Bitcoin’s dominance, altcoin season’s odds, and all about this deep market reset

- Bitcoin’s dominance now exceeds 63%, signaling a bearish setting for altcoins throughout all metrics

- Stablecoin flows hinted at a risk-off section, delaying any main altcoin breakout

It might appear that Bitcoin [BTC] is now tightening its grip on the broader crypto market.

In reality, with its dominance now over 63%, the newest market construction is perhaps hinting at deep struggles for altcoins.

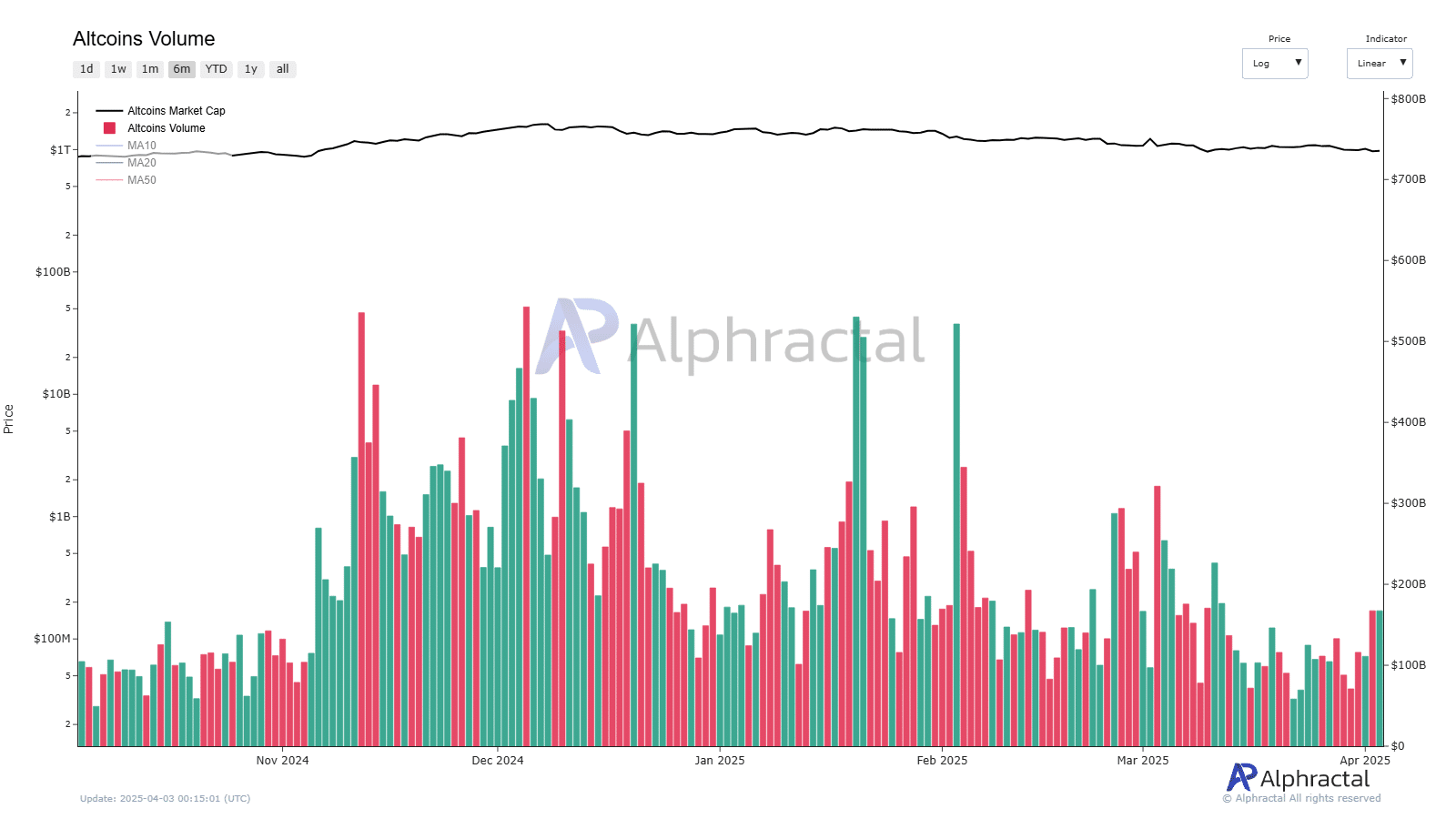

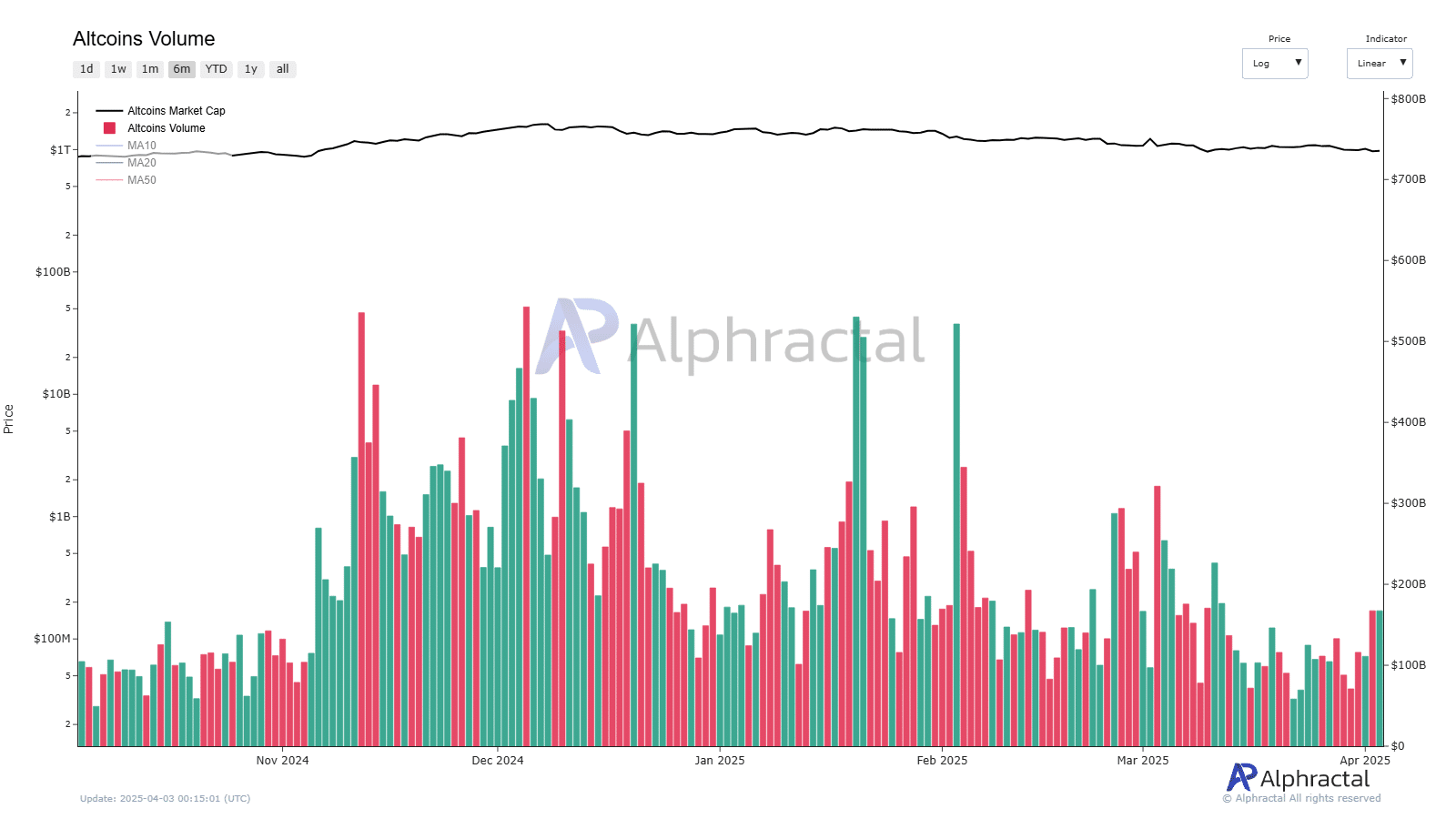

Supply: Alphractal

This shift was highlighted by Alphractal CEO Joao Wedson in a tweet contrasting Bitcoin’s worth with an Altcoin Season Index.

On the time of writing, fewer than 25% of altcoins gave the impression to be outperforming Bitcoin — A textbook Bitcoin Season.

Supply: Alphractal

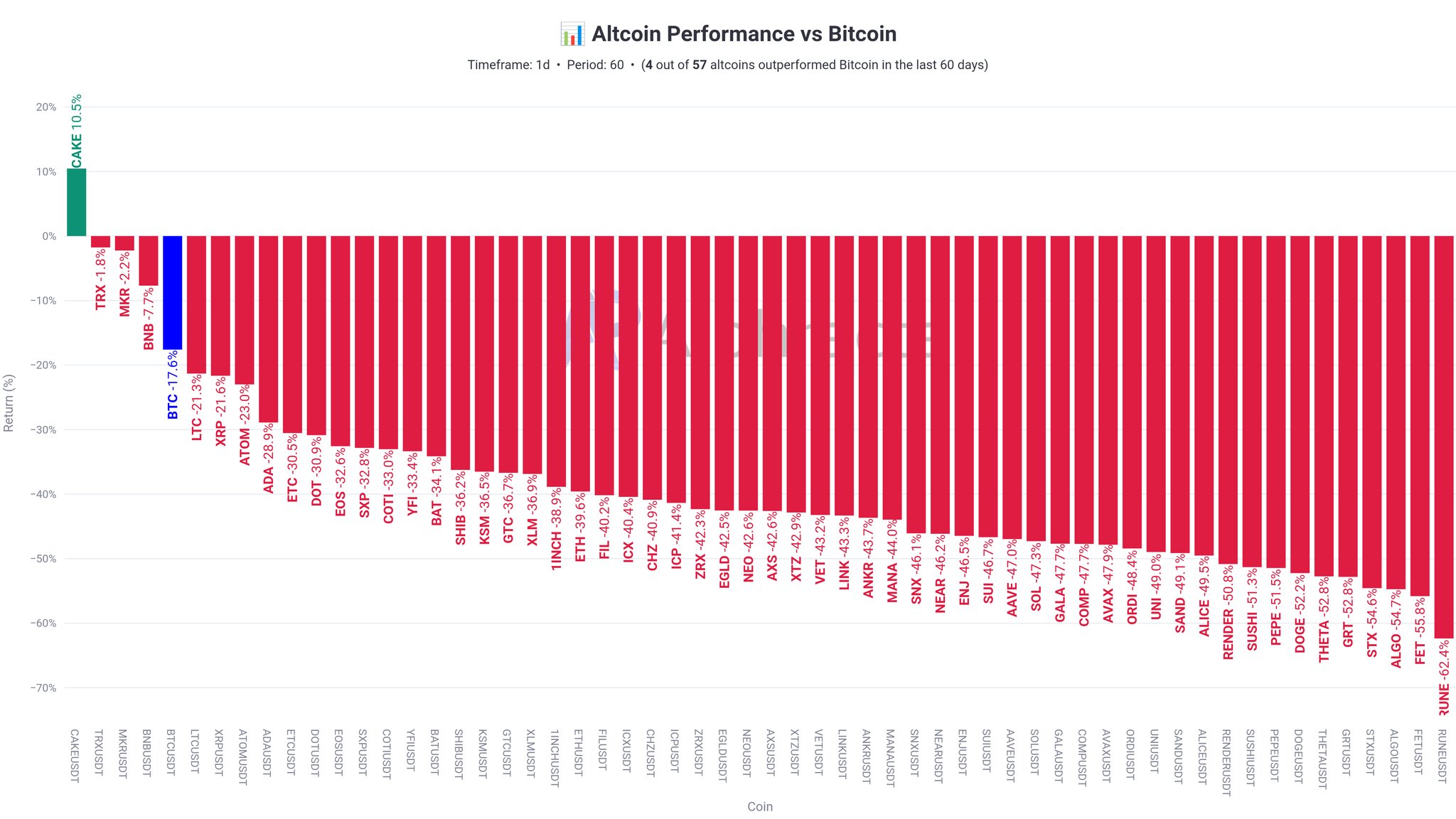

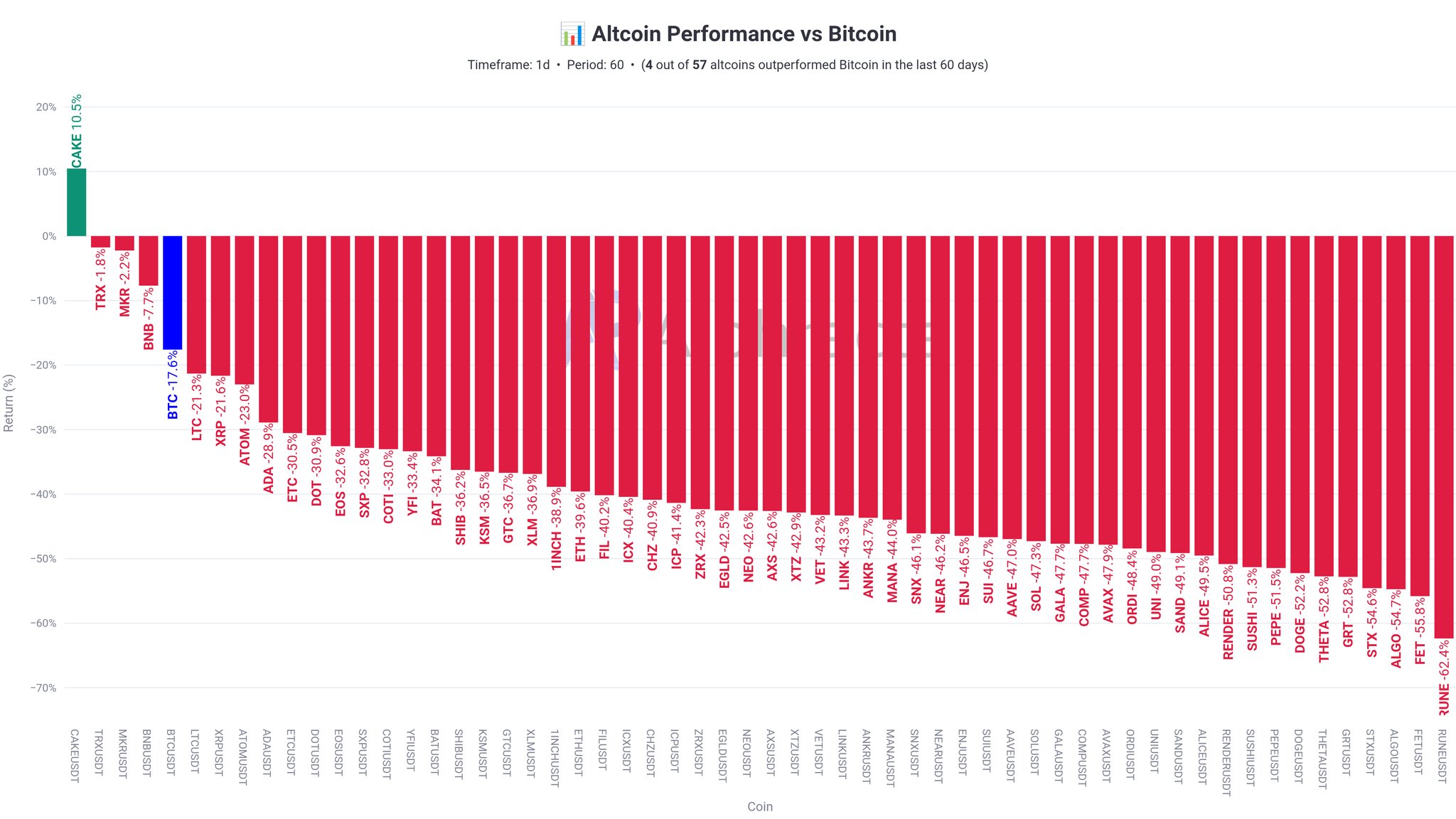

4 survivors in a sea of pink

In response to Alphractal, simply 4 out of 57 altcoins have outperformed Bitcoin, which itself dropped by -17.6% on the charts. Among the many few outperformers, PancakeSwap [CAKE] posted the one optimistic returns with figures of +10.5%.

To place it merely, the underperformance is stark.

Most altcoins returned between -20% and -72%, with JUNE main losses at -72.4%. Bitcoin, regardless of its personal drop on the charts, nonetheless stays a relative protected haven.

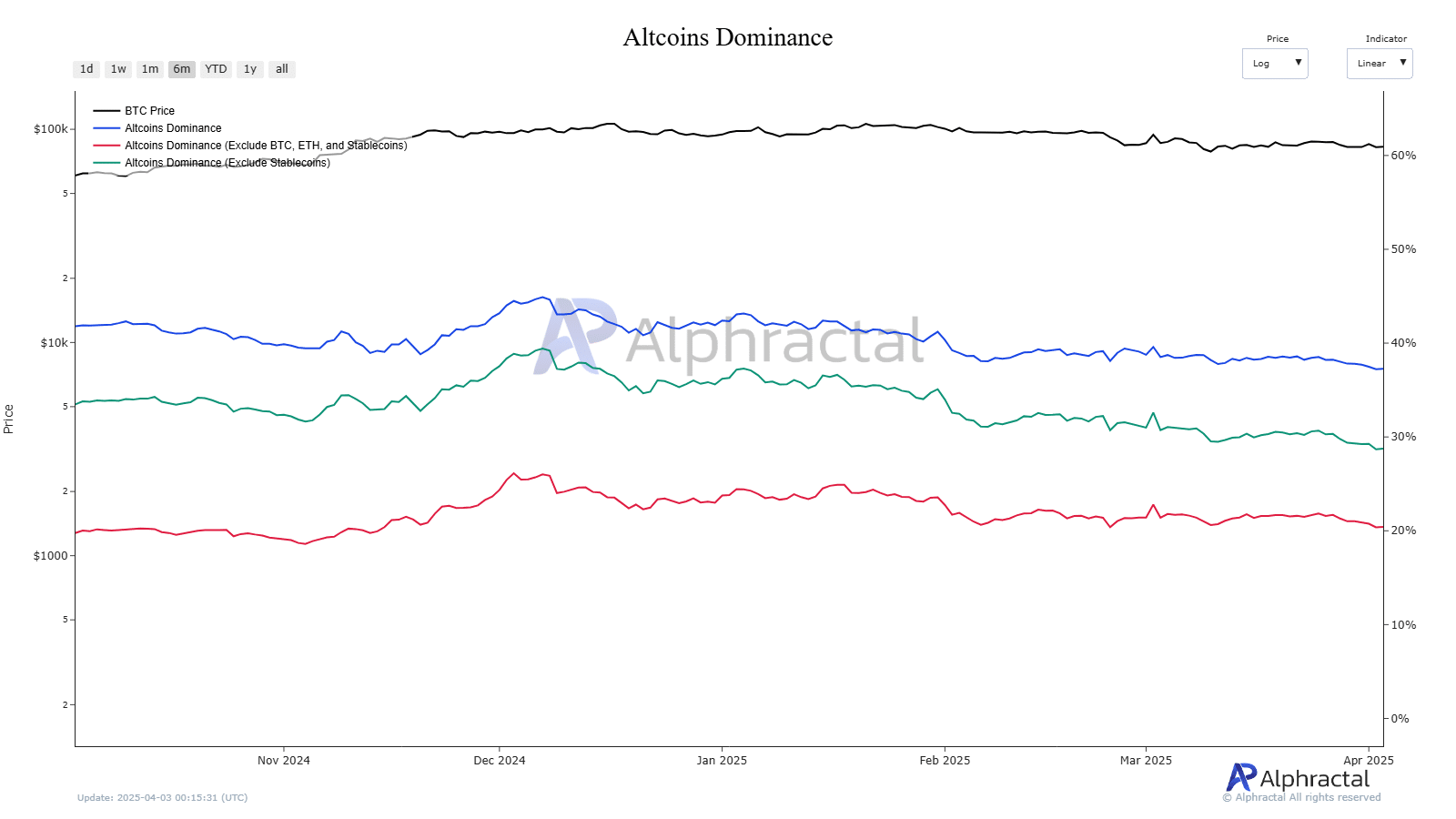

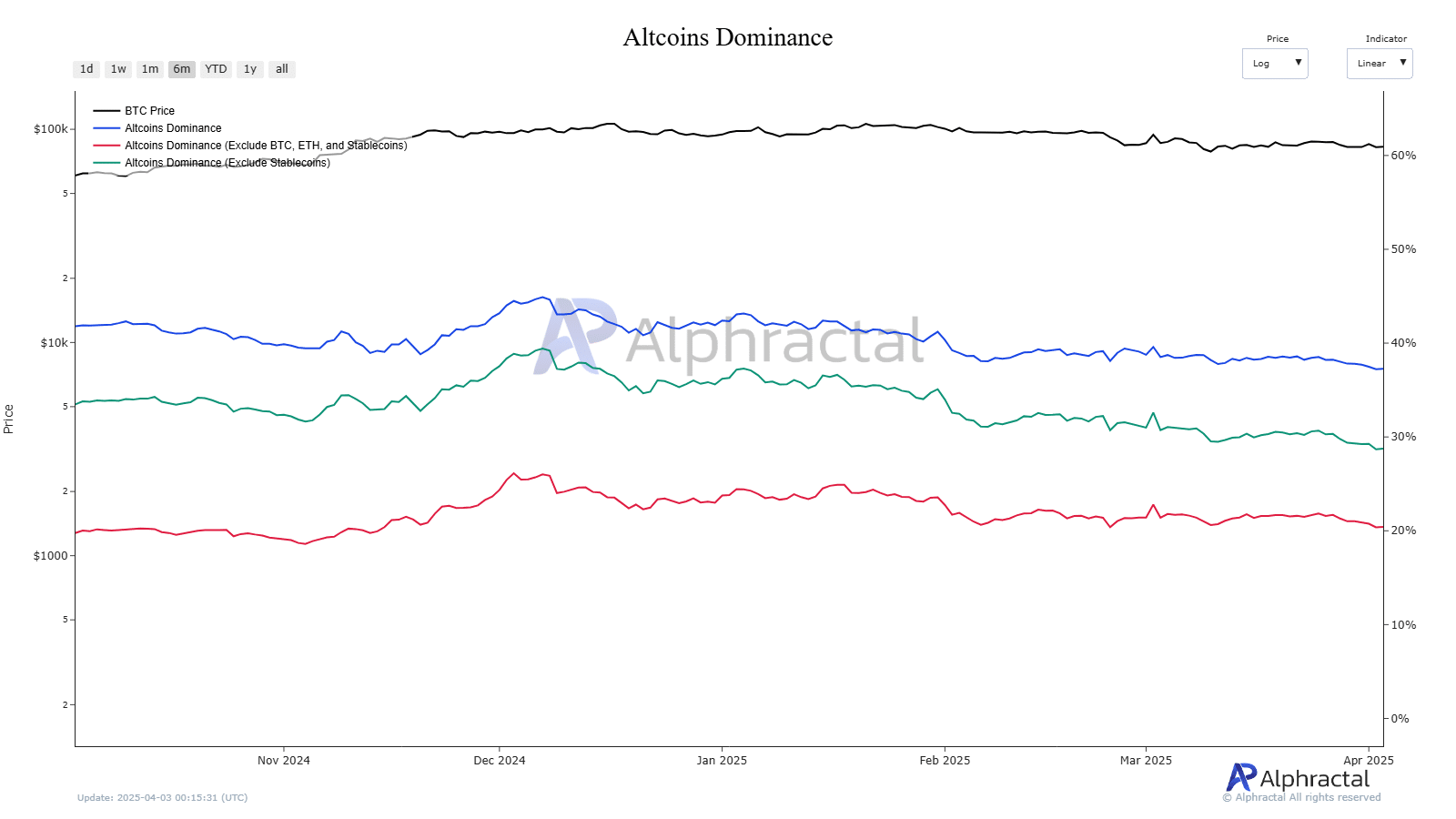

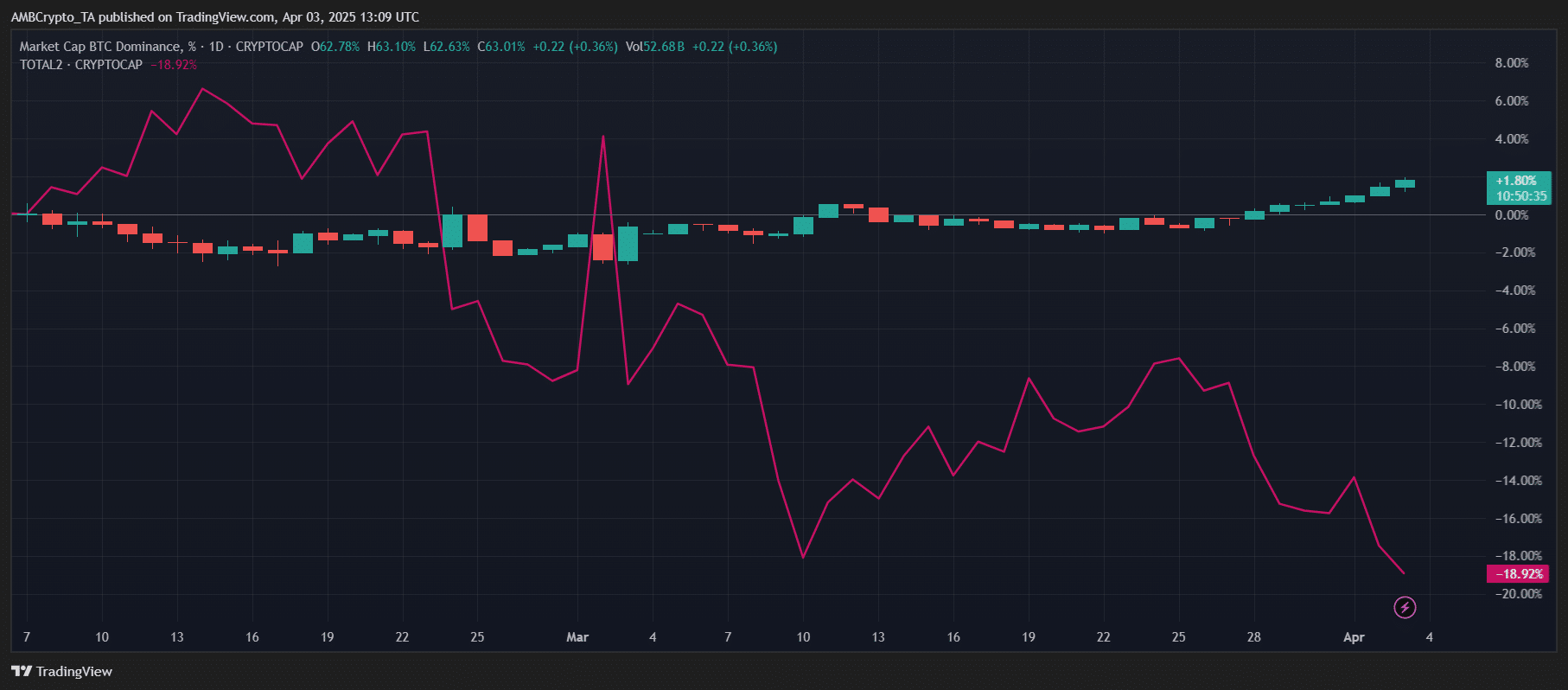

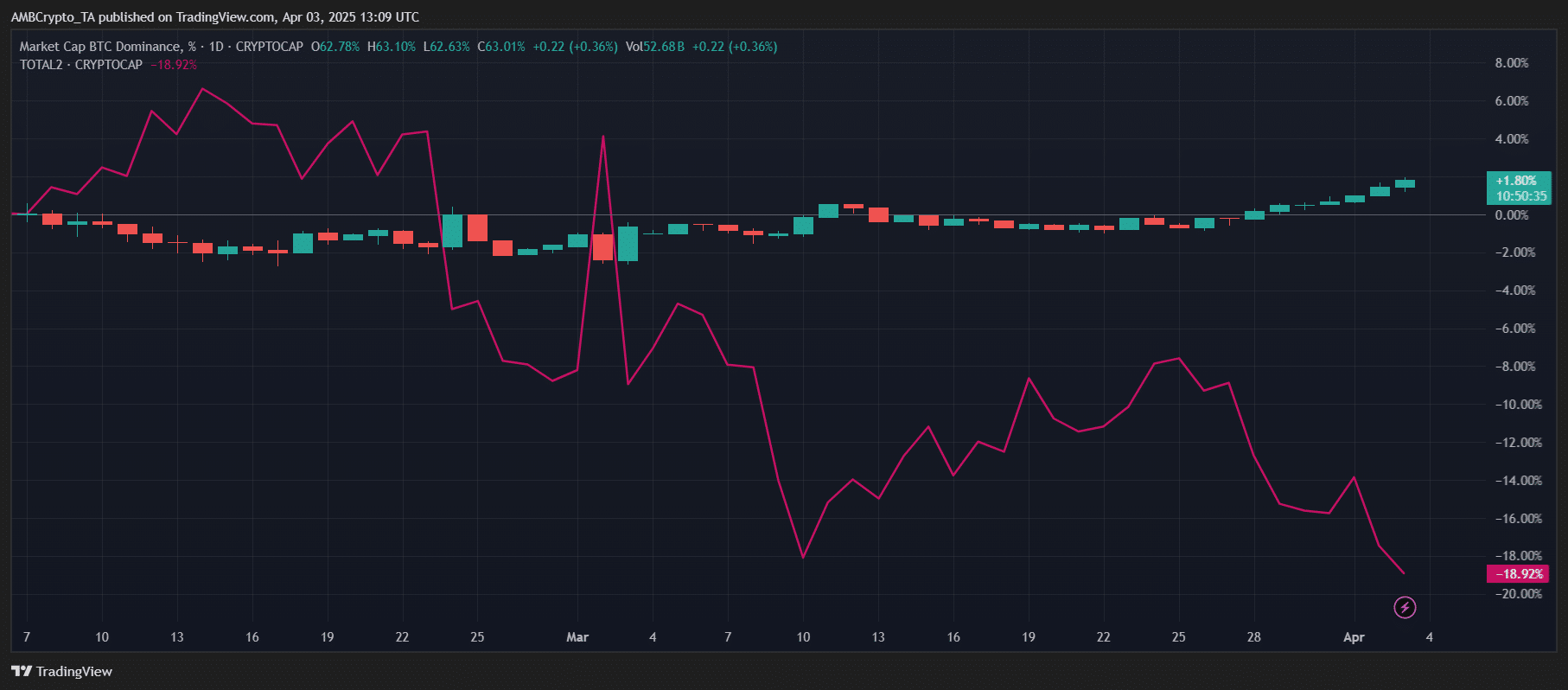

Quite the opposite, altcoin “dominance” tells us the identical story.

Supply: Alphractal

Since November, the altcoin market’s share has dropped from 41% to 37%. Excluding stablecoins, it really slipped from 35% to twenty-eight%.

Vanishing act of altcoin credibility

Filtering out Bitcoin, Ethereum, and stablecoins paints a good bleaker image, with shares for a similar falling from 23% to twenty%. Given the whole lot that has been taking place, the aforementioned decline merely confirms an absence of investor conviction in non-Bitcoin belongings.

Momentum in buying and selling has additionally vanished currently.

Supply: Alphractal

On 05 December, the altcoin market cap peaked at $1.43 trillion, with quantity at $542.63 billion. By 03 April, nonetheless, these numbers fell to $975.64 billion and $137.31 billion, marking 32% and 296% drops, respectively.

These figures painted an image of waning investor confidence.

Spikes in December weren’t sustained. And by March, the development was clearly southbound throughout each worth and participation.

Bitcoin’s rise in dominance additionally coincided with clear alerts from the Stablecoin Provide Ratio (SSR).

Supply: CryptoQuant

When peaks flip to warnings

23 February stands out as a turning level as a result of each Bitcoin’ss worth and the SSR peaked concurrently.

Bitcoin peaked at $96,209, alongside a 16.03 SSR. Inside three days, nonetheless, each reversed sharply. By April, BTC fell to $81,800, and the SSR dropped to 14.21.

This alignment might be seen as an indication of how liquidity shifts sign development exhaustion. Importantly, regardless of Bitcoin’s personal losses, its market dominance rose, not fell.

Each indicator results in the identical conclusion – Altcoin seasons are uncommon, transient, and fragile. Bitcoin’s dominance, now previous 63%, displays a consolidating market the place capital flows into perceived security.

Supply: TradingView

Bitcoin or bust?

Quick-term optimism round altcoins exists. Nevertheless, information additionally revealed that with out a structural shift in dominance and liquidity, any rallies might stay remoted and transient.

For now, the good cash seems to be staying parked in Bitcoin, or ready on the sidelines.