Bitcoin’s liquidity test: Will $87K decide BTC’s next major move?

The markets are tense, however Bitcoin’s chart tells a extra strategic story than the headlines counsel.

BTC pulled again after failing to interrupt the $94.5K ceiling, and the 3-day heatmap now reveals lengthy liquidity constructing closely between $89K and $87K.

These dense clusters typically act as magnets earlier than a reversal, particularly when good cash hunts for over-leveraged positions.

The present pullback matches that sample, with value drifting towards untouched liquidity swimming pools that sometimes decide the following directional leg.

Will Bitcoin drop to brush liquidity at 89K–87K?

The slide towards $90K matched the liquidity constructed earlier within the week, and a deeper cluster nonetheless sits between $87K and $86.3K.

This zone hasn’t been examined since early December, making it a pure goal if BTC can’t maintain above present ranges. A sweep into that pocket would clear overleveraged longs earlier than any actual reversal try.

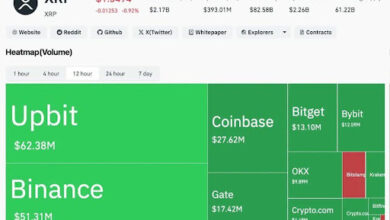

Supply: CoinGlass

Shedding this space would pull BTC towards $86,320, with a deeper liquidity shelf close to $80,507 performing as the ultimate draw back magnet.

Whether or not value defends or takes the $89K–$87K block will decide if BTC rebounds towards $96K or slips right into a broader breakdown.

Can Bitcoin explode from THIS stage?

Bitcoin [BTC] presently trades inside two overlapping bullish constructions: a minor ascending triangle that defines short-term compression and a significant ascending trendline that has supported each rebound since November.

Supply: TradingView

BTC tapped the decrease boundary of the minor triangle with precision.

On the identical time, RSI carved out a clear bullish divergence—a basic signal that draw back strain is dropping momentum whilst value makes marginal new lows. This mixture typically precedes sharp rebounds if structural assist holds.

However the danger stays easy. A breakdown from the minor construction exposes the key ascending trendline.

Holding that line retains the bullish path intact. Shedding it, nonetheless, opens the broader liquidity cabinets between $86K and $80.5K, ranges which have traditionally reset leveraged markets and cleaned out weaker lengthy positions.

Farzam Ehsani, CEO of VALR, affirmed this notion, telling AMBCrypto in am e mail,

“Bitcoin’s technical image displays this nervousness. Resistance at $92,000 and a narrowing vary are setting the stage for a decisive breakout that might decide the path for months to return.”

Fed lower response: Macro concern vs. technical reversal

The Fed’s 25 bps lower briefly pushed BTC to $94.5K earlier than sellers stepped in. Related patterns appeared in previous lower cycles, the place early optimism pale rapidly.

Powell signaled Treasury purchases could keep elevated, a quiet trace of QE-style assist—whereas additionally warning about rising employment dangers and tariff-driven inflation.

9 of twelve FOMC members backed the lower, exhibiting strong inner settlement. Even so, markets seen the tone as cautious slightly than strongly dovish, triggering BTC’s pullback.

Ehsani continued,

“Scrutiny of US authorities choices, which encompasses the most important Bitcoin holders, relies on the notion {that a} new spherical of home financial disasters because of the chapter of firms with vital Bitcoin reserves, which actively lobbied for his or her pursuits and sponsored the present authorities throughout elections, is unacceptable.”

That macro response now meets Bitcoin’s technical setup at a important second.

Path towards $96K: Can BTC reverse?

CryptoQuant analysts notice a transparent drop in promoting strain. Change deposits fell from 88K in late November to 21K as we speak.

Whale deposits slid from 47% to 21%, and common deposits dropped from 1.1 BTC to 0.7 BTC, signaling massive sellers have stepped again.

Ray Youssef, CEO of NoOnes, echoed this sentiment, telling AMBCrypto,

“A dovish Fed tone might open the door to renewed risk-on sentiment, triggering a “Santa rally” for digital property, with BTC reclaiming $100,000, ETH rising above $3,500, XRP at $2.3, and Solana shifting in the direction of $150.”

This backdrop typically permits aid rallies. $99K is Bitcoin’s the primary main upside checkpoint, matching the decrease band of the Dealer Realized Worth.

Above that, $102K and $112K are the following resistance zones. If BTC avoids a deeper liquidity sweep and holds its ascending construction, a transfer towards $96K stays in play.

Youssef summarized it completely, observing,

“Market construction is lastly starting to stabilize after latest pressured unwinds and intense promoting strain, significantly from long-term holders. Nevertheless, the depth of the market restoration stays shallow.”

He continued,

“ETF inflows have solely just lately turned optimistic after heavy redemptions, and cumulative spot shopping for strain remains to be underwhelming.”

Closing Ideas

- Liquidity clusters beneath stay the most important near-term danger.

- Bullish divergence and easing promoting strain preserve the upside state of affairs alive.