Bitcoin’s futures market drops 35% – Is BTC’s stability at risk?

- Bitcoin’s Futures Open Curiosity dropped by 35%, mirroring ETF outflows and shifting sentiment in derivatives markets.

- Decrease futures and ETF liquidity might amplify short-term BTC volatility as merchants modify their positions.

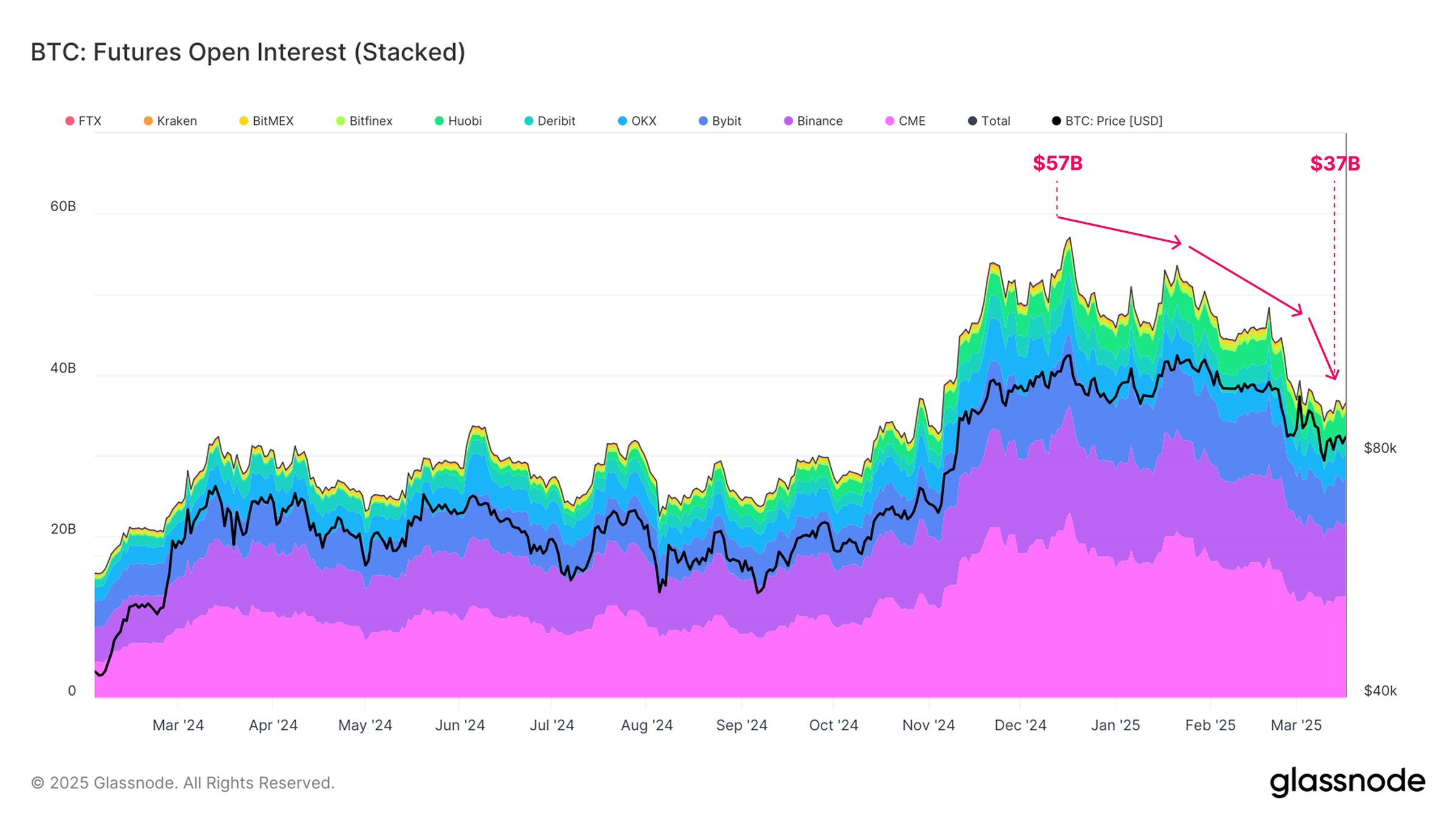

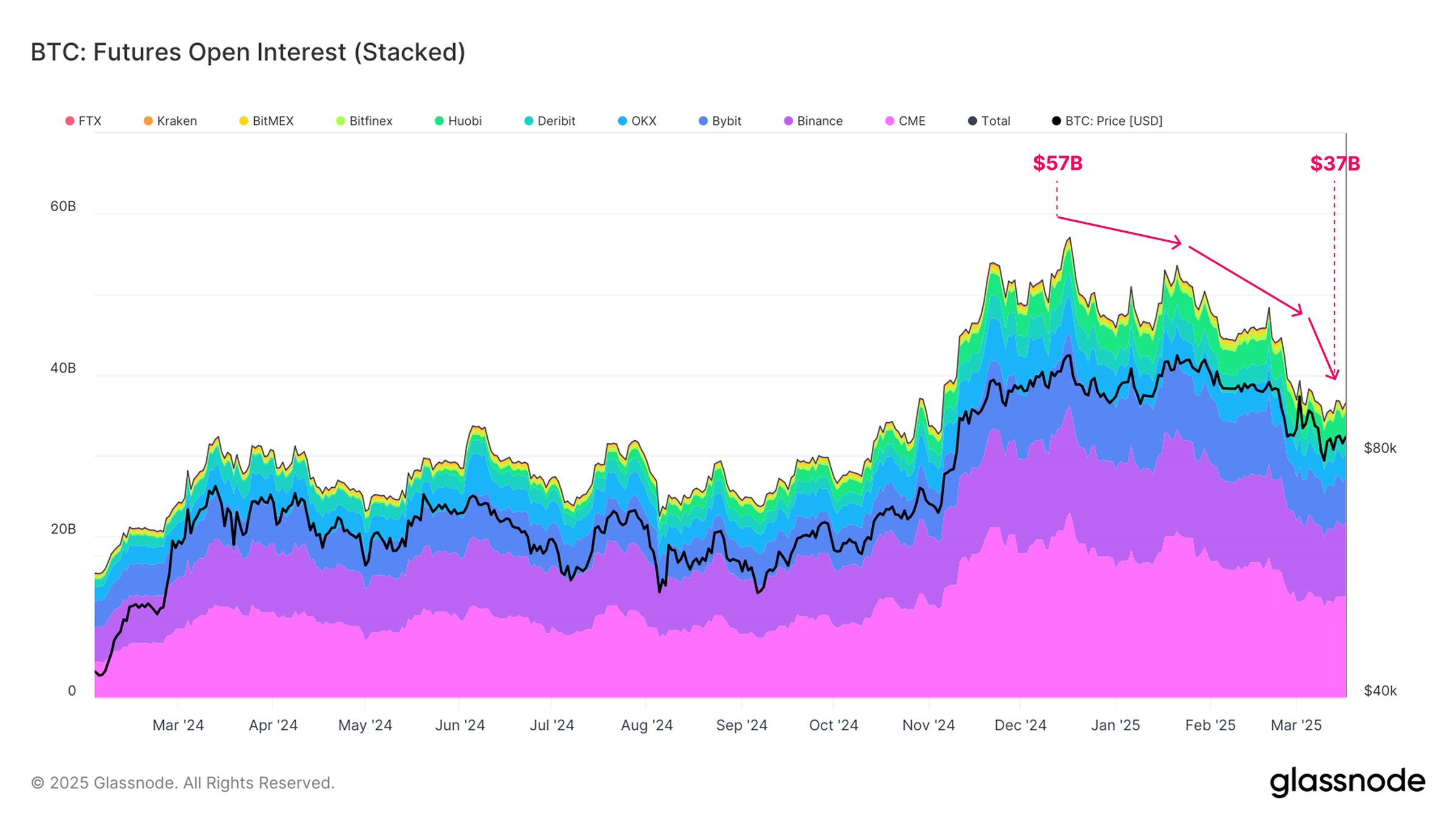

Bitcoin’s [BTC] futures market has seen a pointy contraction, with Open Curiosity (OI) plunging from $57 billion to $37 billion, a major 35% drop since BTC’s all-time excessive (ATH).

This decline in OI, coupled with ETF outflows and waning CME futures exercise, alerts a shift in investor positioning.

As liquidity contracts, questions come up about Bitcoin’s potential to keep up stability amid altering market situations.

Declining Bitcoin Futures Open Curiosity

Futures OI has traditionally been a key indicator of market hypothesis and leveraged positioning.

The steep drop means that merchants are closing positions, doubtlessly as a result of profit-taking or threat aversion following Bitcoin’s ATH. This lower displays a broader shift towards a extra cautious market, with lowered hypothesis and hedging exercise.

Supply: Glassnode

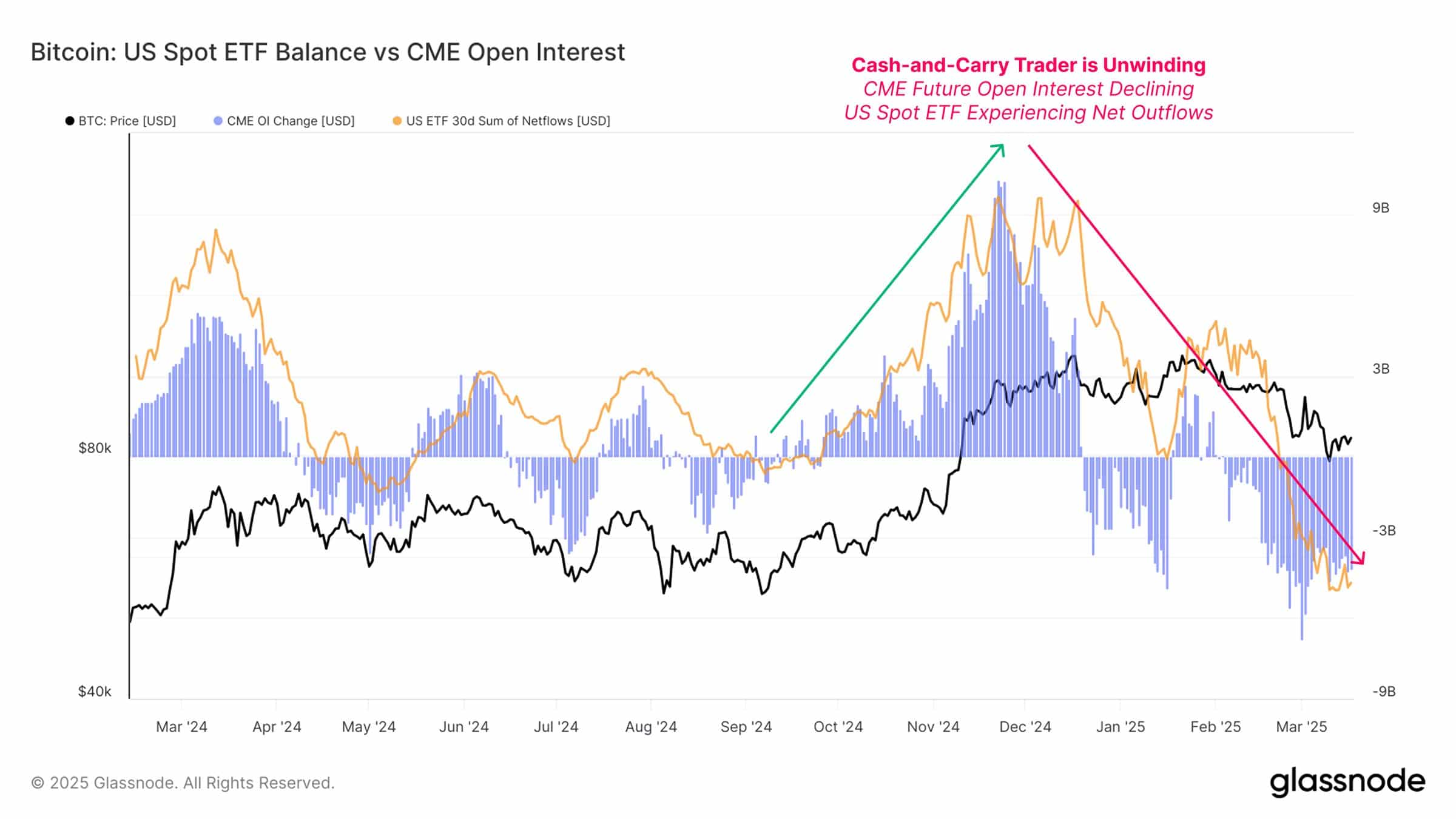

The chart from Glassnode illustrates a gradual build-up of Futures Open Curiosity over 2024, peaking at $57 billion earlier than starting its downtrend.

The decline aligns with a interval of decrease BTC volatility, indicating that leveraged merchants have been unwinding positions somewhat than aggressively getting into new trades.

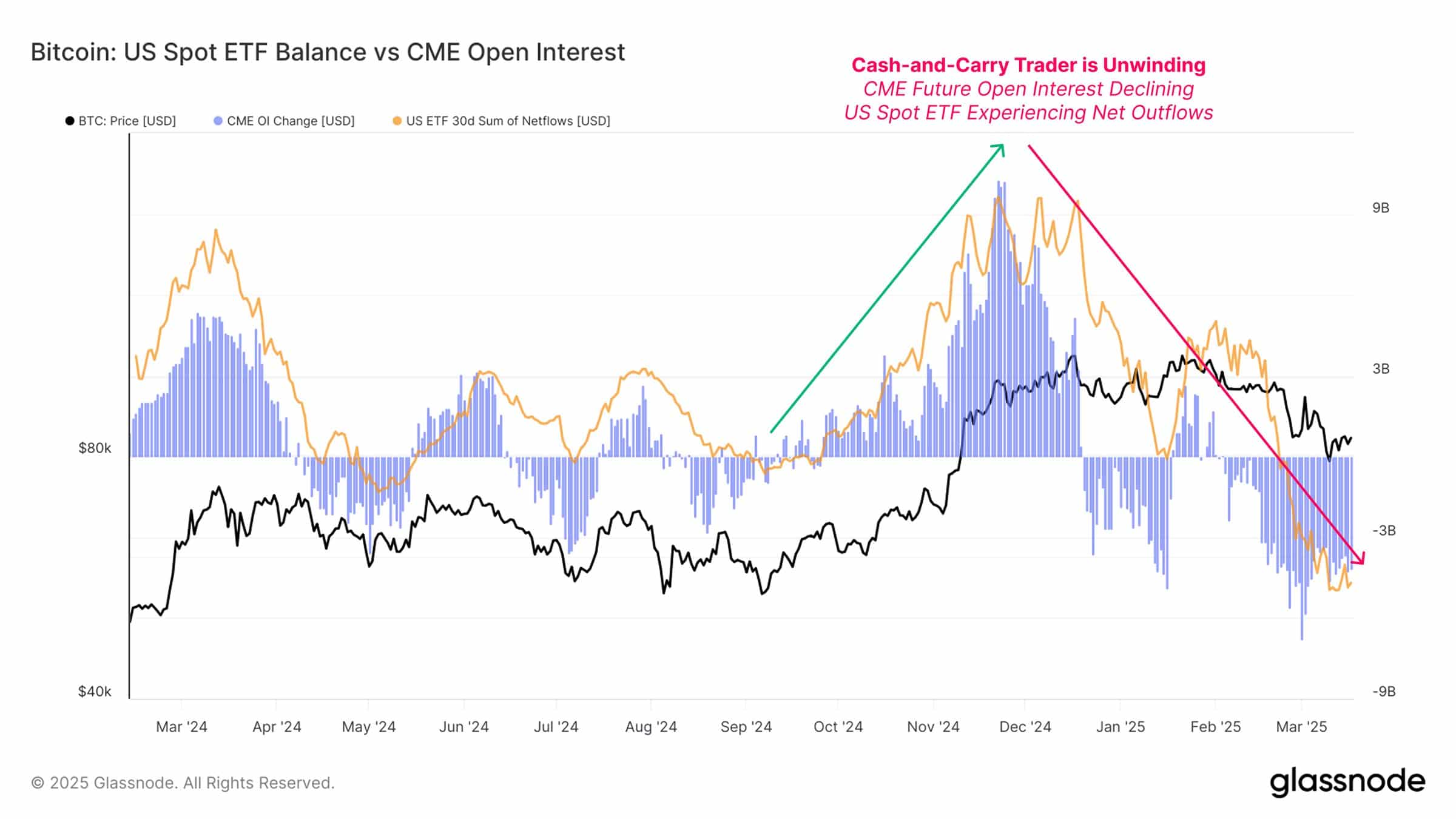

ETF outflows and CME Futures closures add to promoting stress

Alongside the futures market contraction, the Bitcoin ETF area has additionally skilled internet outflows. The unwind of the cash-and-carry commerce, a method merchants use to take advantage of the unfold between futures and spot costs, has contributed to the ETF liquidity drain.

This implies that establishments and enormous gamers could also be repositioning away from Bitcoin within the quick time period.

Supply: Glassnode

CME futures information additionally exhibits declining open curiosity, which traditionally alerts institutional hesitation.

The correlation between CME futures and BTC worth actions has strengthened in current months, making this decline an important issue to observe. Bitcoin might battle to reclaim key resistance ranges if the outflows proceed.

What this implies for BTC’s worth

Bitcoin was buying and selling at $83,918 at press time, hovering beneath its 50-day Shifting Common (MA) at $85,386 and considerably beneath the 200-day MA at 95,340.

Supply: TradingView

The shortage of futures-driven liquidity means that BTC would possibly face issue in sustaining bullish momentum. Key assist lies close to $80,000, whereas resistance at $85,000 stays an important threshold for any upward transfer.

With Futures OI shrinking and ETF liquidity drying up, Bitcoin’s worth might enter a part of elevated volatility.

Whether or not BTC stabilizes or experiences additional draw back might rely on whether or not long-term holders step in to soak up the promoting stress. Merchants ought to look ahead to renewed accumulation alerts earlier than anticipating a sustained rally.