Bitcoin’s ‘different’ halving – Why miners aren’t selling their usual BTCs

- Final month, miners bought lower than 1/third of the whole cash bought in February

- HODLing may also be motivated by the destructive state of the market at the moment

The countdown to Bitcoin’s [BTC] halving has begun, with the hotly-anticipated occasion set to happen in lower than 12 hours.

Miners, who guard the community and earn incentives within the type of block rewards, are set to face a giant hit to their revenues within the aftermath of the occasion. Sometimes, miners begin liquidating their holdings forward of the halving to capitalize earlier than the income hit later.

This time, nevertheless, has been totally different.

Miners scale back promoting stress

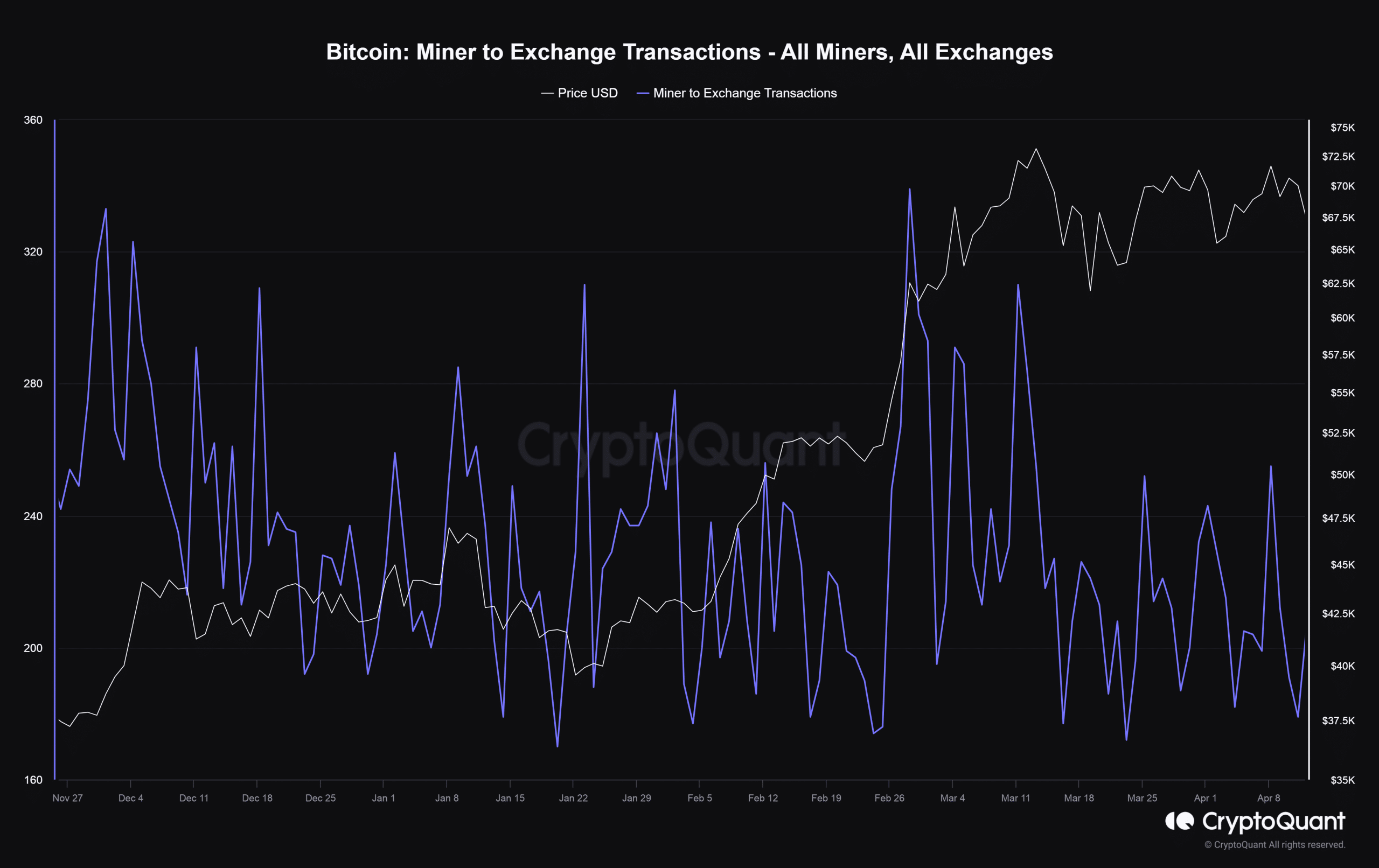

In accordance with a researcher at on-chain analytics agency CryptoQuant, round 374 BTCs have been despatched by miners each day to identify exchanges on common over the previous month – Lower than one-third of the each day common recorded in February.

Supply: CryptoQuant

The researcher claimed that this motion helped forestall extra draw back stress on the king coin.

“It’s potential that the promoting stress has already been executed prematurely by miners, one thing that might profit the market within the brief time period, particularly when there may be already important stress in the marketplace because of the feeling of danger aversion.”

Weak returns spurring HODLing?

Moreover, the HODLing may need been motivated by the continued market hunch, which has seen BTC lose greater than 12% of its worth over the week. Miners is likely to be ready for a post-halving rally to get higher returns on their sale.

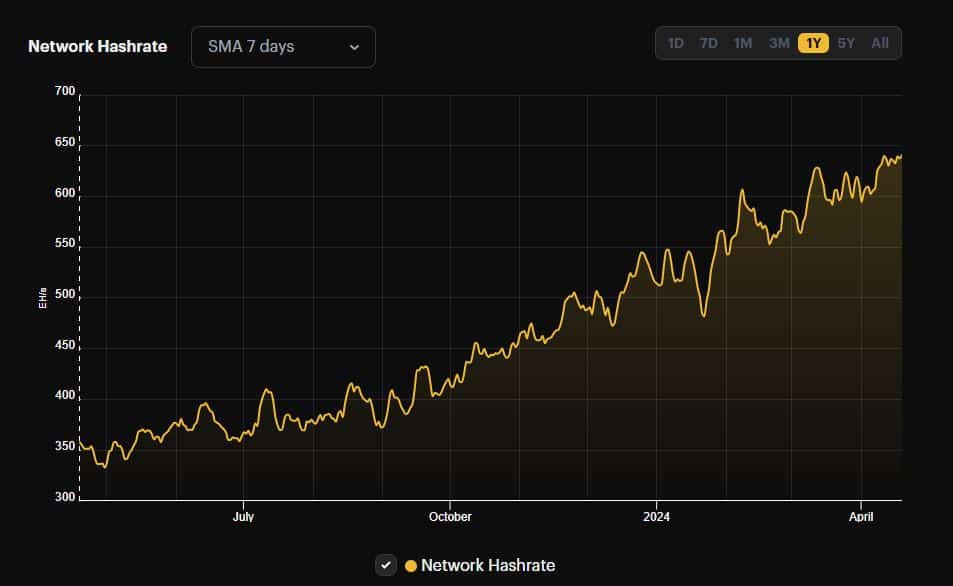

Machines operating on full energy

In the meantime, the community hash charge, a measure of the whole computational energy devoted by miners, rose to 641 exahashes per second (EH/s), on the time of writing. The hash charge has surged forward of the halving, indicating miners’ push to maximise their earnings earlier than they’re halved ultimately.

Supply: Hashrate Index

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Right here, it’s value noting that Bitcoin tanked under $60,000 throughout Asia buying and selling hours Friday as a result of heightening geopolitical tensions within the Center East. Nonetheless, the digital asset recovered to $62,000 at press time, as opportunistic merchants capitalized on the the dip to build up extra.