Bitcoin’s post halving history – All the highs BTC’s price can and cannot hit

- A Galaxy Digital report highlighted three totally different views on the impression of Bitcoin halving.

- Arthur Hayes pinned institutional demand for BTC on sovereign bond market points.

It’s lower than two days earlier than the fourth Bitcoin [BTC] halving, and the market is stuffed with daring projections and debate. On one finish, a piece of the market sees the halving as a bullish case for BTC value motion.

One other opposing part deems the halving occasion to be bearish, whereas others see it as negligible.

However most analysts agree on one factor — every halving is exclusive and totally different.

Unpacking the previous two bull cycles, Coinbase Institutional’s statement emphasised the previous two cycles’ uniqueness. The assertion learn,

“Crypto bull cycles hit totally different. The previous two bull markets lasted 3.5 years. We’re 1.5 years in. The previous two bull markets noticed costs enhance 113x and 19x. Costs have elevated 4x.”

BTC halving impression: Bullish, bearish, and impartial views

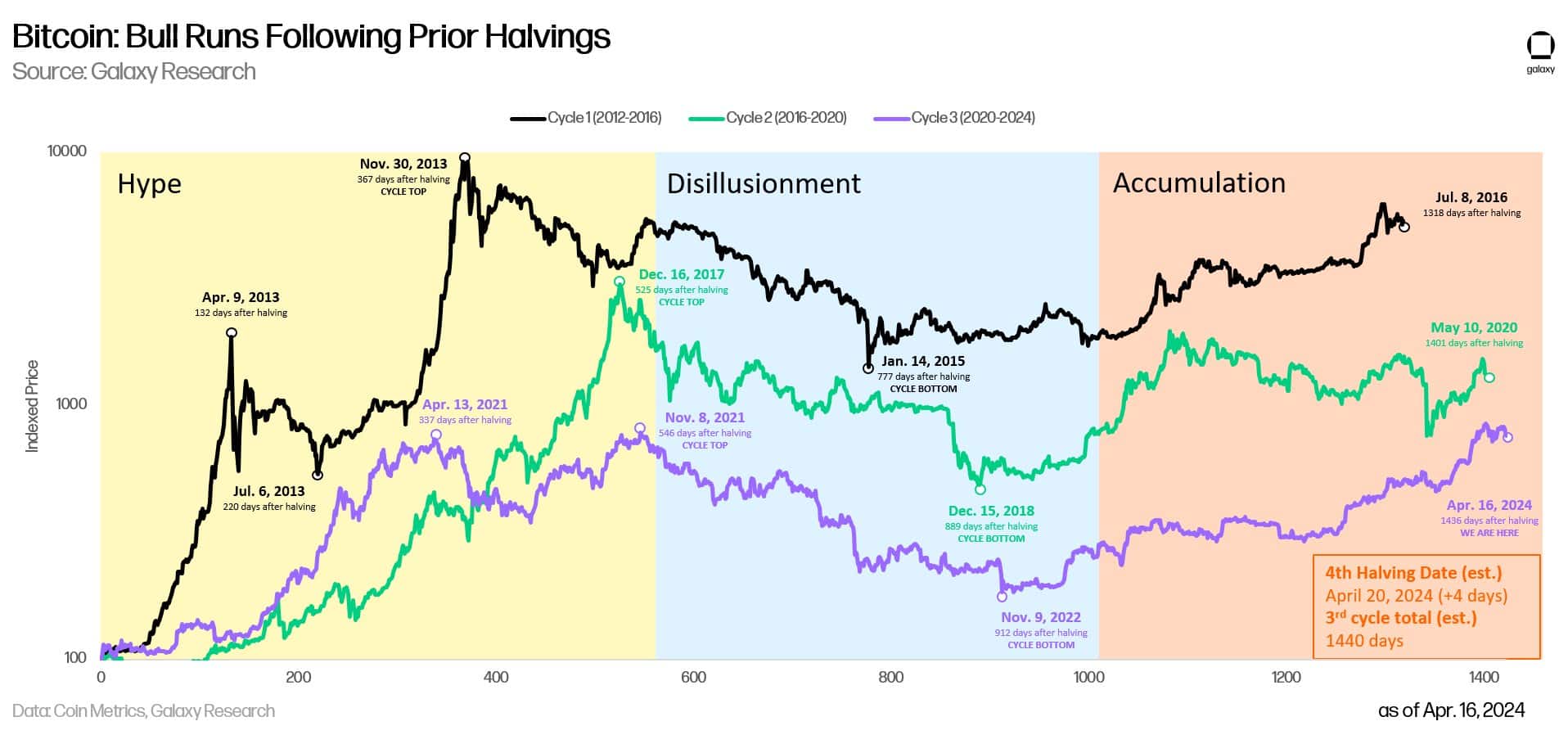

A latest digital asset supervisor Galaxy Digital report unpacked the three views on the impression of BTC halving.

Supply: Galaxy Digital

For the bullish case, the report famous that lowering block rewards by half (halving) causes provide shock, which contributes to cost surges.

Moreover, miners’ promote strain is diminished when their block rewards are slashed by half.

“Discount in promote strain from the mining neighborhood led to a rise within the worth of Bitcoin following the November 2012, July 2016, and Might 2020 halvings and will do the identical following the fourth halving.”

Quite the opposite, the bearish view sees the subsequent halving occasion as a “sell-the-news” occasion. Within the present cycle, for the primary time, BTC is buying and selling close to an all-time excessive earlier than halving.

So, the bearish group believes the halving has already been priced in. The report famous,

“At this level, previous to the final two halvings, BTC was down 42%+ from its earlier all-time highs. Successfully, the bull runs of 2017 and 2020 hadn’t but begun at this stage in Bitcoin’s provide schedule.”

Moreover, the bears preserve that the post-halving will have an effect on most miners and will make the community much less safe.

Nonetheless, there’s a third group of market watchers who deem the halving negligible (impartial). The impartial view believes that the BTC value is affected by demand and total macro situations.

On the impartial view, the report learn,

“Bull markets following halvings are way more associated to adjustments in demand and never provide and will even be extra correlated to issues like world market liquidity, central financial institution charges, and different macro situations.”

Apparently, BitMEX founder and CIO of crypto fund Maelstrom, Arthur Hayes, leans towards the impartial view.

In a latest interview, Hayes defined the rationale behind institutional allocations to Bitcoin. He stated,

“Why are institutional buyers investing in Bitcoin? As a result of there’s a complete narrative concerning the destruction of the sovereign bonds market, which began principally because the Fed began elevating charges in March 2022. So, there’s a purpose folks allocate to Bitcoin, not simply because Bitcoin exists.”

In different phrases, a number of elements may very well be driving BTC value motion earlier than and after the halving occasion.

So, focusing the value motion solely on the halving may be limiting, particularly if you wish to maximize your commerce positions or funding returns.