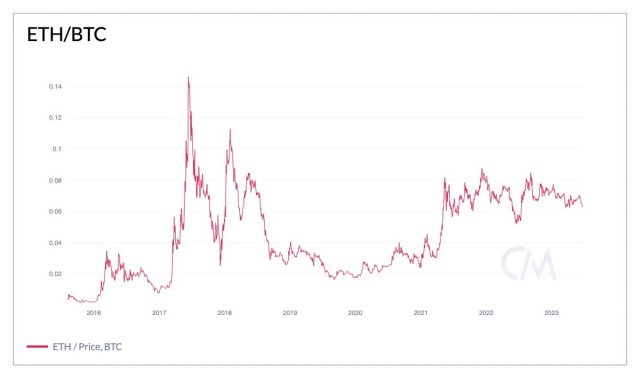

Evaluating the efficiency of BTC and ETH, ETH/BTC rose to 0.087 in December 2021 close to the height of the bull market, however fell to 0.061 as of June 2023.

Coin Metrics

That is the bottom degree for the reason that summer time of 2010, and at present it’s calculated that about 16 ETH might be obtained with 1 BTC.

Round 21:00 on the twenty eighth, it was discovered that Micro Technique, a listed firm that holds a considerable amount of Bitcoin (BTC), purchased 12,333 BTC price 50 billion yen ($347 million).

MicroStrategy has acquired a further 12,333 BTC for ~$347.0 million at a mean worth of $28,136 per #bitcoinAs of 6/27/23 @MicroStrategy hodls 152,333 $BTC acquired for ~$4.52 billion at a mean worth of $29,668 per bitcoin. $MSTR https://t.co/joHo1gEnR0

— Michael Saylor⚡️ (@saylor) June 28, 2023

This brings MicroStrategy’s common acquisition worth to $29,668 and whole holdings to achieve 152,333 BTC, price $4.52 billion.

connection:What’s an alternate traded belief “Bitcoin ETF” | Why the applying of BlackRock attracts consideration

connection:Countdown to the following Bitcoin half-life lower than a yr away, market tendencies and knowledgeable predictions?

Click on right here for an inventory of market stories printed prior to now

[Recruitment]Recruitment of recent personnel resulting from Web3 enterprise enlargement

Japan’s largest cryptocurrency media CoinPost is in search of full-time staff and interns because it expands its Web3 enterprise.

1. Media Enterprise (Editorial Division)

2. Advertising and marketing operations

3. Convention administration and launch work

4. Open Place (college students welcome)Particulars https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual foreign money info site-[app delivery](@coin_post) February 14, 2023