Bitcoin’s turning point ahead? – THIS metric could predict BTC’s future

- Bitcoin’s long-term realized cap impulse neared historic help, signaling a possible main market pivot.

- Sentiment remained impartial as long-term holders face a key determination that might outline Q2’s course.

Bitcoin [BTC] is at a pivotal juncture. As one in every of its most telling long-term metrics approaches a traditionally important degree, the market finds itself holding its breath.

The times forward might set the tone for what’s to return — whether or not as the bottom of a contemporary rally or the sting of a deeper slide.

What does the info say?

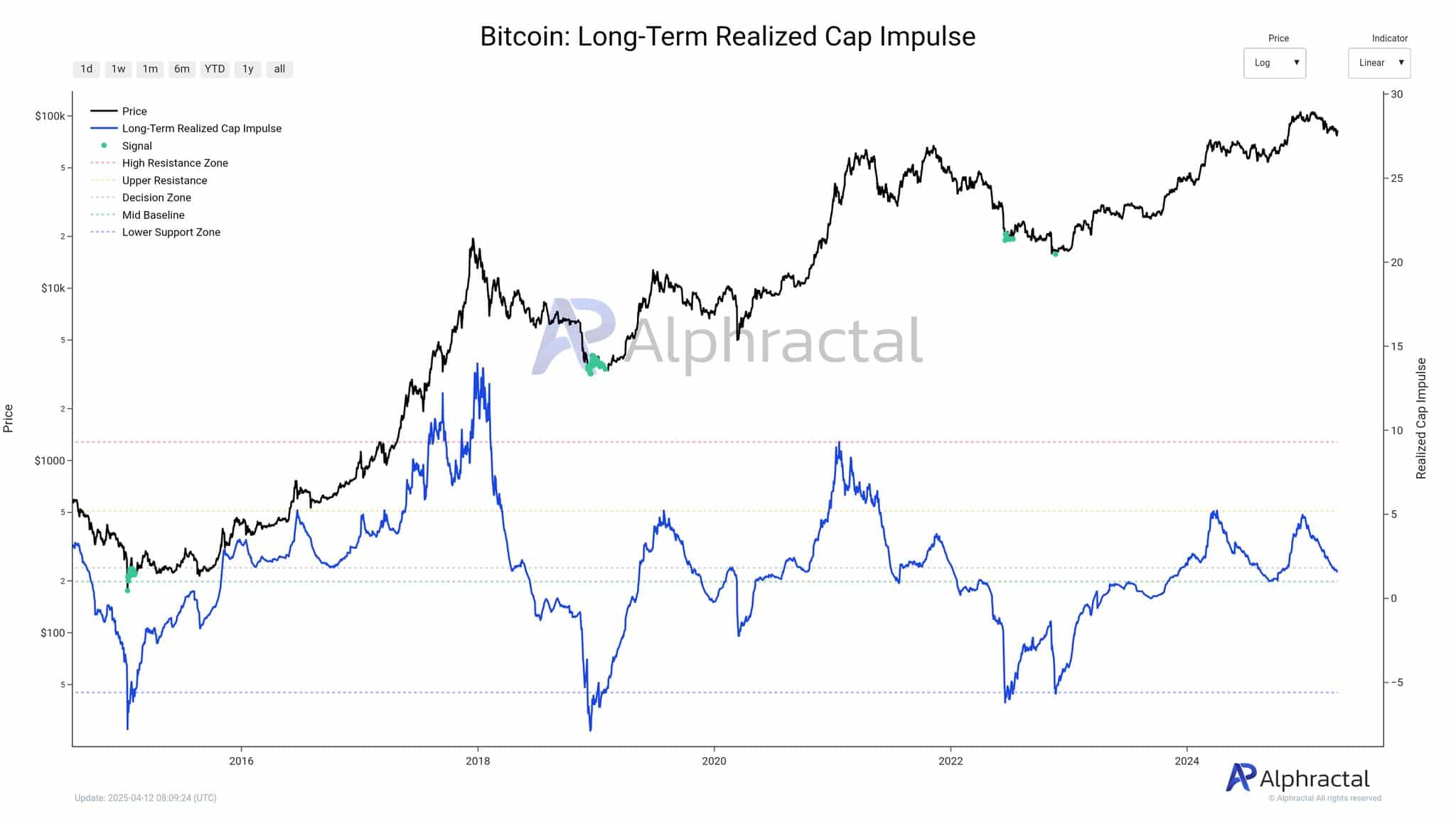

The long-term realized cap impulse is a key metric for gauging the conviction of long-term Bitcoin holders.

This metric evaluates the momentum of realized capitalization, which displays the motion of cash primarily based on their most up-to-date transaction value and is adjusted for long-term traits.

Traditionally, when this impulse reaches its decrease help zone, it has aligned with important turning factors in Bitcoin’s value.

Supply: Alphractal

At press time, the impulse sits at a degree that beforehand preceded important market recoveries in 2019 and late 2022. This sample means that long-term holders are coming into a essential determination window.

Both they continue to be agency, or the broader market narrative might start to shift.

Help bounce or structural breakdown?

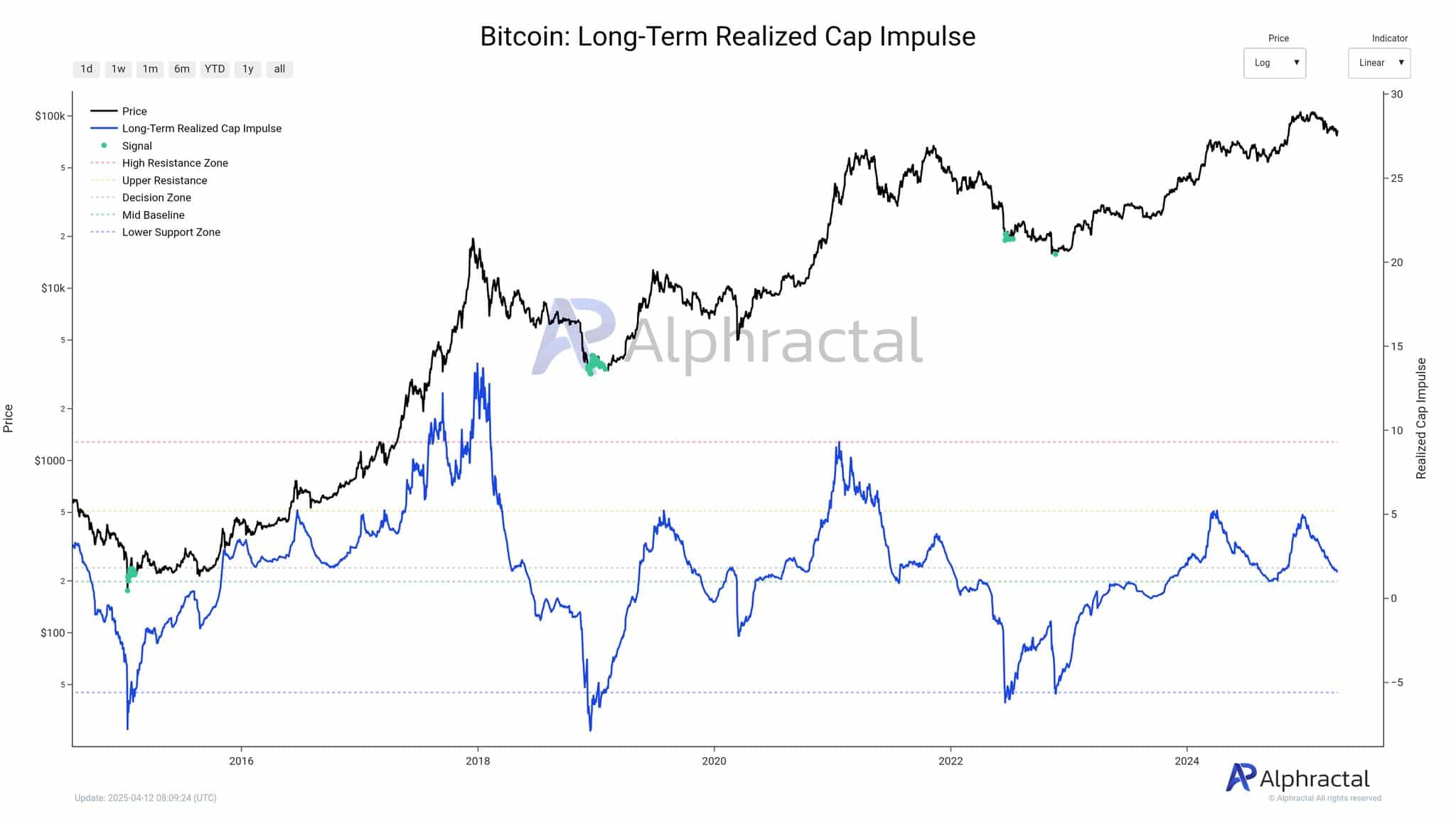

The present setup presents a binary final result. If Bitcoin manages a constructive bounce from this help zone, it may sign that long-term holders are sustaining their positions, laying the groundwork for renewed accumulation and upward momentum.

Supply: Alphractal

Nonetheless, a breakdown at this degree may signify a lack of confidence among the many market’s most resilient members—those that often soak up promoting stress moderately than add to it. Such a shift would possibly set off a extra pronounced correction.

Contemplating the long-term impulse’s monitor document of anticipating macro reversals, its subsequent motion may outline the trajectory for the upcoming quarter.

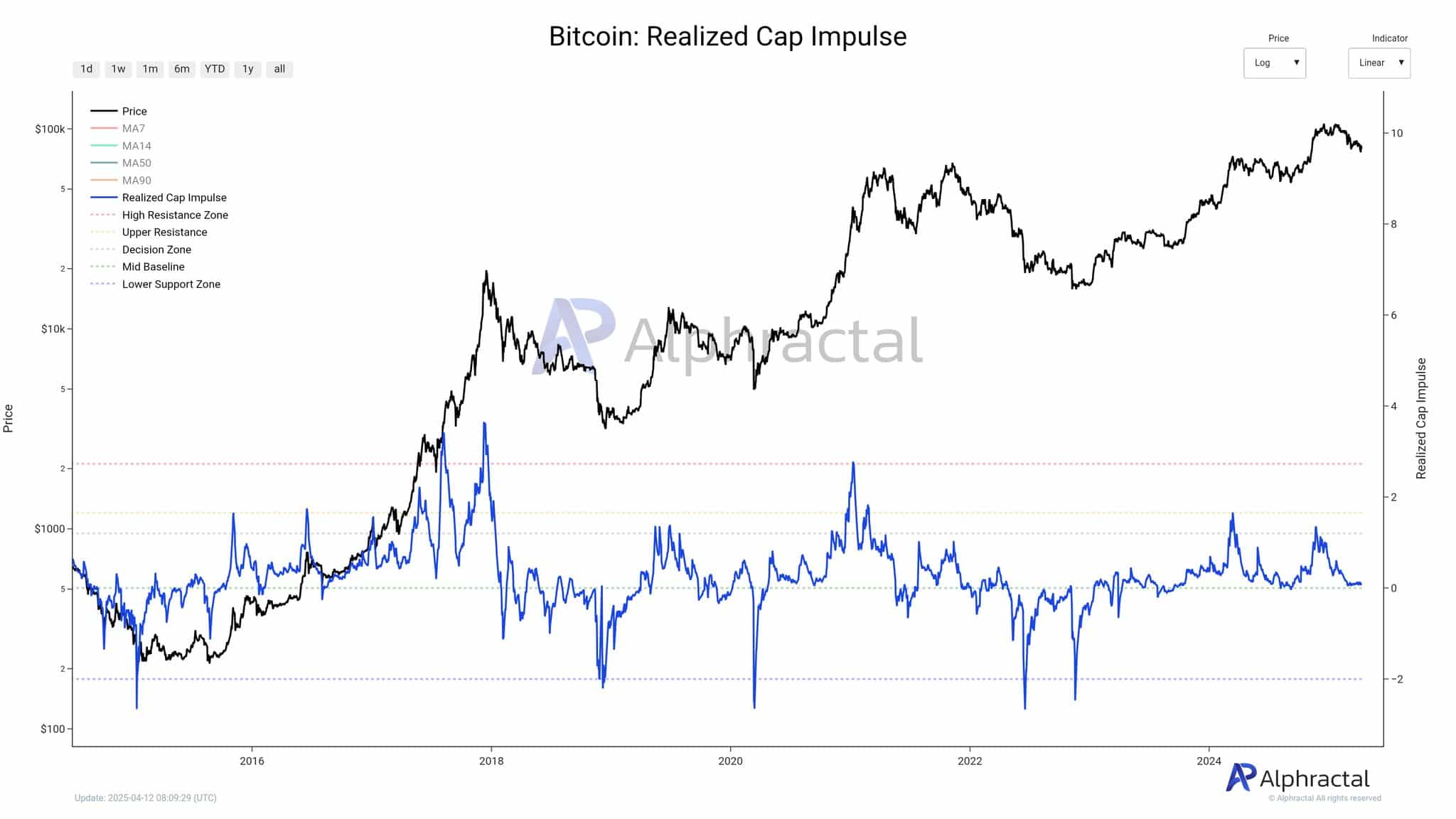

Bitcoin: Sentiment on the sting

At press time, the worry and greed index stood at 45, indicating a cautiously impartial sentiment—leaning towards worry however stopping in need of capitulation. This displays a market characterised by uncertainty whereas remaining attentive to potential catalysts.

The sentiment studying mirrors the indecision seen on the long-term impulse chart, underscoring that Bitcoin is nearing a essential determination level.

Traditionally, sentiment usually trails structural metrics, suggesting the present calm may precede a major directional shift. Whether or not this shift turns bullish or bearish will largely rely on the conduct of long-term holders throughout this pivotal second.