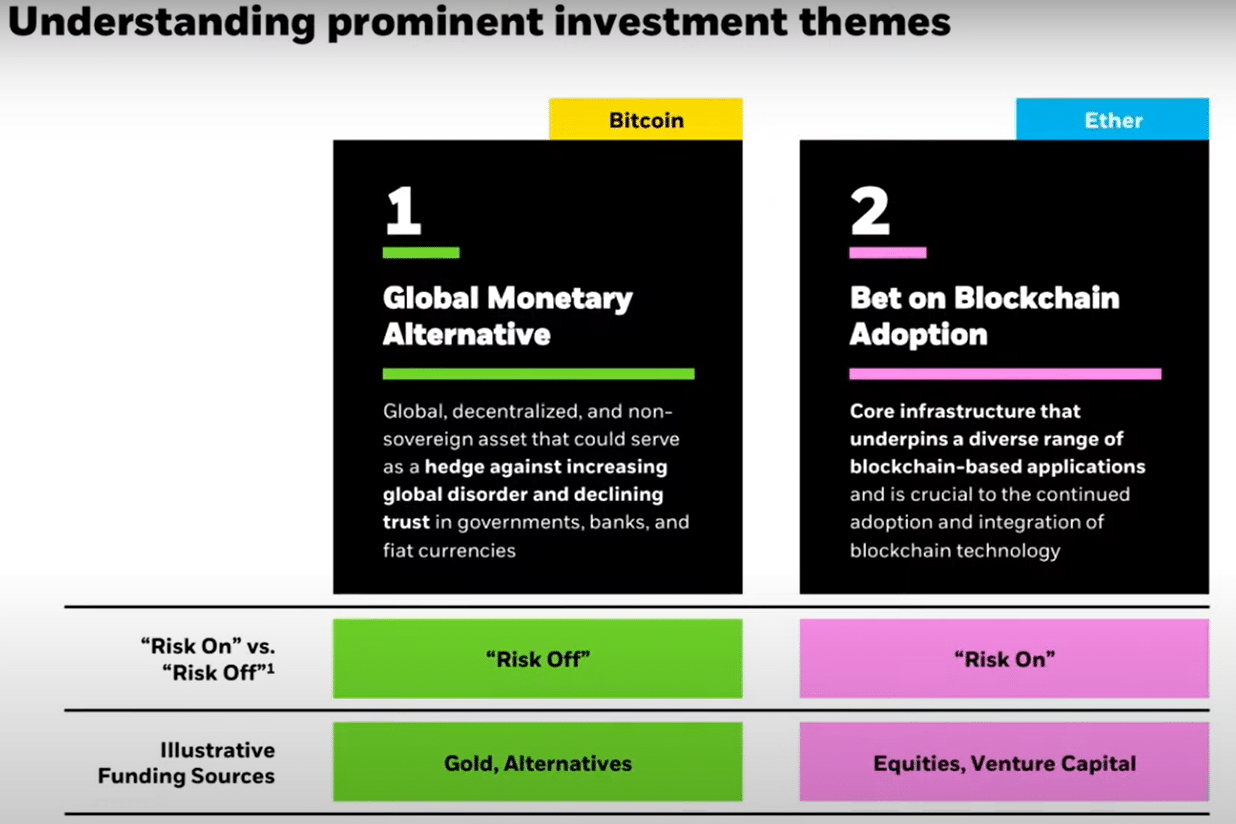

BlackRock: Bitcoin is ‘gold alternative,’ Ethereum a ‘technology bet’ – Why?

- BTC is sound cash and a ‘risk-off’ asset, per BlackRock.

- However ETH is a speculative wager on blockchain know-how adoption.

BlackRock, the world’s largest asset supervisor, just lately offered distinctive but totally different pitch decks for Bitcoin [BTC] and Ethereum [ETH].

The twin pitch deck was offered throughout a digital property convention held in Brazil. BlackRock’s Robbie Mitchnick offered BTC as a ‘risk-off’ asset, placing it at par with or higher than gold.

Alternatively, ETH was pitched as a ‘risk-on’ asset, just like U.S. shares.

BTC as cash; ETH as a wager

The asset supervisor praised BTC as a worldwide financial various and a very good hedge towards declining belief in governments and fiat currencies’ relentless debasement (devaluation).

Supply: BlackRock

Quite the opposite, ETH was showcased as a speculative wager on blockchain know-how adoption, an funding that Mitchnick equated to US shares.

He noted,

“On one hand, you’ve BTC, a commodity like gold and a substitute for shares and bonds. Ethereum, extra of a long-term know-how wager that this blockchain will present extra use circumstances and extra worth to the financial system going ahead.”

A part of the crypto group echoed Mitchnick’s displays, underscoring that BTC is ‘cash’ with much less inflationary strain than fiat currencies, which lose worth yearly.

However it additionally settled the raging debate that has been occurring for some time: ETH isn’t cash. The truth is, because the introduction of Blobs earlier this yr, ETH’s inflation has hiked, making it much less of an “ultra-sound cash.”

If the projections maintain, BTC may rally extra throughout future geopolitical tensions, whereas ETH may decline in such eventualities.

BlackRock’s perspective is essential since it’s a trendsetter and extensively accredited. Together with Grayscale, the asset managers are perceived to be chargeable for the US shift and ultimate approval of US spot BTC ETFs.

Because the ETFs debuted, BlacRock’s ETFs have outperformed each various providing and crossed key milestones.

On the time of writing, its BTC ETF, iShares Bitcoin Belief [IBIT], had a cumulative netflow of $21.5 billion with practically $23 billion in web property.

That mentioned, because it started buying and selling in July, BlacRock’s ETH ETF, ETHA, has netted $1.1 billion in complete inflows.

Ergo, the world’s largest asset supervisor, may affect how different buyers view the sector. In keeping with some market observers, the message appears clear — Bitcoin is cash, whereas the remainder of crypto is speculative.

Within the meantime, BTC was valued at $62K, down 5% on the weekly charts. Alternatively, ETH was valued at $2.4K, down 8.5% over the identical interval.