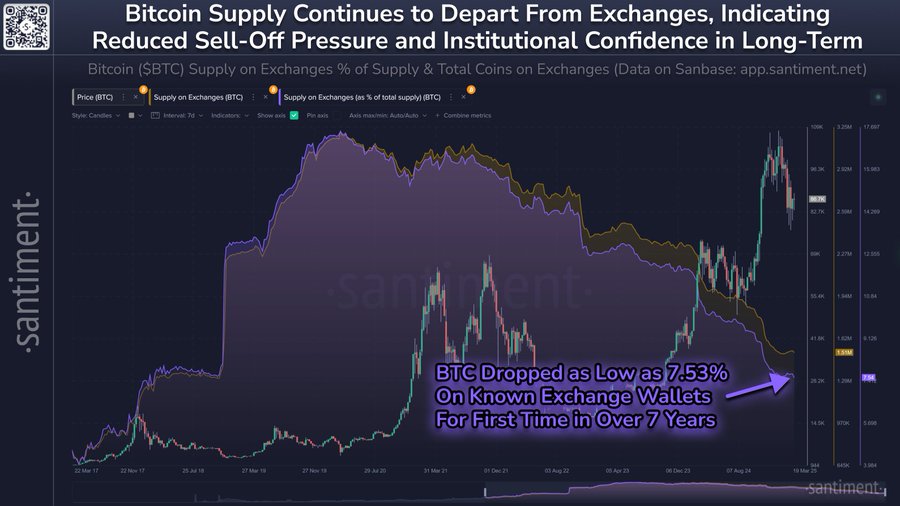

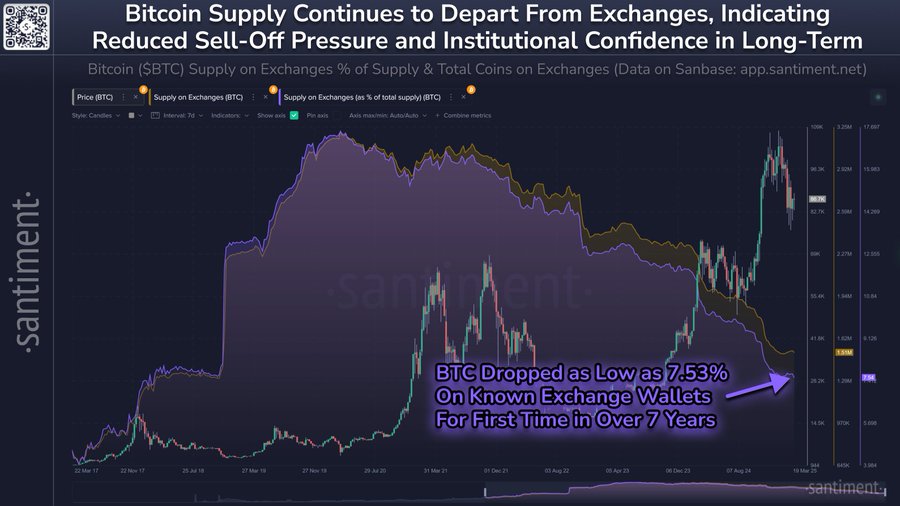

Bitcoin’s exchange supply falls to 7.53% – Is a bullish phase in sight?

- Bitcoin’s provide on exchanges dropped by 7.53%, indicating elevated investor confidence and lowered liquidity.

- Rising community exercise and technical indicators instructed that Bitcoin might be coming into a bullish section.

Bitcoin’s [BTC] provide on exchanges has dropped to simply 7.53%, marking its lowest stage since February 2018. At press time, Bitcoin traded at $87,075.28, down 0.95% over the previous 24 hours.

As extra buyers select to ‘hodl’ their BTC, this shrinking provide displays growing institutional confidence in Bitcoin’s long-term worth. With fewer individuals keen to promote, BTC may see heightened volatility because of the lowering liquidity out there.

Why is Bitcoin’s alternate provide shrinking?

The sharp decline in Bitcoin’s alternate provide displays a shift in investor sentiment towards holding moderately than promoting. This means rising confidence in Bitcoin’s future potential.

With lowered availability, value fluctuations could happen as demand surpasses provide. Elevated market confidence means fewer holders are keen to promote, additional limiting Bitcoin’s alternate provide.

Supply: Santiment

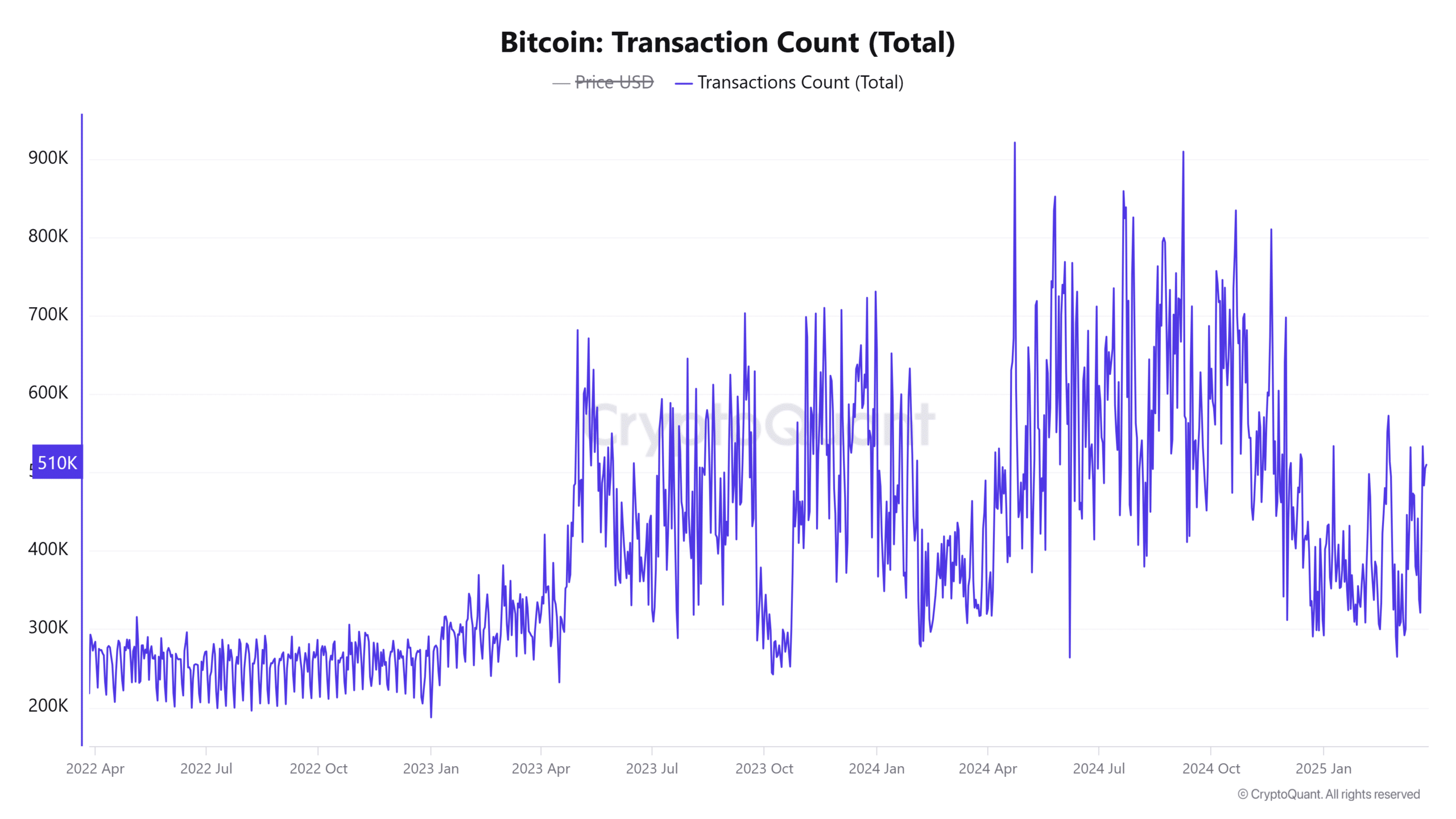

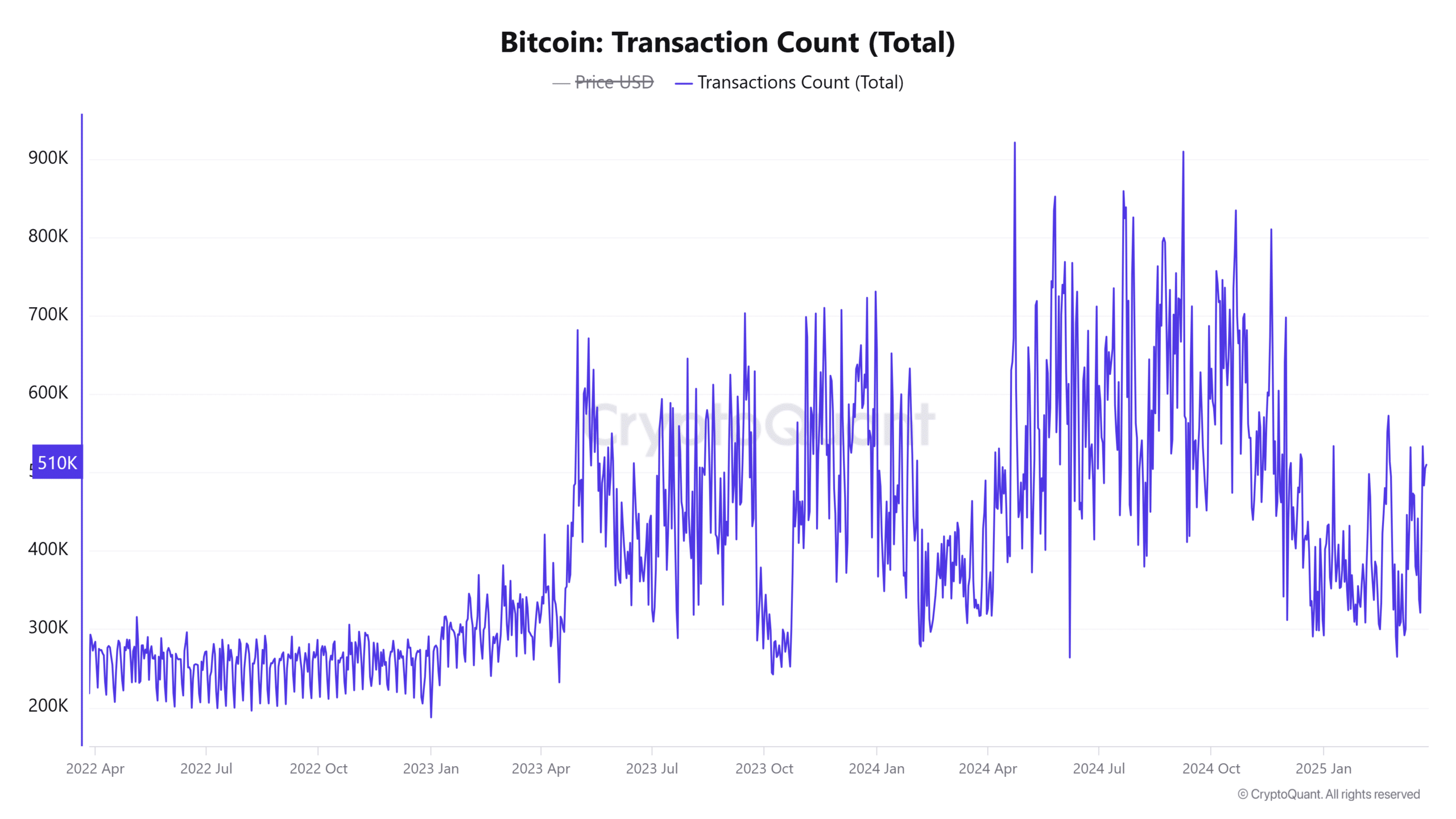

How energetic is the Bitcoin community?

Bitcoin’s community exercise additionally displays rising investor curiosity. Energetic addresses have elevated by 1.16%, reaching 10.17 million. This rise reveals extra customers interacting with the BTC community, whether or not by sending or receiving funds.

Moreover, the transaction rely has risen by 0.74%, totaling over 418,000 transactions. This improve in community exercise signifies that extra individuals are turning into concerned in BTC, which may result in larger demand and, probably, upward value stress.

Supply: CryptoQuant

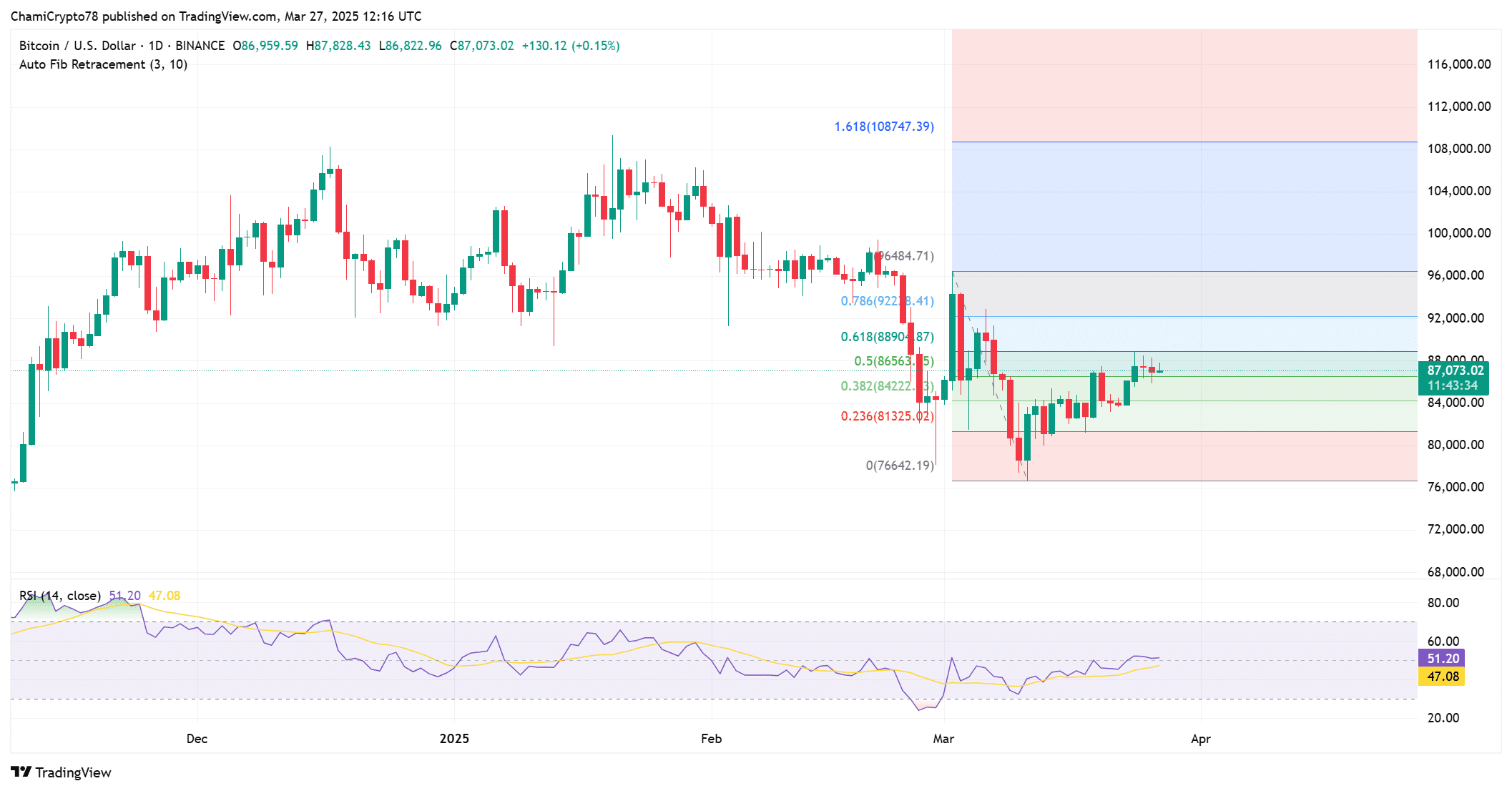

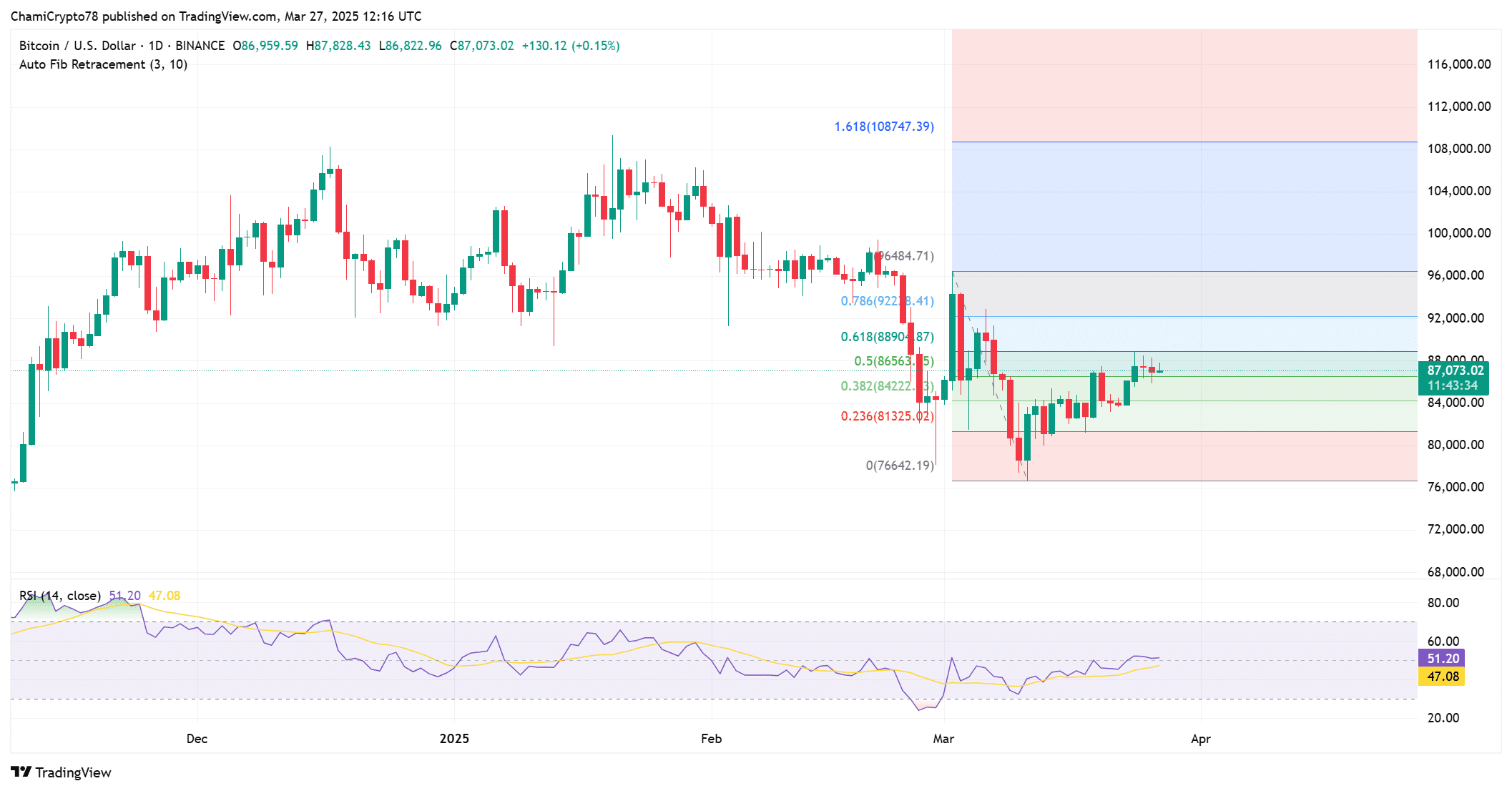

Technical indicators: Is BTC prepared for a breakout?

Taking a look at technical indicators, BTC’s value chart reveals encouraging indicators. At press time, the Fibonacci retracement ranges instructed that Bitcoin has discovered help on the 0.236 stage, round $81,325.

Moreover, the RSI was at 51, which signifies that BTC is neither overbought nor oversold. This implies that BTC nonetheless has room to maneuver in both course, with a possible breakout on the horizon if it continues to carry above key help ranges.

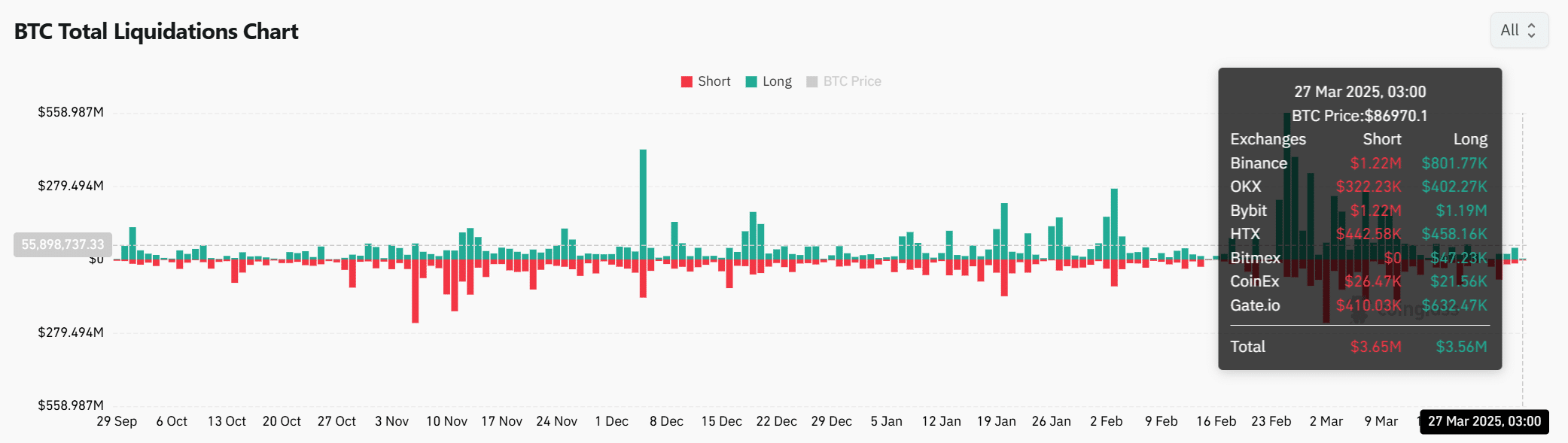

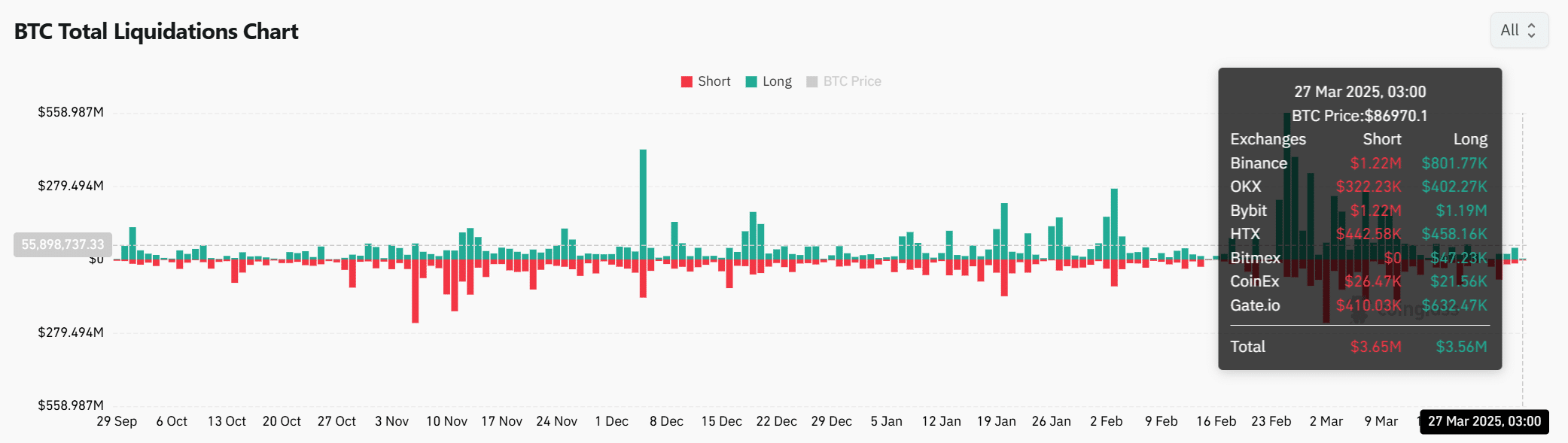

Lengthy vs. quick liquidations

BTC’s liquidation information reveals that lengthy and quick liquidations are practically equal, with $3.65 million in lengthy liquidations and $3.56 million briefly liquidations.

This implies that the market is balanced, with each optimistic and cautious merchants adjusting their positions. The balanced liquidations level to an equilibrium out there, awaiting the subsequent main value motion.

Supply: Coinglass

Conclusively, BTC’s low provide on exchanges, rising community exercise, and promising technical indicators counsel that BTC might be coming into a brand new bullish section.

The rising variety of holders, mixed with key help ranges, factors to upward momentum.

Subsequently, it’s possible that BTC will proceed to see constructive value motion, though short-term volatility may nonetheless impression the market.