Bitcoin’s major sell-off might be ending: Will BTC recover now?

- Bitcoin offered a shopping for alternative, however the downtrend was not but over.

- The sell-off is likely to be at an finish, and BTC token switch volumes resembled their 2023 ranges.

Bitcoin [BTC] has shed almost 5% since Friday, dragging the Concern and Greed Index decrease. The short-term holders had been going through losses, whereas longer-term holders most popular to build up.

This won’t spark an instantaneous restoration, however a restoration could possibly be brewing.

The stablecoin ratio channel signaled a shopping for alternative for BTC and altcoins. The rise in stablecoin provide signifies elevated liquidity and tends to happen throughout bearish market phases.

Markets are cyclical, and the market will swing bullishly — the query is when.

The Coinbase Premium Index tracks the worth distinction between Coinbase and Binance. A optimistic premium implies better demand from U.S.-based traders.

This has not been the case over many of the previous three months, an indication of concern from U.S. traders.

The CB Premium Index is close to impartial ranges proper now. Its motion would rely on the BTC worth motion, which was bearishly biased within the decrease timeframes at press time.

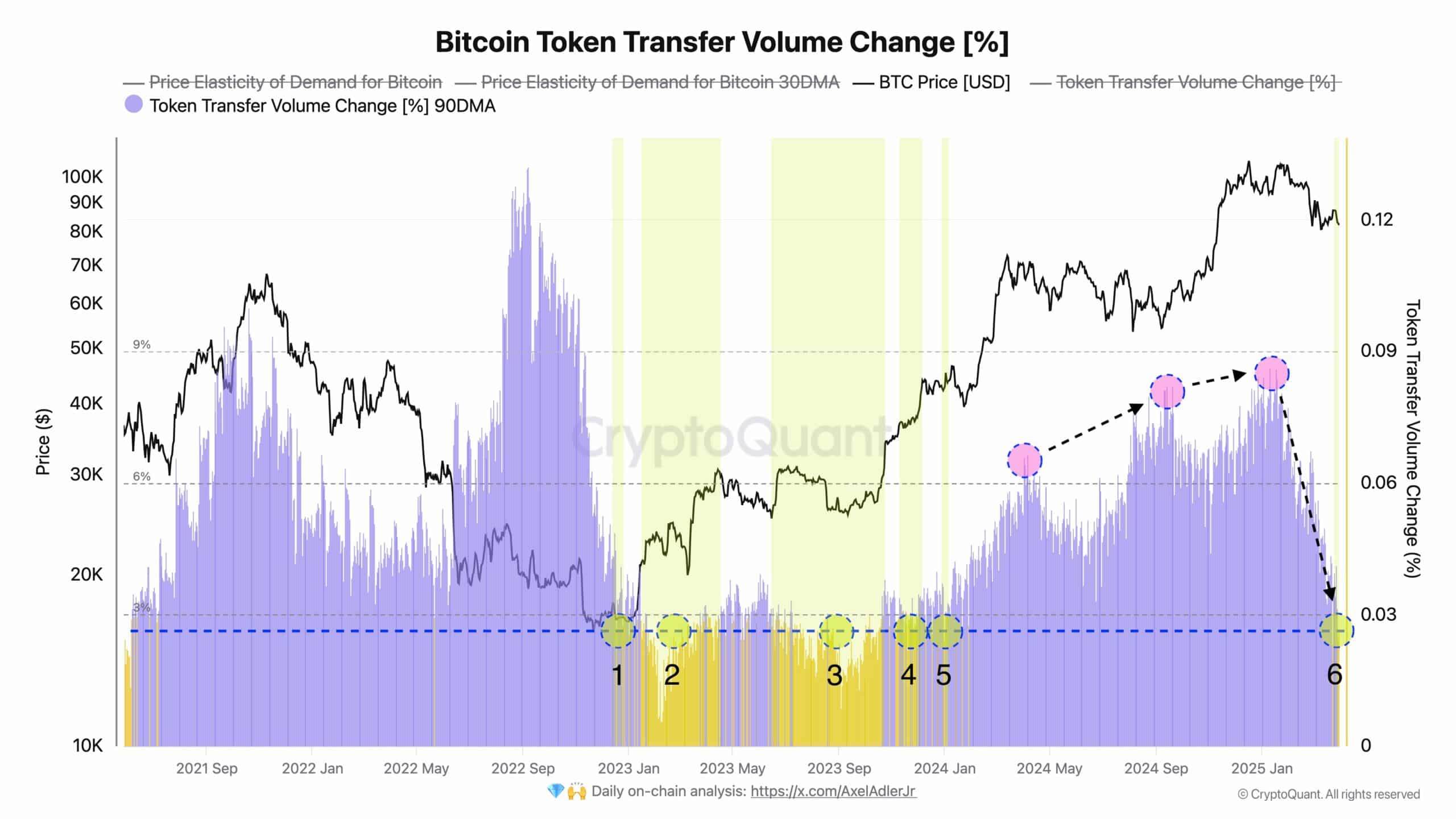

Nevertheless, the promoting strain is likely to be at an finish. Crypto analyst Axel Adler Jr noticed in a post on X that the 90-day transferring common of the Bitcoin token switch quantity change (%) was falling.

It was at the moment close to the lows from 2023, which corresponded to a interval of BTC accumulation.

The indicator exhibits the common change in transaction quantity over the past 90 days in comparison with the day prior to this.

Its latest retreat meant that main sell-offs had been over, and Bitcoin would possibly start to development larger on the worth chart.

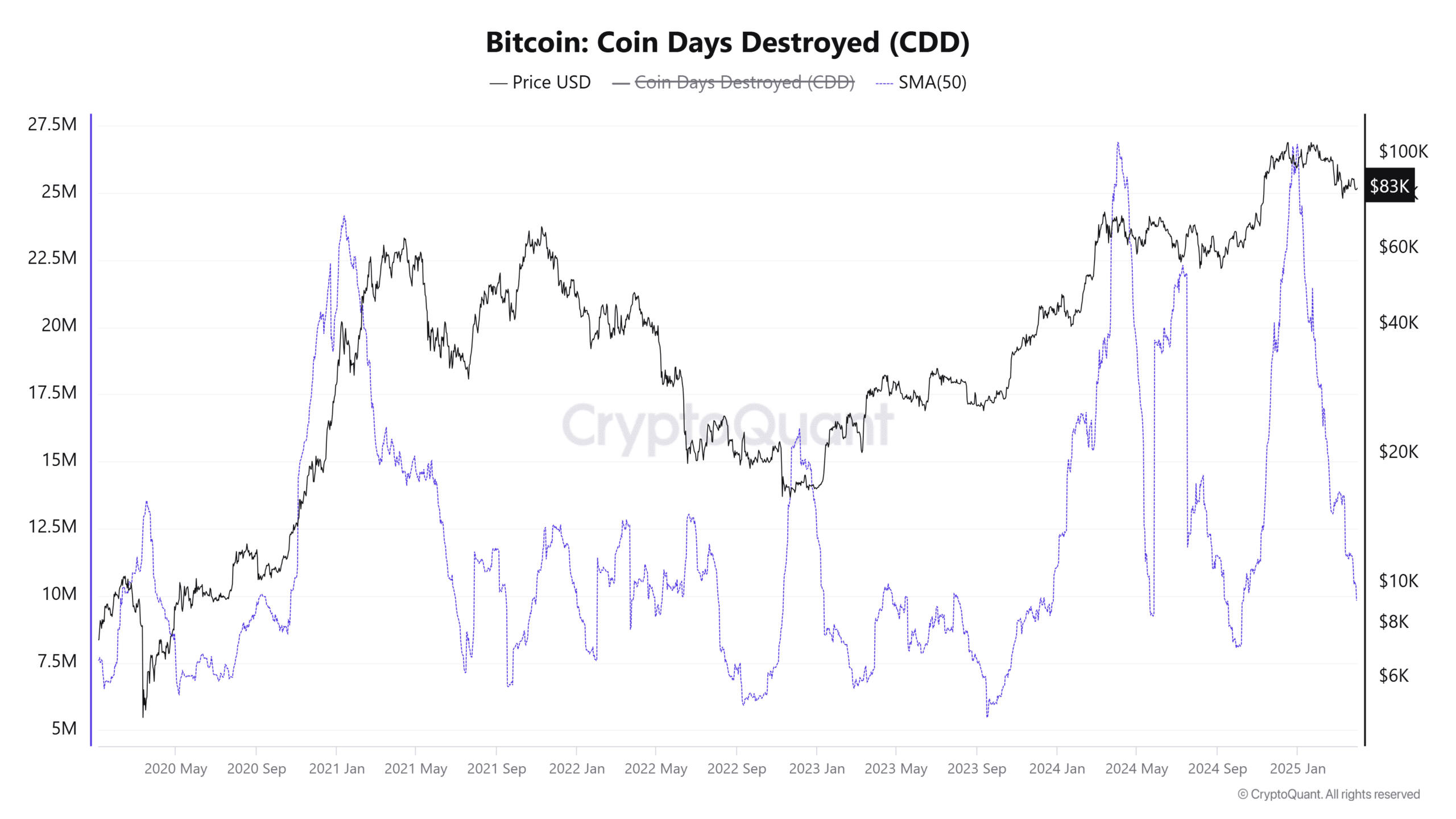

The BTC coin days destroyed (CDD) tracks the long-term holder exercise.

When a coin is spent, the variety of days the coin was held is multiplied by the variety of cash moved to reach at CDD. Excessive CDDs point out long-term holders promoting, and might mark main development shifts.

Over the previous three months, the 50DMA of the BTC CDD metric has been falling. This signaled lowered promoting strain from long-term holders.

Placing the clues collectively, it appeared possible that Bitcoin was nearing the tip of the downtrend.

Nevertheless, it doesn’t sign an instantaneous development reversal, and merchants and traders should be cautious of being too desperate to catch the worth backside.