Bitcoin’s market sentiment turns negative for ‘first time in months’ – Details

- Twitter and media sentiment turned damaging, signaling a possible reset for Bitcoin’s market

- On-chain exercise and miner confidence hinted at robust fundamentals regardless of market volatility

With Bitcoin [BTC] coming into a brand new section, recent analysis has revealed a shift in market sentiment. Each Twitter and mainstream media are turning damaging for the primary time since December 2024.

Now, whereas this doesn’t assure a direct value drop, it does sign a broader market reset. As Bitcoin navigates this shift, the query stays – The place does it go from right here?

Social Media – Shaping Bitcoin market sentiment

Market sentiment performs a vital function in shaping Bitcoin’s value actions, and platforms like X have turn into key indicators of public notion. The sentiment expressed on social media can act as a robust forecasting device, influencing investor conduct.

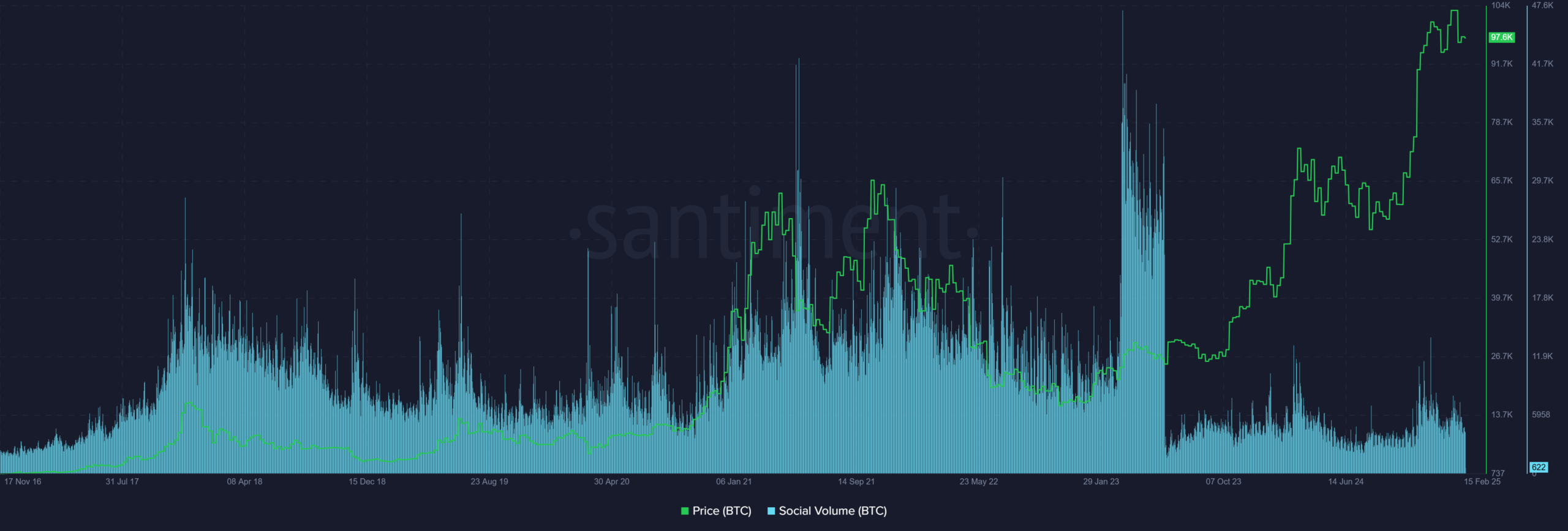

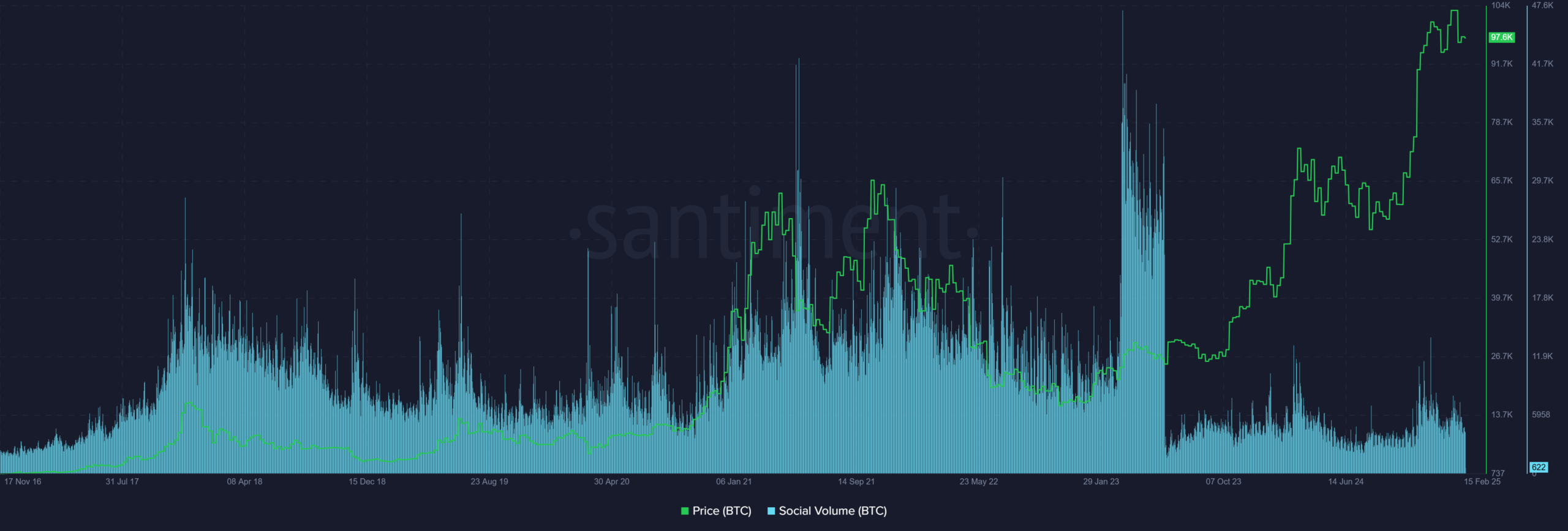

Supply: Santiment

When optimistic sentiment is excessive, it will possibly drive shopping for exercise, whereas damaging sentiment can set off promoting stress.

Traditionally, Bitcoin has seen vital value fluctuations following shifts in social media sentiment. For instance, in 2017, a surge in optimistic tweets about Bitcoin preceded its meteoric rise. Quite the opposite, downturns in 2018 and 2022 had been mirrored by rising pessimism on-line.

A warning or a possibility?

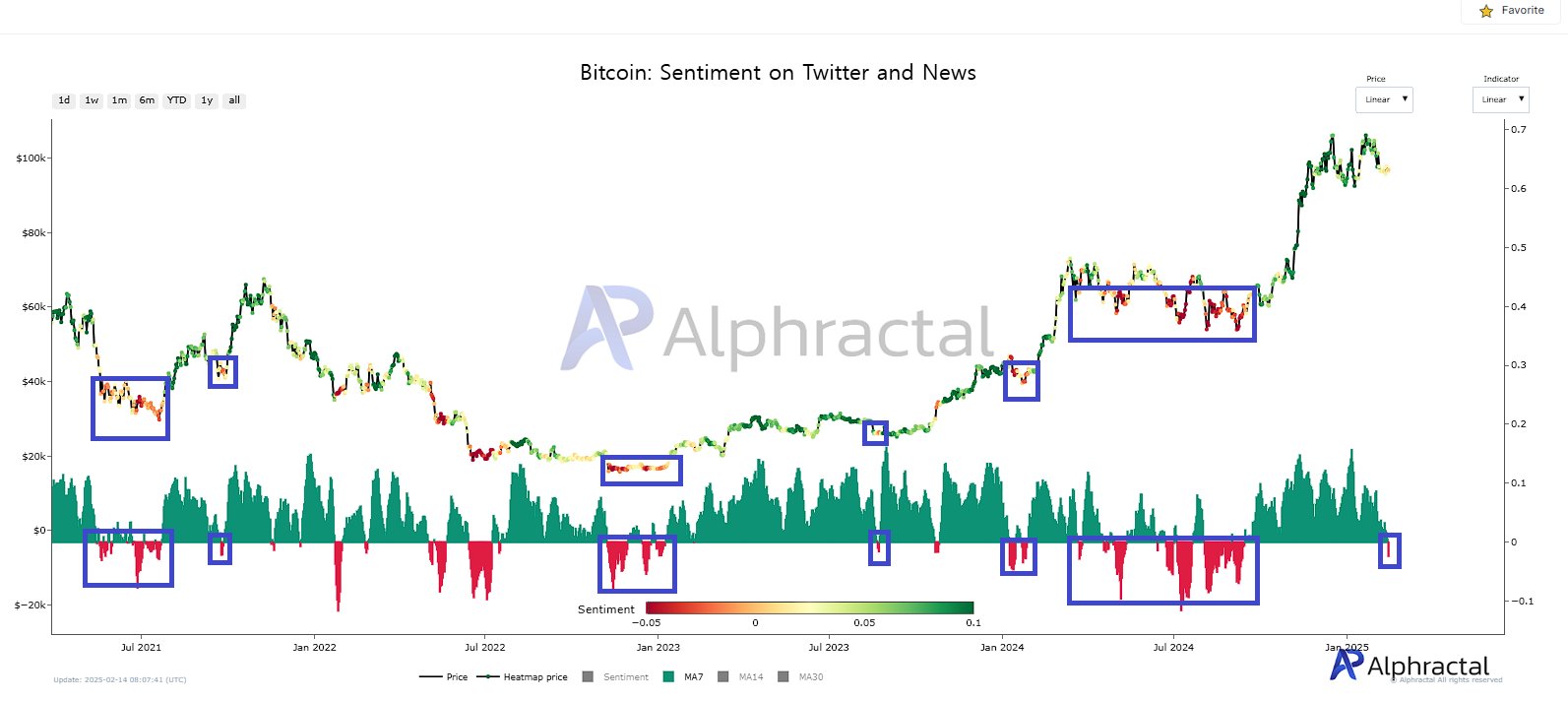

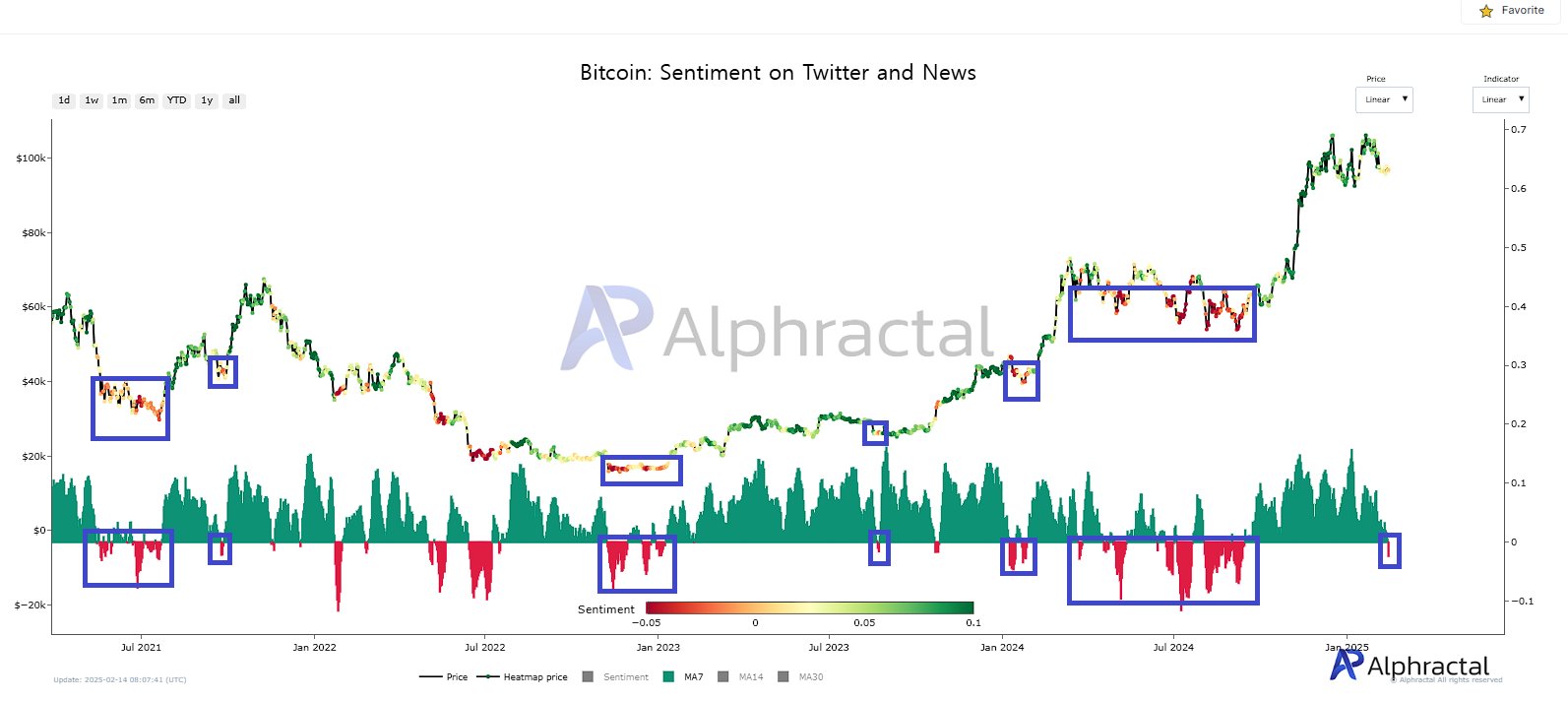

Bitcoin’s sentiment has flipped damaging for the primary time since December 2024, marking a stark distinction to the euphoria that fueled its latest highs.

Traditionally, such downturns in sentiment have acted as inflection factors – Both previous prolonged consolidation, as seen in mid-2024, or setting the stage for a pointy rebound, like in early 2023.

Supply: Alphractal

The important takeaway isn’t simply that sentiment has turned damaging; it’s that the market’s emotional cycle is resetting. This section typically sees weak arms exiting, whereas institutional and deep-pocketed traders quietly accumulate. Worry-driven promoting has traditionally created uneven alternatives for contrarian traders.

Reasonably than treating this as a definitive backside sign, merchants ought to use this second to reassess their positioning. Monitoring derivatives and on-chain knowledge will probably be key to figuring out whether or not Bitcoin is gearing up for a restoration or bracing for a deeper shakeout.

Bitcoin nears $100k amid rising on-chain exercise and hashrate

Bitcoin’s each day chart underlined a consolidation section, with the value hovering close to $97,600 on the charts. The 50-day SMA at $98,762 appeared to be performing as rapid resistance, whereas the 200-day SMA at $79,836 hinted at long-term assist.

Supply: TradingView

The RSI at 46.89 alluded to impartial momentum, reflecting indecision out there. In the meantime, the MACD was damaging, with weak bullish divergence hinting at a attainable pattern shift.

If Bitcoin reclaims $100k, it might set off renewed bullish sentiment. Nevertheless, failure to interrupt key resistance ranges might result in additional consolidation or a retest of decrease assist zones.

Supply: Santiment

There has additionally been a surge in each day lively addresses and whale transactions – An indication of rising institutional and retail participation.

Traditionally, such spikes have preceded main value strikes and they are often interpreted to indicate excessive market curiosity.

Supply: Cryptoquant

In the meantime, Bitcoin’s hashrate has been hovering too, indicative of miner confidence and long-term community safety. The resilience of miners at these value ranges means decreased promote stress – Highlighting Bitcoin’s energy.

Bitcoin’s rally has robust fundamentals, regardless of all of the damaging sentiment, which means that this may occasionally simply be a short lived section. Nevertheless, whale exercise needs to be monitored for potential profit-taking close to $100k. A decisive breakout might set off additional momentum, however volatility stays a key danger.