BlackRock ETF Pushing Bitcoin to ‘Inflection Point’ as US Entities Accumulate BTC: Glassnode

A distinguished analytics agency says BlackRock’s Bitcoin (BTC) spot exchange-traded fund (ETF) software is pushing US-based entities to build up the crypto king.

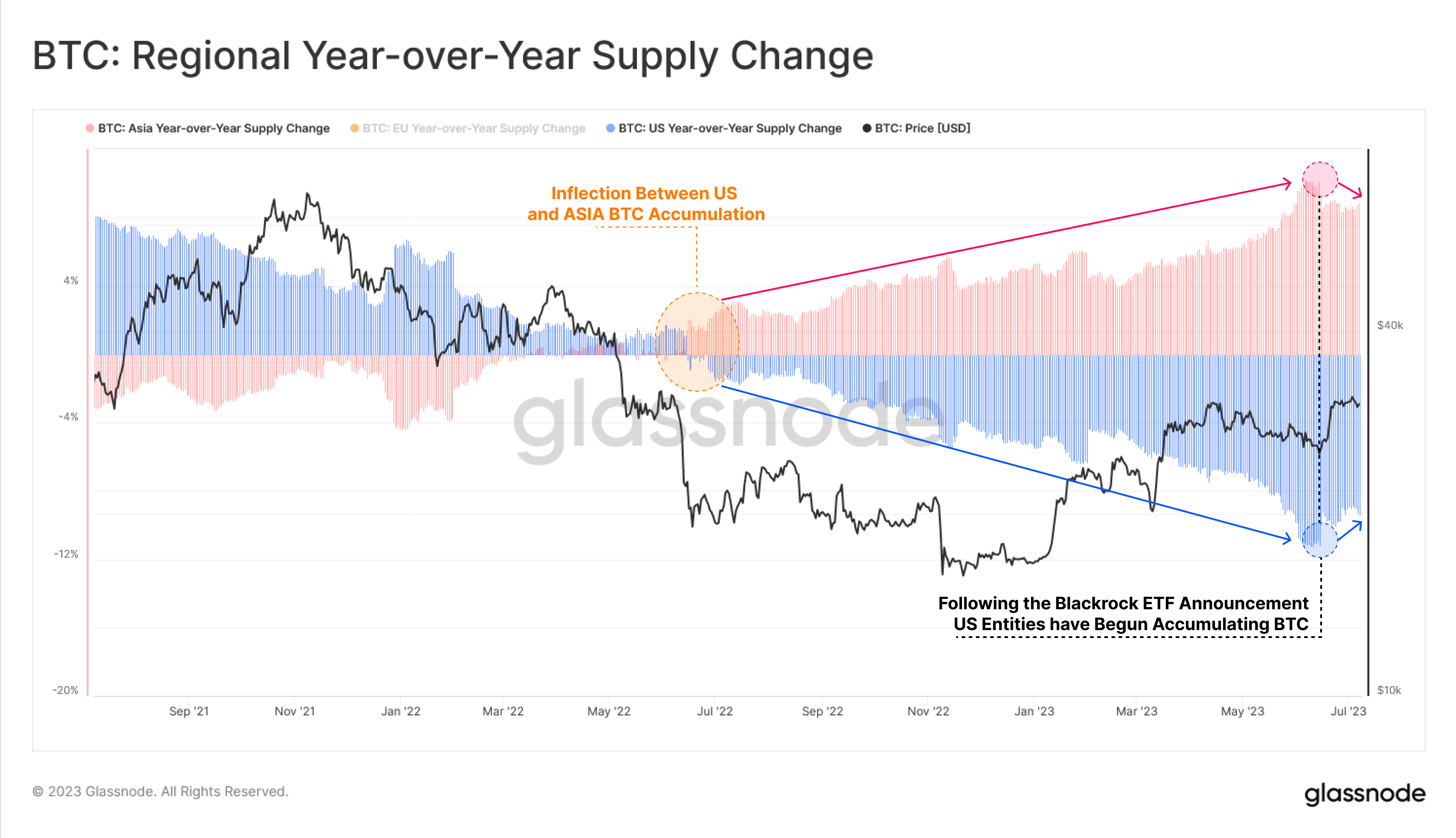

Glassnode notes that the share of Bitcoin provide held and traded by US entities is witnessing a major rise since BlackRock, the world’s largest funding agency with over $10 trillion in belongings beneath its administration, first filed for a BTC ETF final month.

No US Bitcoin spot ETF software has ever been authorized up to now, regardless of submissions from Grayscale, VanEck, and Cathie Wooden’s ARK Make investments, although the U.S. Securities and Trade Fee (SEC) did greenlight the launch of the primary Bitcoin futures ETFs in October 2021.

Glassnode shares a chart displaying a surge within the provide of BTC held or traded by US traders whereas Asian-based market members seem like distributing their Bitcoin stacks.

“Following the Blackrock Bitcoin ETF request announcement on June fifteenth, the share of Bitcoin provide held/traded by US entities has skilled a notable uptick, marking a possible inflection level in provide dominance if the pattern is sustained.”

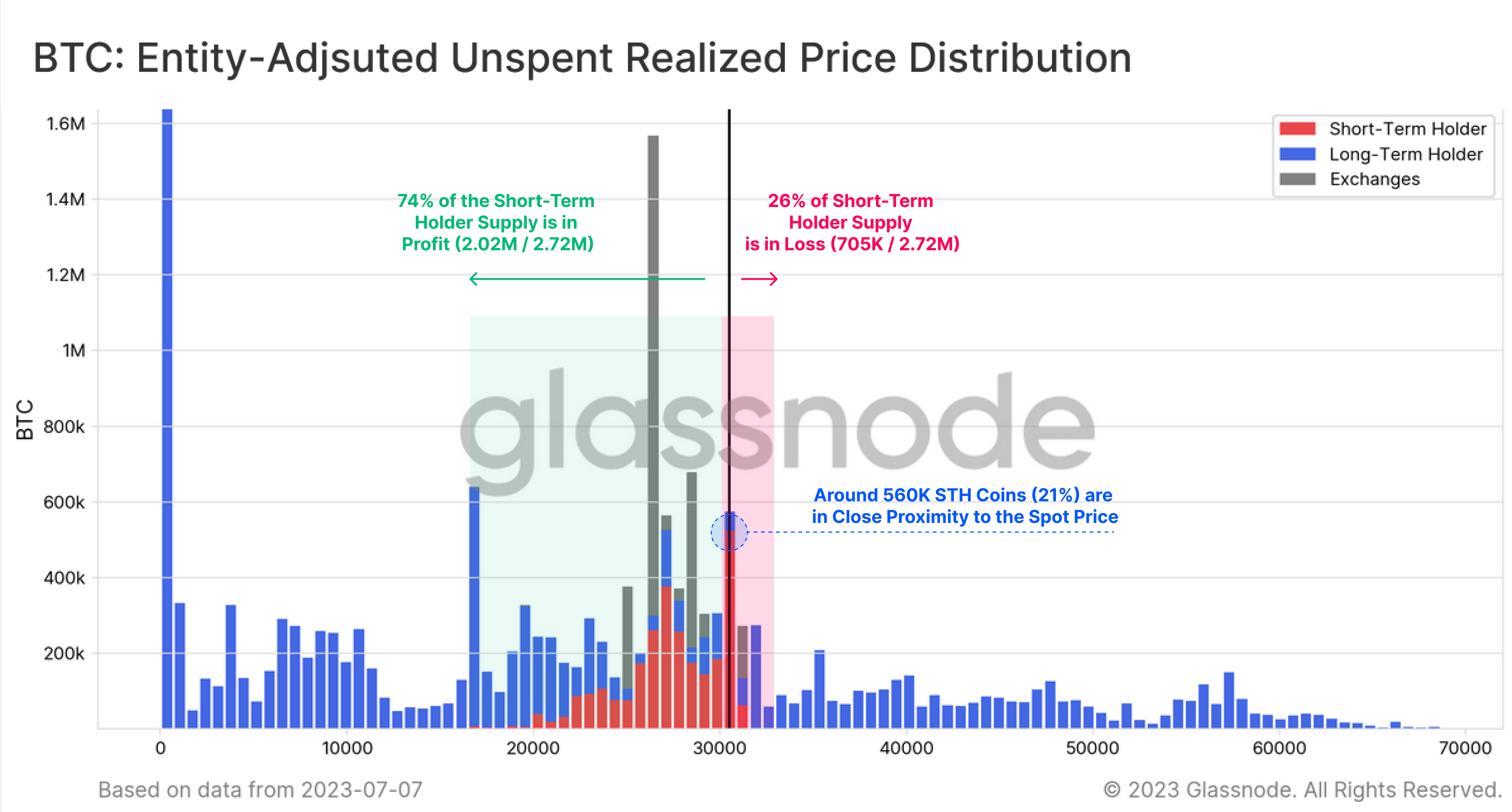

The analytics agency additionally notes that roughly 560,000 Bitcoin owned by short-term holders (STHs), which signify 21% of the general STH provide, had been bought at a worth that’s in shut proximity to the present worth of BTC.

In accordance with Glassnode, the situation means that extra short-term holders might see their positions within the crimson if Bitcoin goes by a light corrective part.

“Of be aware, ~560,000 STH cash (21%) are in shut proximity to the spot worth suggesting a non-trivial portion of the STH provide has a heightened sensitivity to cost motion.”

At time of writing, Bitcoin is value $30,556.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Generated Picture: Midjourney