Bloomberg Analyst Predicts Massive but Historically ‘Normal’ Market Crashes for Bitcoin, Oil and Stock Market

Bloomberg commodity strategist Mike McGlone says that there’s an opportunity of an enormous correction in US markets that would pummel the worth of Bitcoin (BTC), oil and shares.

In a put up on the social media platform X, McGlone says the US has a “self-correcting mechanism” that will push again in opposition to President Trump’s tariff battle, which might create market chaos.

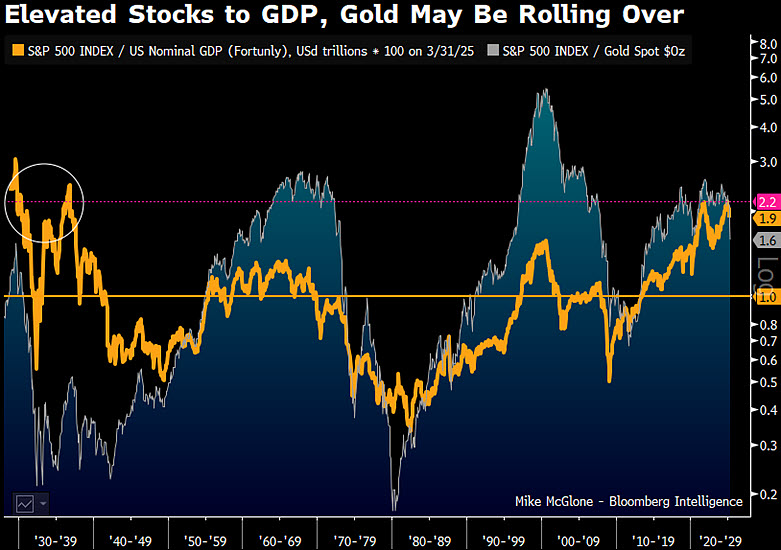

The analyst shares a chart suggesting that the S&P 500 vs. GDP ratio and the S&P 500 vs. gold ratio are each at elevated ranges – a setup that has traditionally marked inventory market crashes, resembling within the Nineteen Thirties, the late Nineties, and 2008.

Such an occasion, or “reversion,” might lead to important drops in shares, Bitcoin oil, copper and bonds, in response to McGlone.

“America’s self-correcting mechanism is unstoppable. If unprecedented tariffs and austerity don’t work, pushback will come within the subsequent elections. If the nice rebalance try works, it might reset world order underpinnings for the approaching century.

The issue is that the discombobulation is coming with US inventory market cap vs. GDP and the remainder of the world, the best in about 100 years.

My regular reversion base case:

– 50% drawdown within the US inventory market

– $40 a barrel crude oil

– $3 per pound copper

– 3% US 10-year yield

– $10,000 Bitcoin, 90% drawdowns in many of the hundreds of thousands of cryptocurrencies

– $4,000 gold, the outlier as a result of not being easy reversion”

Whereas McGlone’s predicted drawdowns seem extreme, the analyst says that the magnitude of the potential draw back strikes is “regular” based mostly on historic phrases.

At time of writing, Bitcoin is buying and selling for $87,529.

Comply with us on X, Facebook and Telegram

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Value Motion

Surf The Day by day Hodl Combine

Generated Picture: Midjourney