Bitcoin’s boom is not good news for this DeFi sector

- The expansion curve of DeFi protocols offering publicity to U.S. treasuries has stagnated.

- These merchandise have been anticipated to stay chilly within the coming months.

Tokenized U.S. treasuries have been one of many largest success tales in decentralized finance (DeFi) throughout final 12 months’s bear market.

By issuing them as on-chain belongings, DeFi customers gained entry to one of many most secure and most dependable funding autos within the conventional market.

Nevertheless, for the reason that starting of 2024, buyers’ urge for food for such initiatives has dipped significantly, with most getting drawn in direction of returns supplied by riskier investments akin to cryptocurrencies.

Bitcoin’s acquire is tokenized treasuries’ ache

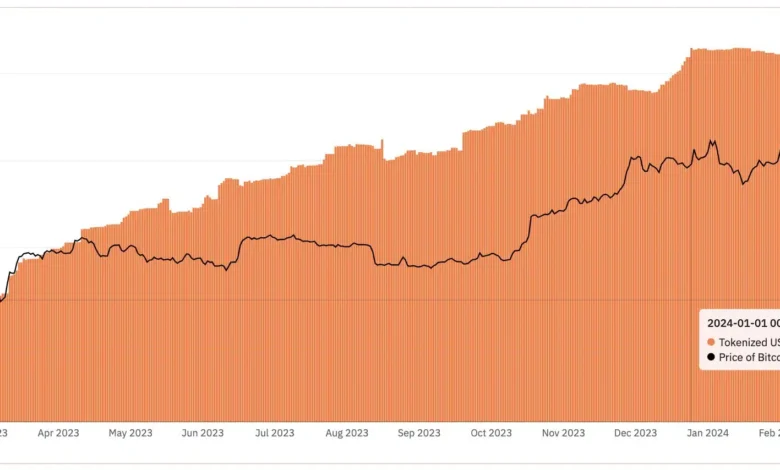

On-chain analyst Tom Wan drew consideration to the unfavorable correlation between investments in tokenized treasuries and the value of Bitcoin [BTC].

Because the world’s largest cryptocurrency grew from $38k to $64k, the dimensions of the on-chain treasury market shrank.

Supply: 21.co

Furthermore, the expansion curve of protocols offering publicity to U.S. treasuries stagnated.

Ondo Finance and Mountain Protocol, two of the largest names within the sector, noticed month-to-month TVL drops of 0.1% and 0.26% respectively, AMBCrypto examined utilizing DeFiLlama knowledge.

Supply: DeFiLlama

Not wanting too optimistic?

A weak macroeconomic local weather and a hawkish U.S. Federal Reserve spurred engaging yields on U.S. authorities debt final 12 months.

Their subsequent tokenization enabled Web3 customers to get pleasure from these assured returns as nicely. This was the time when the crypto market had stagnated.

Nevertheless, because the market heated up in current months, many buyers ditched the steady 5% yield in favor of double-digit, and even triple-digit returns.

Given broader expectations of the Fed reducing rates of interest, tokenized treasuries have been anticipated to stay chilly within the coming months.

Tom Han, whereas advising the builders of those initiatives, stated,

“For my part, U.S. Treasuries protocols ought to give attention to adoption and integration as a substitute of product growth.”

He acknowledged that although the thought of tokenization of equities and bonds sounds cool, the sector was weak to regulatory dangers.

He additionally urged integrating these merchandise into layer-1 and layer-2 networks to spice up their adoption.