Bitwise CIO Bullish On Ethereum ETFs Fueling Surge To Record Highs Above $5,000

Because the extremely anticipated launch date of spot Ethereum ETFs approaches, Matt Hougan, Chief Funding Officer of crypto asset supervisor Bitwise, has burdened the potential for these ETF inflows to drive the Ethereum worth to document highs.

In a latest consumer be aware, Hougan highlighted the numerous influence that ETF flows might have on the Ethereum worth, surpassing even the results witnessed within the spot Bitcoin ETF market within the US.

Ethereum ETFs Poised To Surpass Bitcoin’s Influence?

Hougan confidently predicts that introducing spot Ethereum ETFs will result in a surge in ETH’s worth, probably reaching all-time highs above $5,000. Nonetheless, he cautions that the primary few weeks after the ETF launch may very well be unstable, as funds might circulation out of the prevailing $11 billion Grayscale Ethereum Belief (ETHE) after it’s transformed to an ETF.

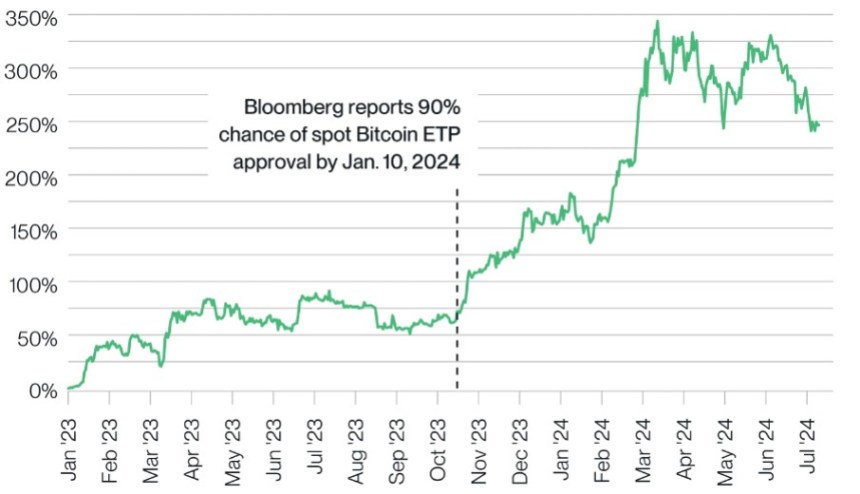

This may very well be much like the case of the Grayscale Bitcoin Belief (GBTC), which noticed important outflows of over $17 billion after the Bitcoin ETF market was authorized in January, with the primary inflows recorded 5 months in a while Could 3.

Nonetheless, Hougan expects the market to stabilize in the long run, pushing Ethereum to document costs by the tip of the yr after the preliminary outflows subside, drawing a comparability with Bitcoin in key metrics to know this thesis.

Associated Studying

For instance, Bitcoin ETFs have bought greater than twice the quantity of Bitcoin in comparison with what miners have produced over the identical interval, contributing to a 25% improve in Bitcoin’s worth for the reason that ETF launch and a 110% improve for the reason that market started pricing within the launch in October 2023.

That mentioned, Hougan believes the influence on Ethereum may very well be much more important, and identifies three structural the reason why Ethereum’s ETF inflows might have a larger influence than Bitcoin’s.

Decrease Inflation, Staking Benefit, And Shortage

The primary purpose Bitwise’s CIO highlights is Ethereum’s decrease short-term inflation charge. Whereas Bitcoin’s inflation charge was 1.7% when Bitcoin ETFs launched, Ethereum’s inflation charge over the previous yr has been 0%.

The second purpose lies within the distinction between Bitcoin miners and Ethereum stakers. As a result of bills related to mining, Bitcoin miners typically promote a lot of the Bitcoin they purchase to cowl operational prices.

In distinction, Ethereum depends on a proof-of-stake (PoS) system, the place customers stake ETH as collateral to course of transactions precisely. ETH stakers, not burdened with excessive direct prices, should not compelled to promote the ETH they earn. Consequently, Hougan means that Ethereum’s each day compelled promoting strain is decrease than that of Bitcoin.

Associated Studying

The third purpose stems from the truth that a considerable portion of ETH is staked and, due to this fact, unavailable on the market. At the moment, 28% of all ETH is staked, whereas 13% is locked in sensible contracts, successfully eradicating it from the market.

This leads to roughly 40% of all ETH being unavailable for fast sale, creating a substantial shortage and finally favoring a possible improve in worth for the second largest cryptocurrency available on the market, relying on the outflows and inflows recorded. Hougan concluded:

As I discussed above, I anticipate the brand new Ethereum ETPs to be a hit, gathering $15 billion in new property over their first 18 months available on the market… If the ETPs are as profitable as I anticipate—and given the dynamics above—it’s onerous to think about ETH not difficult its outdated document.

ETH was buying and selling at $3,460, up 1.5% up to now 24 hours and practically 12% up to now seven days.

Featured picture from DALL-E, chart from TradingView.com