Bitcoin’s looming supply crunch – Is that good news for you?

- Bitcoin reserves on spot exchanges have dropped to their lowest degree since 2017

- Rising institutional demand amid the falling provide may set off a prize squeeze

Bitcoin (BTC), at press time, was buying and selling at $101,718 on the charts following positive aspects of 1.6% in 24 hours. As anticipated, the king coin continues to be essentially the most dominant crypto out there, with a market capitalization of >$2 trillion.

Alongside these latest positive aspects although, demand for BTC has surged too. This has created a market imbalance as a consequence of falling provide. If these developments persist, Bitcoin may be going through a possible provide squeeze, one that might push its worth increased.

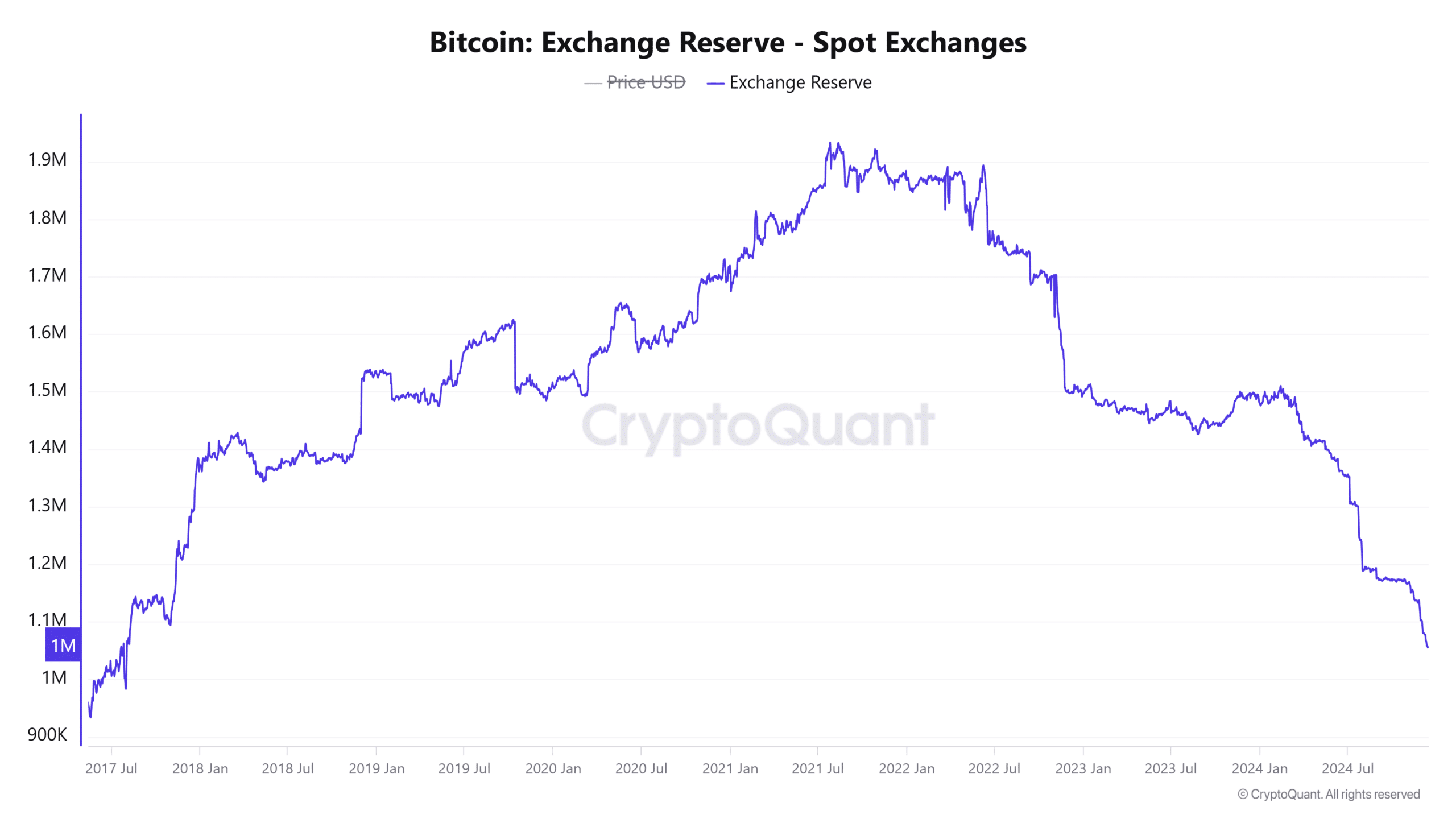

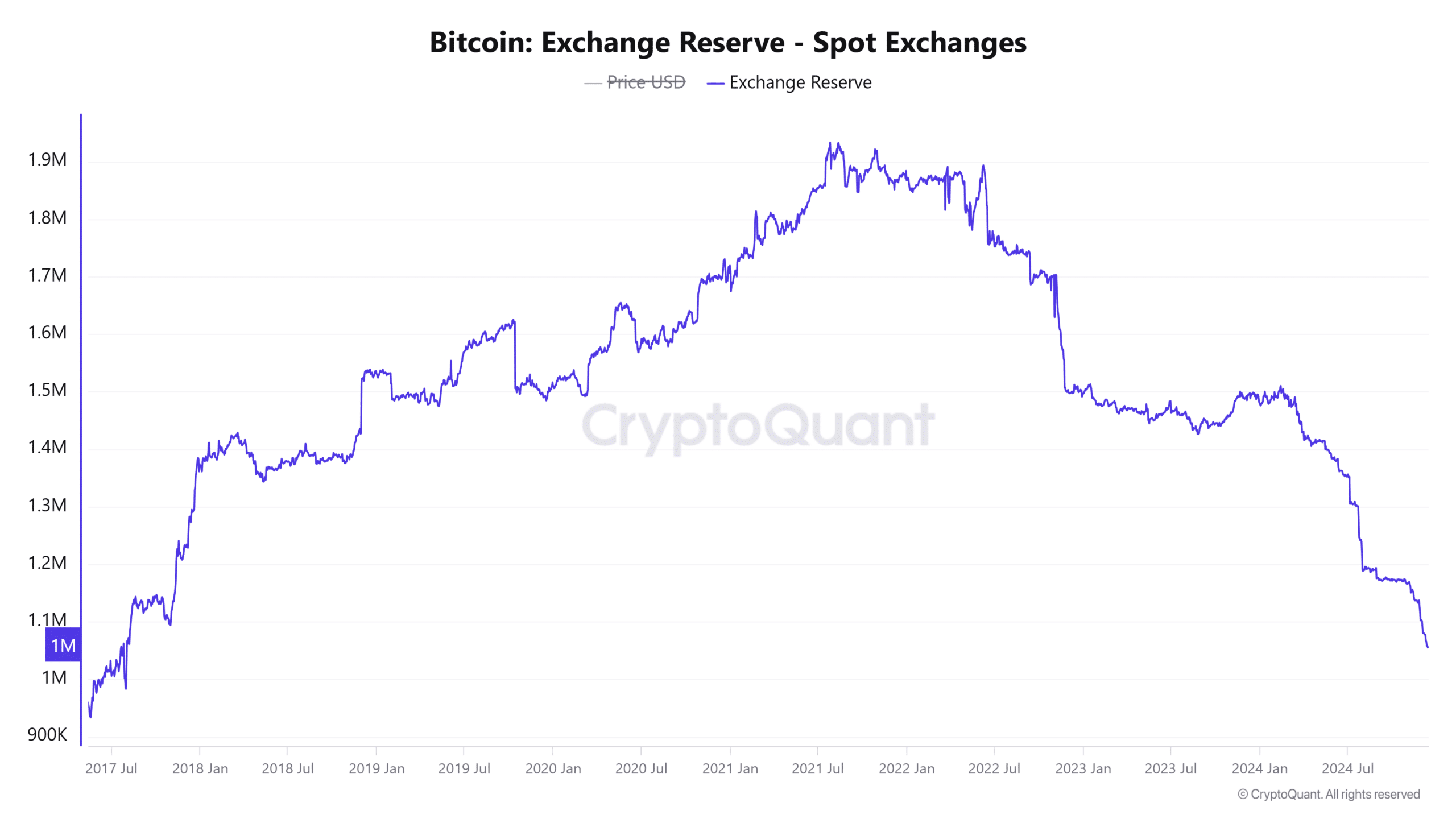

Bitcoin spot trade reserves hit a 7-year low

Knowledge from CryptoQuant highlighted the drop in Bitcoin’s provide after spot trade reserves fell to their lowest degree since mid-2018. The truth is, the Bitcoin held on spot exchanges now stands at 1,055,716 BTC.

Supply: CryptoQuant

These reserves have recorded a steep drop over the previous month amid Bitcoin’s rally previous $100,000 to new all-time highs.

In accordance with 10X Analysis, Coinbase, which has the best Bitcoin reserves, recorded 72,000 BTC in outflows within the final 30 days. These outflows comprised almost 10% of the trade’s Bitcoin stability.

29,000 BTC was additionally withdrawn from Binance inside the similar interval, whereas Kraken’s outflows accounted for greater than 7% of its whole Bitcoin holdings.

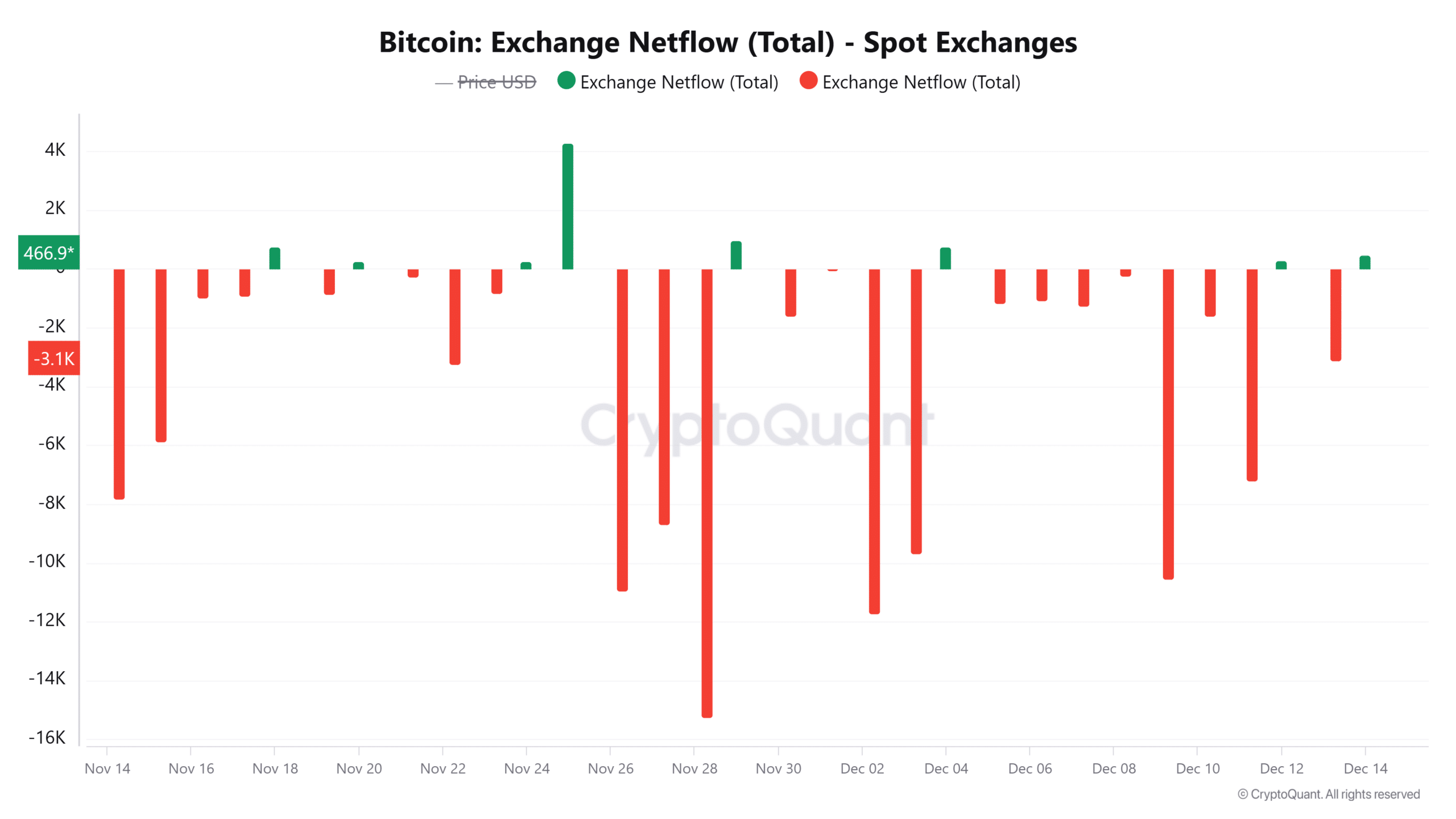

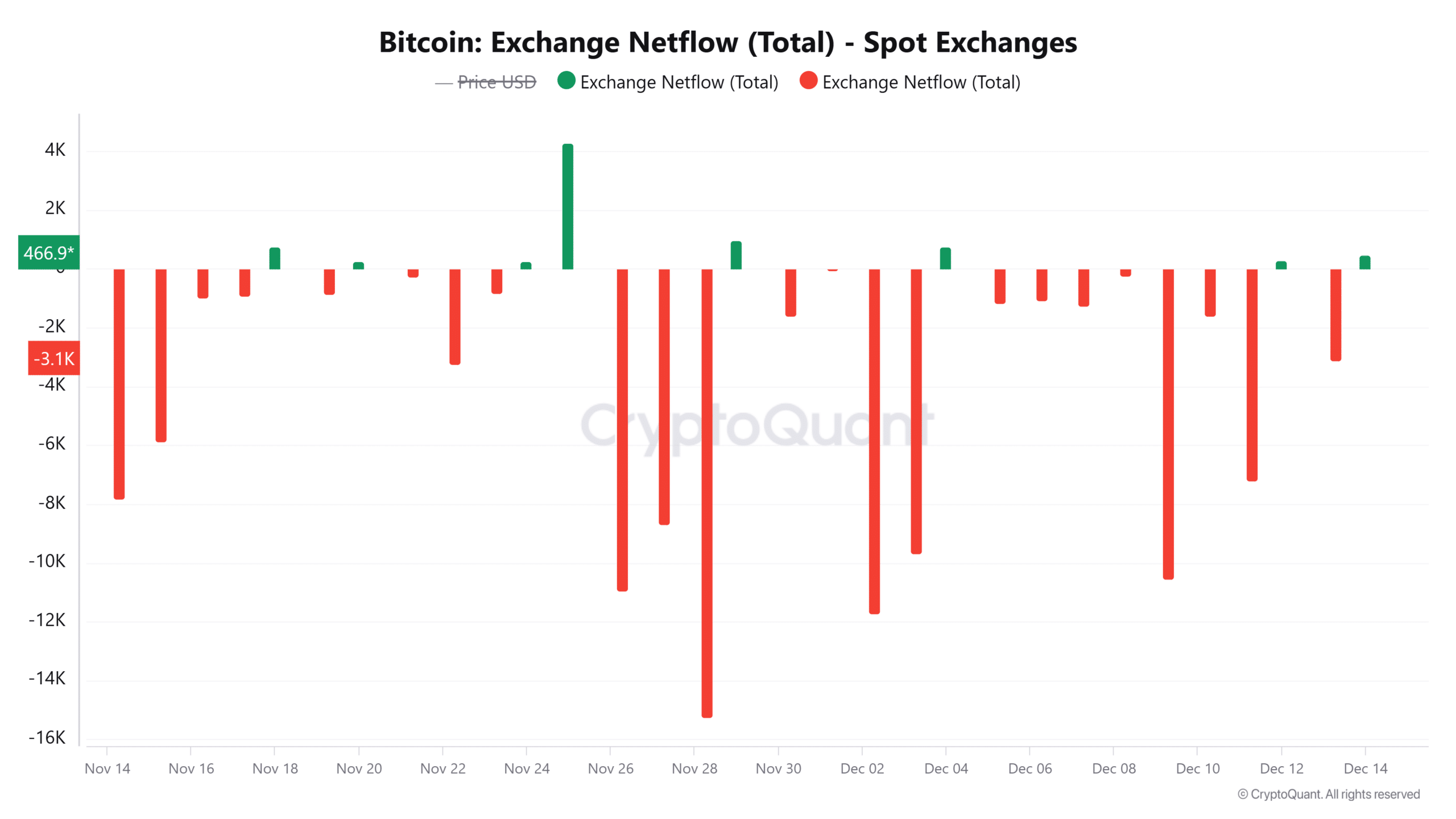

The trade netflow information for the final 30 days additionally revealed that Bitcoin has recorded 22 days of destructive netflows from spot exchanges. That is additional proof of a situation the place merchants haven’t been eager on promoting.

Supply: CryptoQuant

Moreover, this information recommended that the majority merchants are selecting to carry Bitcoin regardless of its latest positive aspects – An indication of their long-term bullish outlook.

Rising institutional demand

The unwillingness to promote has been met with a spike in institutional demand, as seen within the inflows to identify Bitcoin exchange-traded funds (ETFs).

In accordance with SoSoValue information, the entire inflows to identify Bitcoin ETFs within the final three weeks have surpassed $5 billion. These property are inching nearer to holding 6% of Bitcoin’s whole market capitalization.

Inflows to those ETFs have additionally been optimistic for the final 12 consecutive days.

If these inflows persist, it may set off an extra provide squeeze on Bitcoin that might push the worth increased.

Binary CDD reveals….

Lengthy-term Bitcoin holders are recognized to promote every time the market hits a neighborhood prime. As AMBCrypto reported, this cohort began promoting Bitcoin earlier this month, inflicting the rally to stall.

The Binary Coin Days Destroyed (CDD) has been at 1 during the last 5 days. This implied that long-term holders should be taking income.

Supply: CryptoQuant

If this cohort is promoting, it may result in Bitcoin avoiding a possible provide squeeze if the cash being bought are sufficient to soak up the buy-side strain.