Bitcoin’s price to crash by another 4%? BTC Predictions say…

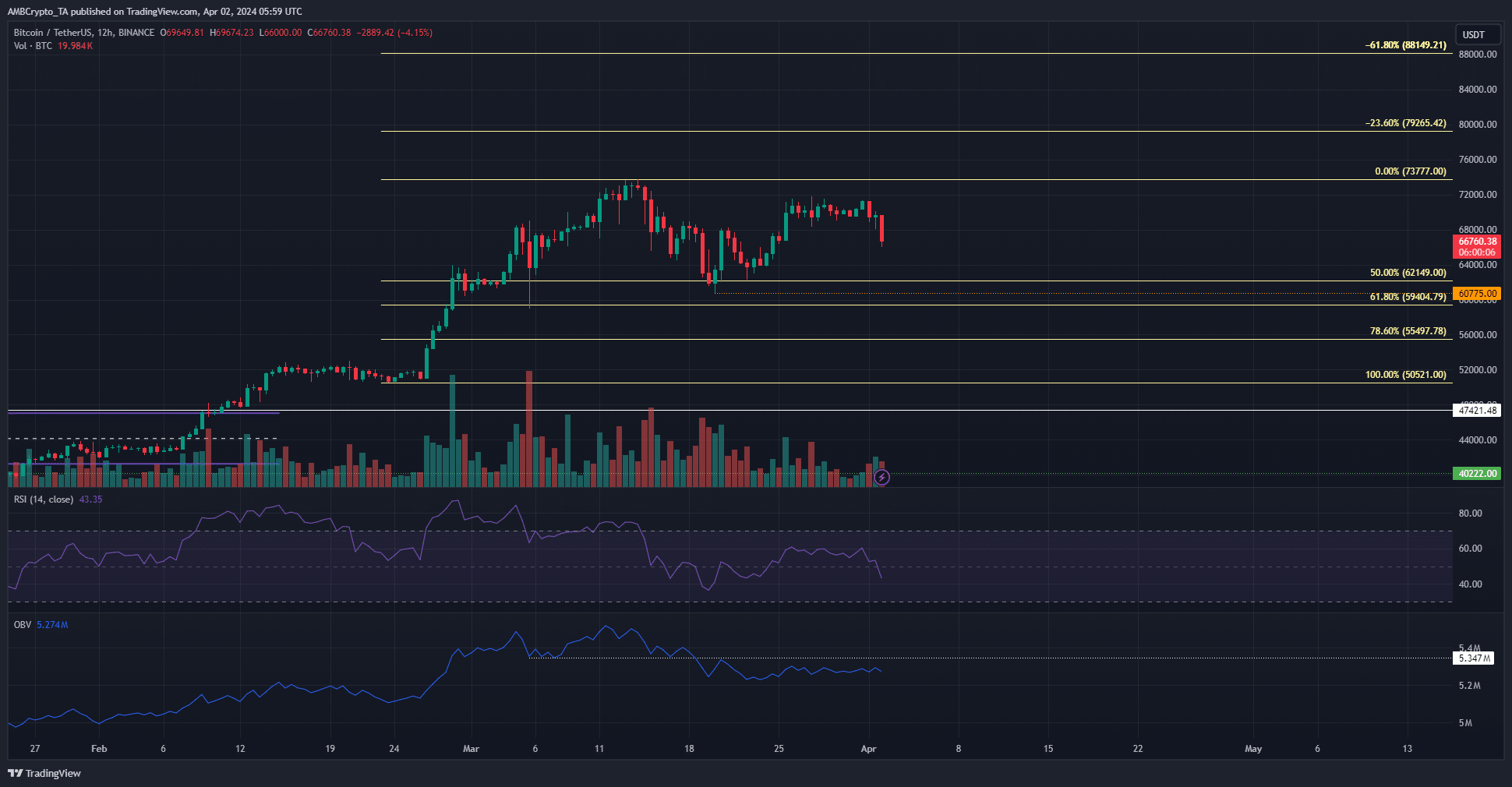

- Bitcoin noticed a shift in momentum because the RSI fell under impartial 50.

- The OBV was unable to climb to a earlier low, indicating rising promoting strain.

Bitcoin [BTC] famous swift losses prior to now 24 hours. Particularly, a 4.9% drop occurred inside an hour on the 2nd of April and witnessed hundreds of thousands of {dollars} in liquidations.

The value smashed under a pocket of liquidity, and the compelled promoting drove costs decrease.

The long-term outlook for BTC remained bullish because the ETF inflows had been extraordinarily sturdy. AMBCrypto reported that the metrics for BTC had been bearish, and costs slid decrease hours later.

Will Bitcoin fall to the swing low at $60.7k?

Supply: BTC/USDT on TradingView

On the 12-hour chart, the market construction was nonetheless bullish. A fall under $60.7k will flip the construction bearishly. The Fibonacci retracement ranges highlighted the $55.5k and $59.4k as important ranges.

The previous 36 hours noticed a 4.2% drop. The 2nd of April noticed $62.2 million price of long liquidations on Bitcoin. The H12 RSI fell under impartial 50 and signaled a shift in momentum.

The OBV trended downward in March and was nonetheless under a key stage. This confirmed that promoting strain has been dominant in current weeks, and extra losses may comply with.

The $64.5k stage is a stage of curiosity this week, as it’s a short-term assist stage. But, technical indicators and the decrease timeframe value motion confirmed Bitcoin may not pattern upward strongly for a while.

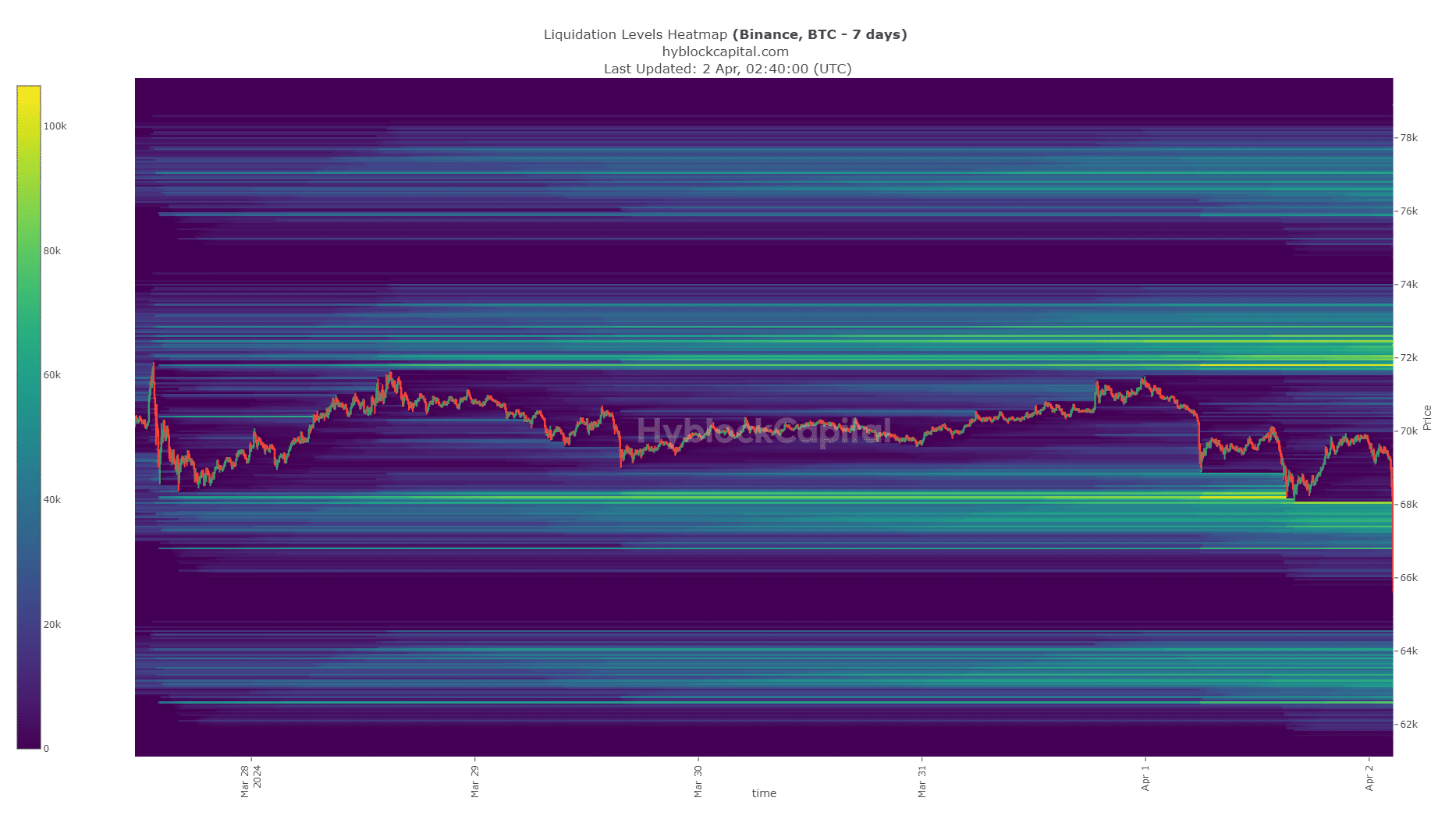

Bitcoin may fall to the following pool of liquidity to the south

Supply: Hyblock

The liquidation ranges at $68k had been worn out, and a liquidation cascade adopted that pushed BTC costs to $66.4k.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Costs may bounce larger to liquidate the late, high-leveraged bears, however a major pocket of liquidity was at $64k.

From $62.8k to $64k, there was an honest focus of liquidation ranges. Bitcoin’s proximity to this area indicated that it may sweep this zone subsequent. Therefore, merchants needs to be ready for extra losses.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.