Is Ethereum Price Under Pressure? Here Is What Futures Data Signals

Latest knowledge from CryptoQuant has revealed a bearish part for Ethereum (ETH), as futures merchants exhibit sturdy promoting exercise.

The crypto neighborhood intently screens these developments, particularly with Ethereum struggling to carry above the $3,500 mark, including stress to an already risky market.

Associated Studying

Ethereum Market Sentiments And Technical Indicators

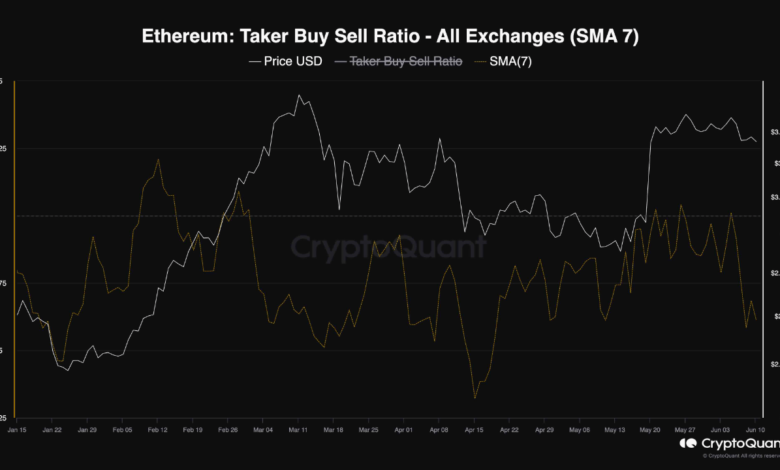

Information from CryptoQuant has make clear the present market situations for Ethereum, suggesting a possible continuation of the present downtrend. The evaluation focuses on the ‘Taker Purchase Promote Ratio,’ a key indicator of market sentiment within the futures enviornment.

This metric assesses the steadiness of shopping for versus promoting exercise; a ratio above 1 signifies dominance by consumers, reflecting stronger shopping for stress, whereas a price under 1 highlights aggressive promoting.

Sadly for Ethereum buyers and fans, this ratio has not too long ago dipped under 1, signaling that sellers are overpowering consumers.

This downtrend is mirrored by the numerous drop within the Taker Purchase Promote Ratio, which has steeply declined, displaying a transparent shift towards vendor dominance.

Such aggressive promoting might stem from merchants aiming to capitalize on speculative beneficial properties or looking for to mitigate dangers amidst heightened market volatility.

$ETH‘s plummet would possibly persist within the quick time period

“This development suggests that almost all of futures merchants have been promoting #Ethereum aggressively, both for speculative functions or to comprehend income.” – By @Greatest_Trader

Hyperlink 👇https://t.co/yz9DVphQ8l

— CryptoQuant.com (@cryptoquant_com) June 11, 2024

The persistence of this development is a regarding sign for Ethereum’s short-term value outlook because it struggles to seek out help ranges that might stabilize its worth. The crypto analyst, Shayan BTC, who posted this replace on the CryptoQuant quick-take platform, notably famous:

This important drop within the metric is a bearish sign, suggesting that the present downward retracement might persist if this development continues.

Implications: ETH’s Present Buying and selling Behaviour

The bearish indicators are greater than a fleeting concern; they’ve tangible impacts on Ethereum’s market place. Over the previous week, Ethereum has seen a 2% decline, with a sharper drop of practically 6% within the final 24 hours alone, bringing its value right down to $3,471.

This correction follows a current excessive of practically $4,000 in late Might, illustrating the risky swings that may have an effect on investor sentiment and market dynamics.

Moreover, Ethereum’s challenges are compounded by the rise of competing platforms like Polygon, which not too long ago reported the next month-to-month energetic person depend than Ethereum.

MAU (Month-to-month Energetic Customers) on @0xPolygon surpassed Ethereum.

Most likely nothing. https://t.co/bpxIxu7ZcF

— Mihailo Bjelic (@MihailoBjelic) June 11, 2024

Whereas this doesn’t instantly affect Ethereum’s value, it indicators shifting preferences throughout the blockchain ecosystem, probably diverting consideration and funding from Ethereum.

Associated Studying

Such shifts are essential for buyers to observe, as they may dictate the strategic instructions of Ethereum and its rising rivals in blockchain applied sciences.

Featured picture created with DALL-E, Chart from TradingView