BlackRock BTC ETF faces zero flows – Are North Korean hackers to blame?

- Bitcoin ETFs confronted $804.8 million in outflows from twenty seventh August to 4th September.

- North Korean hackers goal crypto corporations, impacting ETF stability and investor confidence.

September has been a tough month for the main cryptocurrency, Bitcoin [BTC].

Not solely has Bitcoin struggled to interrupt previous the $60K mark, however Bitcoin exchange-traded funds (ETFs) have additionally confronted important challenges.

Over the previous few days, Bitcoin ETFs noticed outflows of $804.8 million, sending shockwaves via traders and lovers.

Of explicit concern was BlackRock’s iShares Bitcoin Belief ETF (IBIT), which has failed to draw any inflows since twenty seventh August.

The fund had zero inflows on many days, together with the twenty seventh, twenty eighth, thirtieth of August and third of September, including to market issues.

North Korean hackers to be blamed?

Amid these occasions, U.S. authorities have issued a warning about an imminent risk posed by North Korean hackers, particularly focusing on crypto corporations concerned within the rising Bitcoin ETF market.

For context, North Korean hackers, notably the Lazarus Group, have a well-established sample of focusing on cryptocurrency corporations and platforms.

The FBI has revealed that North Korean cybercriminals are focusing their efforts on staff at decentralized finance (DeFi) and cryptocurrency corporations.

In line with the announcement, these criminals are using extremely “difficult-to-detect social engineering campaigns.”

Supply: ic3.gov/

The warning has raised issues concerning the long-term viability of the Bitcoin ETF area because it navigates each monetary and cybersecurity challenges.

IBIT traders’ shift

Nonetheless, it’s necessary to notice that, IBIT’s cumulative web inflows since its launch on eleventh January have been approaching $21 billion.

In actual fact, on twenty second July, IBIT skilled a major influx of half a billion {dollars}, the most important since thirteenth March, in keeping with SpotOnChain knowledge.

This shift highlights the ETF’s fluctuating enchantment to traders over time, reflecting altering market dynamics and sentiment.

Ethereum ETF continues to outflow

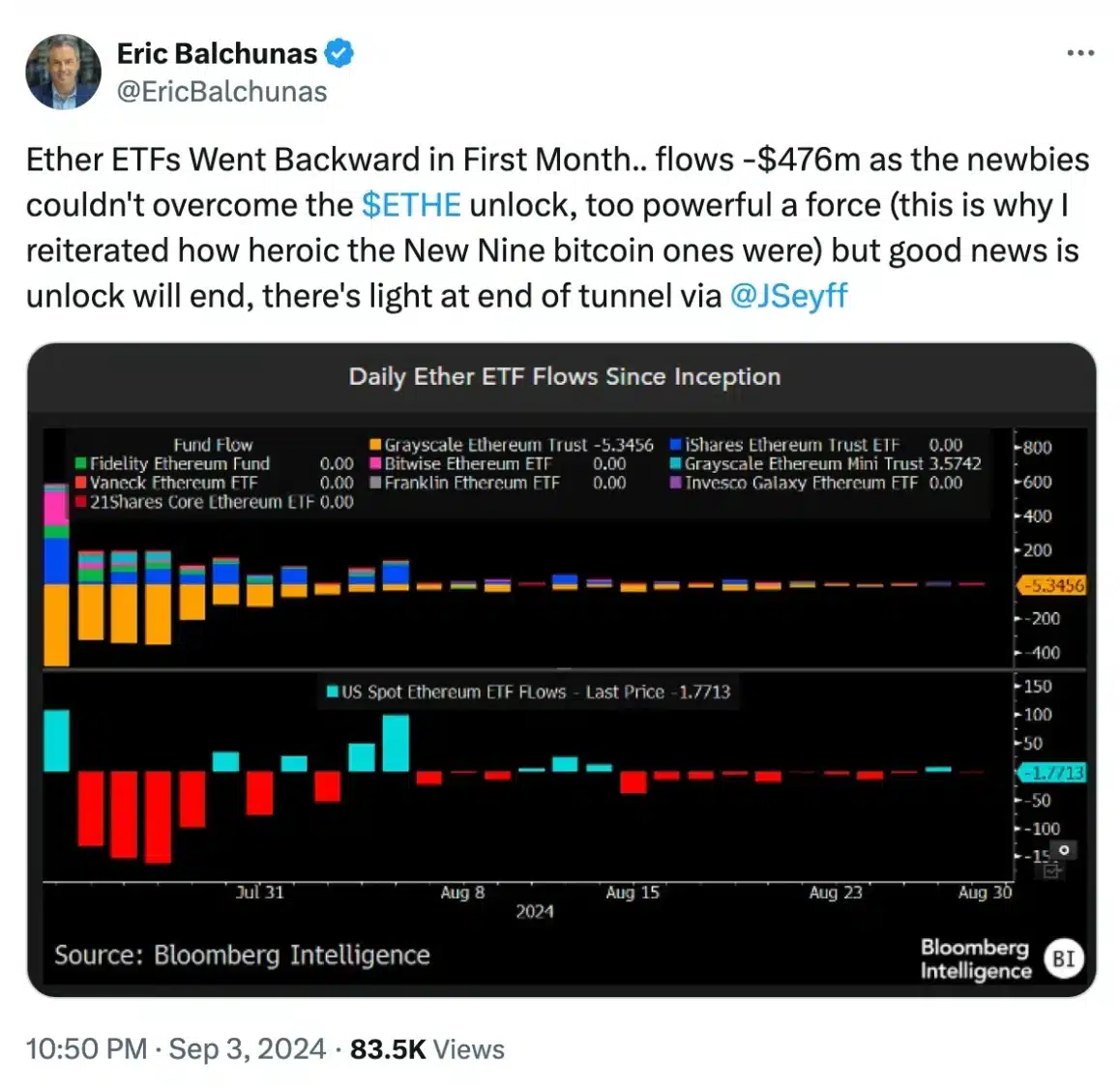

In distinction, Ethereum [ETH] ETFs have been on a constant outflow streak, with solely transient durations of inflows.

Evaluating the identical time-frame used for Bitcoin ETFs—from twenty seventh August to 4th September—ETH ETFs recorded outflows on twenty seventh, and twenty ninth August and once more on third and 4th September.

On thirtieth August and 2nd September, the ETFs noticed zero inflows.

The one notable influx occurred on twenty eighth August, when ETH ETFs registered a modest web influx of $5.9 million, in keeping with Farside Investors.

Equally, BlackRock’s Ethereum ETF skilled predominantly zero flows over the previous few weeks, mirroring the pattern seen with BlackRock’s Bitcoin ETF.

Nonetheless, regardless of the current turmoil, ETF analyst Eric Balchunas maintains a constructive outlook, believing that brighter days are forward.

Supply: Eric Blachunas/X