Bitcoin’s next move: Should you prepare for a drop to $56K?

- Bitcoin’s subsequent vital demand zone was round $56,000.

- Demand slowed down, each from new ETFs and current holders.

Bitcoin [BTC] continued to unload, sinking greater than 4% within the final 24 hours to commerce within the $62,000 zone, in keeping with CoinMarketCap. Buying and selling volumes rose by practically 5% to $45 billion throughout the interval, suggesting excessive hypothesis from market members.

Will the stoop proceed?

Apparently, the newest dip was from a “main demand” zone, in keeping with on-chain analytics agency IntoTheBlock. Historical past confirmed that greater than one million wallets had bought BTC at a mean worth of $64,300, indicating that it served as a robust assist.

However now that the bears have been in a position to breach this assist, the subsequent vital demand zone lied round $56,000. This meant that if accumulation doesn’t achieve steam, BTC was on the danger of plunging to the aforementioned degree.

Was Bitcoin getting bought or…?

Nicely, just a few sensible traders had been utilizing the market draw back to load their Bitcoin luggage.

As per on-chain tracker Lookonchain, a whale purchased as many as 244 Bitcoins, value a whopping $15 million at press time, within the final two days. The rich participant has acquired round 915 Bitcoins since December 2023, further knowledge revealed.

However was there a broader market accumulation development?

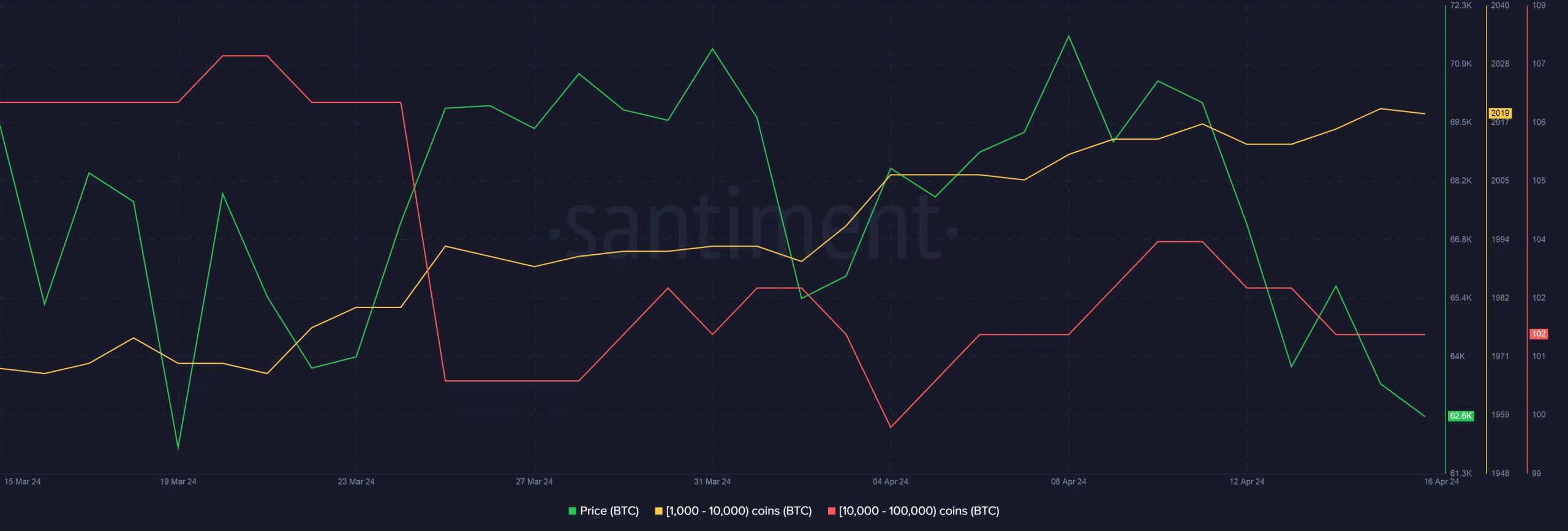

As per AMBCrypto’s evaluation of Santiment’s knowledge, there was an absence of urgency amongst whale cohorts to stockpile Bitcoins.

Whereas wallets holding between 1,000 – 10,000 cash barely confirmed an uptick, the cohort storing 10,000 – 100,000 cash liquidated their holdings over the week.

Supply: Santiment

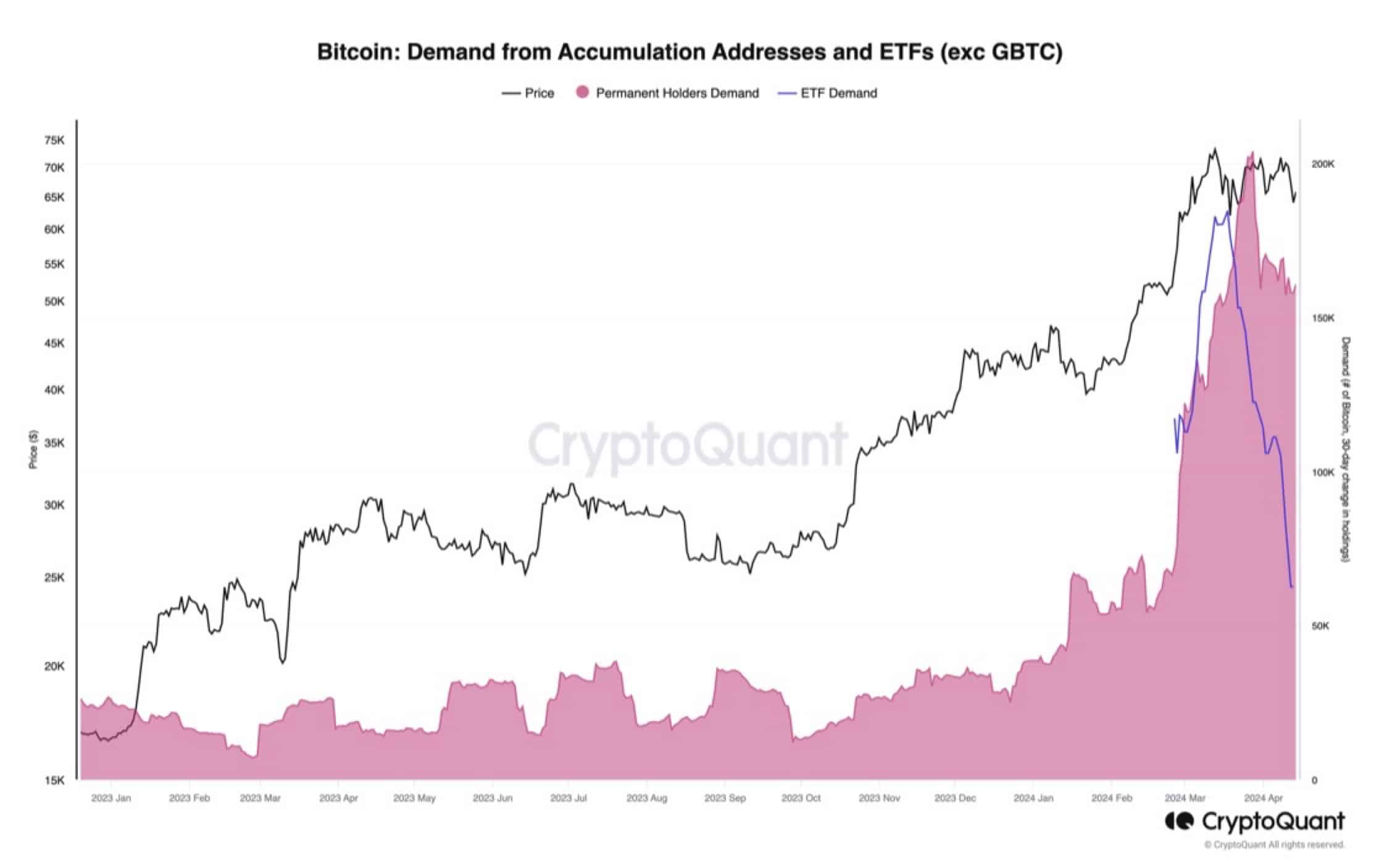

These findings had been corroborated by Julio Moreno, Head of Analysis at CryptoQuant. With backing from knowledge, he confirmed how Bitcoin’s demand has slowed down, each from new exchange-traded funds (ETFs) and current holders.

Supply: CryptoQuant

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Derivatives markets nonetheless bullish on BTC

These alarming developments sparked issues of additional downsides in Bitcoin’s worth within the days to return.

Apparently, speculative merchants weren’t shopping for this narrative. In response to AMBCrypto’s evaluation of Coinglass’ knowledge, the Longs/Shorts Ratio was nonetheless greater than 1, implying that almost all of the futures merchants had been hopeful of a rebound.