BlackRock’s bold bet lifts Solana sentiment to record levels – Could SOL surge next?

- Solana’s sentiment ratio surged to 32.87, outpacing BTC and ETH.

- Value remained range-bound close to $132, with resistance at $140.

Solana [SOL] has turn into the focus within the crypto market, using a recent wave of optimism fueled by institutional curiosity.

With BlackRock launching yield-bearing tokenized treasury funds on the community and GameStop integrating Bitcoin via Solana’s [SOL] infrastructure, sentiment round SOL has surged to unprecedented ranges.

However will this social momentum translate right into a worth breakout?

Sentiment soars as establishments embrace Solana

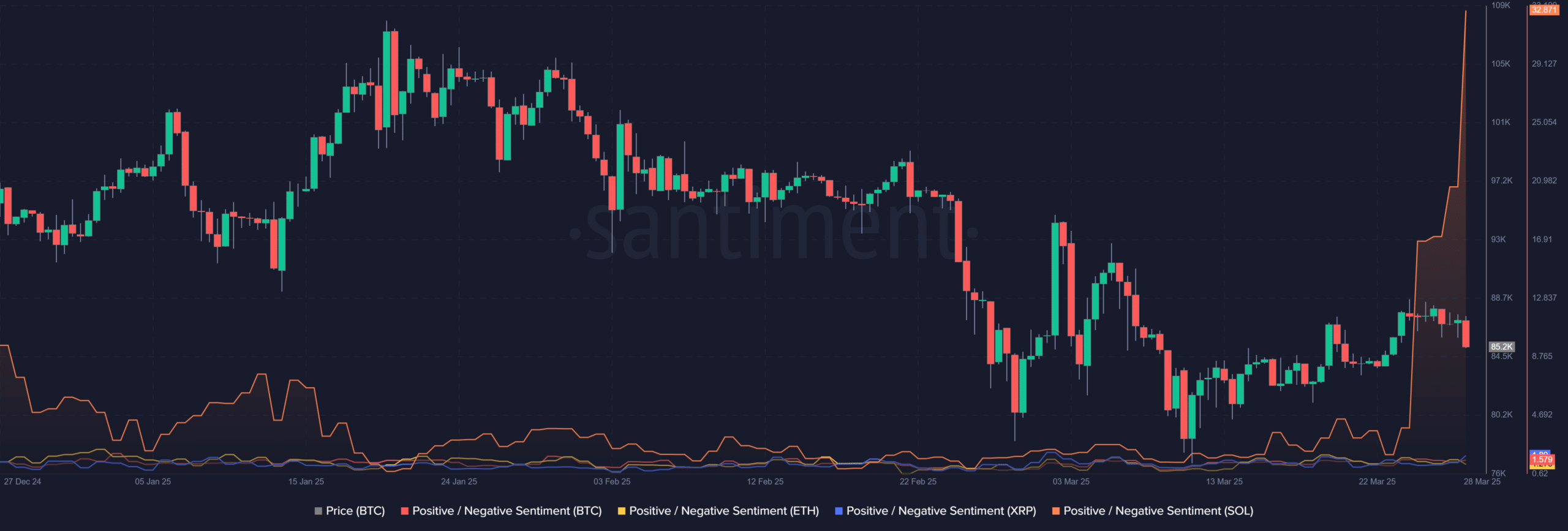

Knowledge from Santiment reveals a pointy spike in Solana’s Constructive/Unfavourable Sentiment Ratio, climbing to 32.87 – far outpacing sentiment ranges round Bitcoin [BTC], Ethereum [ETH], and Ripple[XRP].

This sharp divergence underscores a novel bullish tilt for SOL on social platforms, suggesting rising investor confidence.

Supply: Santiment

The spike coincides with BlackRock’s strategic use of Solana’s infrastructure and GameStop’s broader crypto pivot, each of which have been closely amplified by influencers and group help.

This fusion of technological utility and mainstream integration has created the right storm for a sentiment-driven rally.

Value motion faces resistance regardless of social optimism

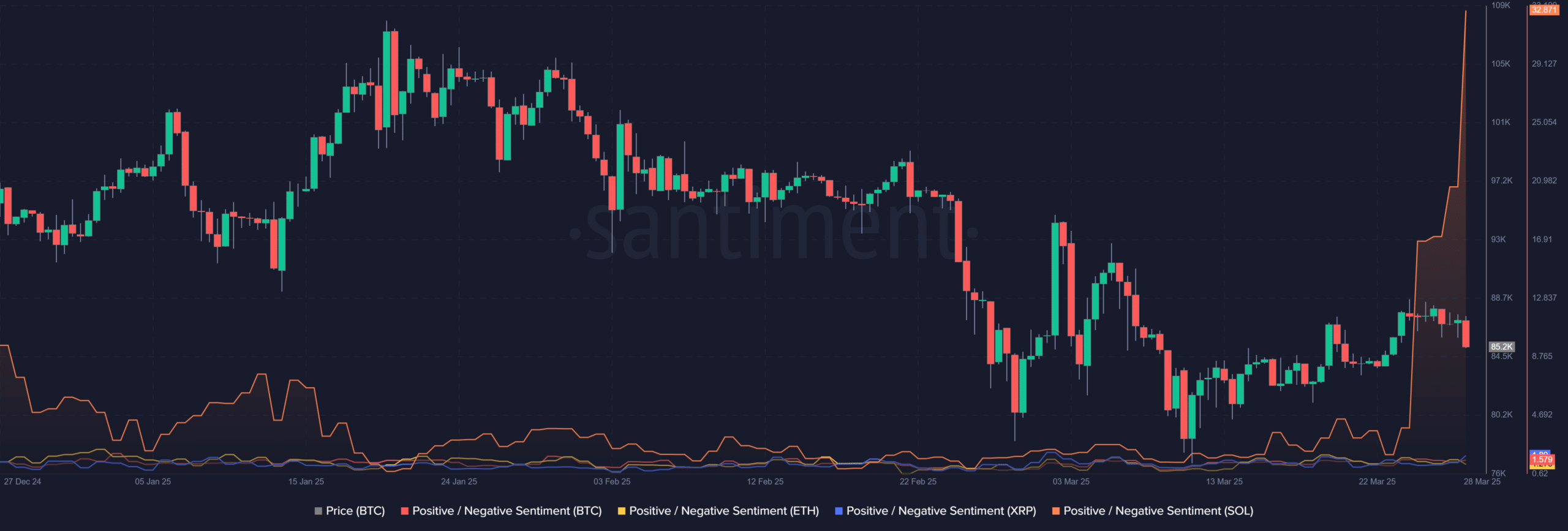

Regardless of the sentiment frenzy, Solana’s worth motion is flashing warning. On the time of writing, SOL was buying and selling at $132.49, registering a 4.27% intraday dip.

The 50-day Shifting Common (MA) at $133.74 has acted as a key resistance degree, whereas the 200-day MA at $183.04 loomed far above, highlighting how a lot floor SOL must reclaim for a real pattern reversal.

Supply: TradingView

At press time, the Bollinger Bands had been tightening, reflecting contracting volatility.

In the meantime, the Common True Vary (ATR) sat at 6.18, suggesting that SOL stays in a low-volatility regime – a possible prelude to an explosive transfer in both route.

Is the market underestimating Solana?

SOL’s worth sample signifies consolidation relatively than a breakout regardless of the overly bullish sentiment amongst merchants. This disparity suggests a possible disconnect between emotional optimism and technical resistance ranges.

Traditionally, such euphoria could be dangerous, particularly when unsupported by quantity and worth motion.

Nevertheless, Solana’s sturdy developer ecosystem and real-world functions in tokenized finance, like BlackRock’s latest initiative, supply strong fundamentals.

If SOL surpasses the $140 mark and turns its short-term resistance into help, a fast upward motion might comply with, fueled by persistent social sentiment.